NTEA is a recognized leader in providing relevant and valuable industry statistics and interpretation of market data and trends affecting the work truck industry. The Association’s comprehensive compilation and interpretation of data and forecasts is updated monthly, offering an in-depth look into the commercial vehicle market.

Members have exclusive access to a regularly updated Market Data Dashboard containing information and analysis for key industry influencers, including:

- Housing starts

- Interest rates

- Gross domestic product quarterly change

- Unemployment rate

- Consumer price index

- Fuel prices

- Commercial vehicle sales and shipments

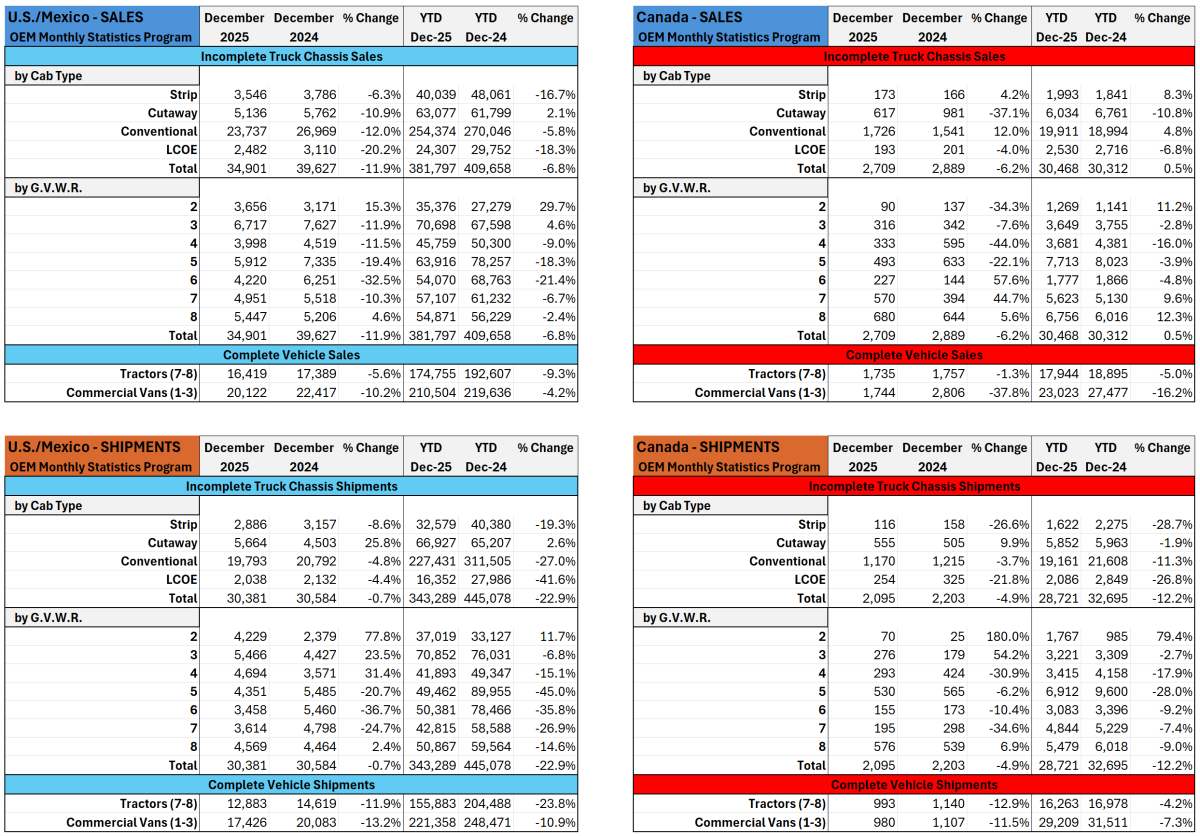

U.S./Mexico – SALES

U.S./Mexico commercial truck chassis sales decreased by -11.9% year-over-year (YoY) in December 2025 compared to December 2024. Year-to-date (YTD) sales are down -6.8%. Tractor sales declined -5.6% YoY and -9.3% YTD, while Commercial Van sales fell -10.2% YoY and are down -4.2% YTD.

By cab type, Cutaway declined (-10.9% YoY, +2.1% YTD), while Conventional fell -12.0% YoY and -5.8% YTD. Strip and LCOE also declined (-6.3% and -20.2% YoY, respectively).

By GVWR, Class 2 sales increased +15.3% YoY and are up +29.7% YTD, while Class 3 declined -11.9% YoY but remains +4.6% YTD. Mid-range Classes 4–6 posted double-digit declines, ranging from -11.5% to -32.5% YoY, and heavy Classes 7–8 were mixed, with Class 7 down -10.3% and Class 8 up +4.6% YoY, though both remain slightly negative YTD.

U.S./Mexico – SHIPMENTS

Truck chassis shipments in the U.S./Mexico region declined -0.7% YoY in December 2025, with YTD shipments down -22.9%. By cab type, Strip declined -8.6% YoY, Conventional fell -4.8%, and LCOE dropped -4.4%, while Cutaway increased +25.8% YoY and is up +2.6% YTD.

By GVWR, Class 2 shipments rose +77.8% YoY and are up +11.7% YTD, while Class 3 increased +23.5% YoY but remains down -6.8% YTD. Classes 4 and 8 posted modest YoY increases (+31.4% and +2.4%, respectively), while Classes 5, 6, and 7 declined, particularly Classes 5 and 6, which remain down -45.0% and -35.8% YTD.

In complete vehicles, Tractor (Classes 7–8) shipments increased +11.9% YoY but are still down -23.8% YTD, while Commercial Van (Classes 1–3) shipments rose +13.2% YoY and are -10.9% lower YTD. The relatively stable December shipment total reflects selective year-end production strength in lighter-duty categories despite continued full-year contraction.

Canada – SALES

Canadian commercial truck chassis sales declined -6.2% YoY in December 2025, with YTD sales up +0.5%. By cab type, Strip sales increased +4.2% YoY and are up +8.3% YTD. Cutaway declined -37.1% YoY and is down -10.8% YTD. Conventional rose +12.0% YoY and remains +4.8% YTD, while LCOE declined -4.0% YoY and is down -6.8% YTD.

By GVWR, Classes 7 and 8 posted YoY increases (+44.7% and +5.6%, respectively) and remain positive YTD. Class 6 also increased +57.6% YoY but is slightly negative YTD. Classes 2, 3, 4, and 5 declined year-over-year, with Class 2 down -34.3% YoY but still up +11.2% YTD.

Complete vehicle sales were mixed: Tractor (Classes 7–8) sales declined -1.3% YoY and -5.0% YTD, while Commercial Van (Classes 1–3) sales fell -37.8% YoY and -16.2% YTD. Overall, Canada’s market finished the year essentially flat compared to 2024 levels.

Canada – SHIPMENTS

Canadian truck chassis shipments declined -4.9% YoY in December 2025 and are down -12.2% YTD. By cab type, Strip fell -26.6% YoY, Conventional declined -3.7%, and LCOE decreased -21.8%, while Cutaway increased +9.9% YoY and is down -1.9% YTD.

By GVWR, Class 2 shipments surged +180.0% YoY and are up +79.4% YTD. Class 3 increased +54.2% YoY but remains slightly negative YTD. Classes 4, 5, and 7 declined year-over-year, while Class 8 rose +6.9% YoY though remains down -9.0% YTD.

For complete vehicles, Tractor (Classes 7–8) shipments increased +12.9% YoY but are down -4.2% YTD, while Commercial Vans (Classes 1–3) rose +11.5% YoY and are -7.3% YTD. These results reflect selective year-end shipment strength in Canada, though full-year totals remain below prior-year levels.

Summary Insights

December results show continued moderation across North America, though year-end activity improved in select lighter-duty shipment categories. U.S./Mexico sales remain below prior-year levels, with strength concentrated in Class 2 while mid-range segments continue to lag. Canadian sales ended essentially flat for the year, supported by heavier GVWR gains despite softness in commercial vans. While December shipments showed improvement in several classes on both sides of the border, full-year trends indicate a broader cooling compared to 2024.

NTEA members can view additional information and insights in the Market Data Dashboard, which is updated monthly (login required). Not sure if you’re a member? Check your status, join today, or contact us for assistance (info@ntea.com or 248-489-7090).