By: Doyle Sumrall, NTEA Managing Director

This article was published in the March 2017 edition of NTEA News.

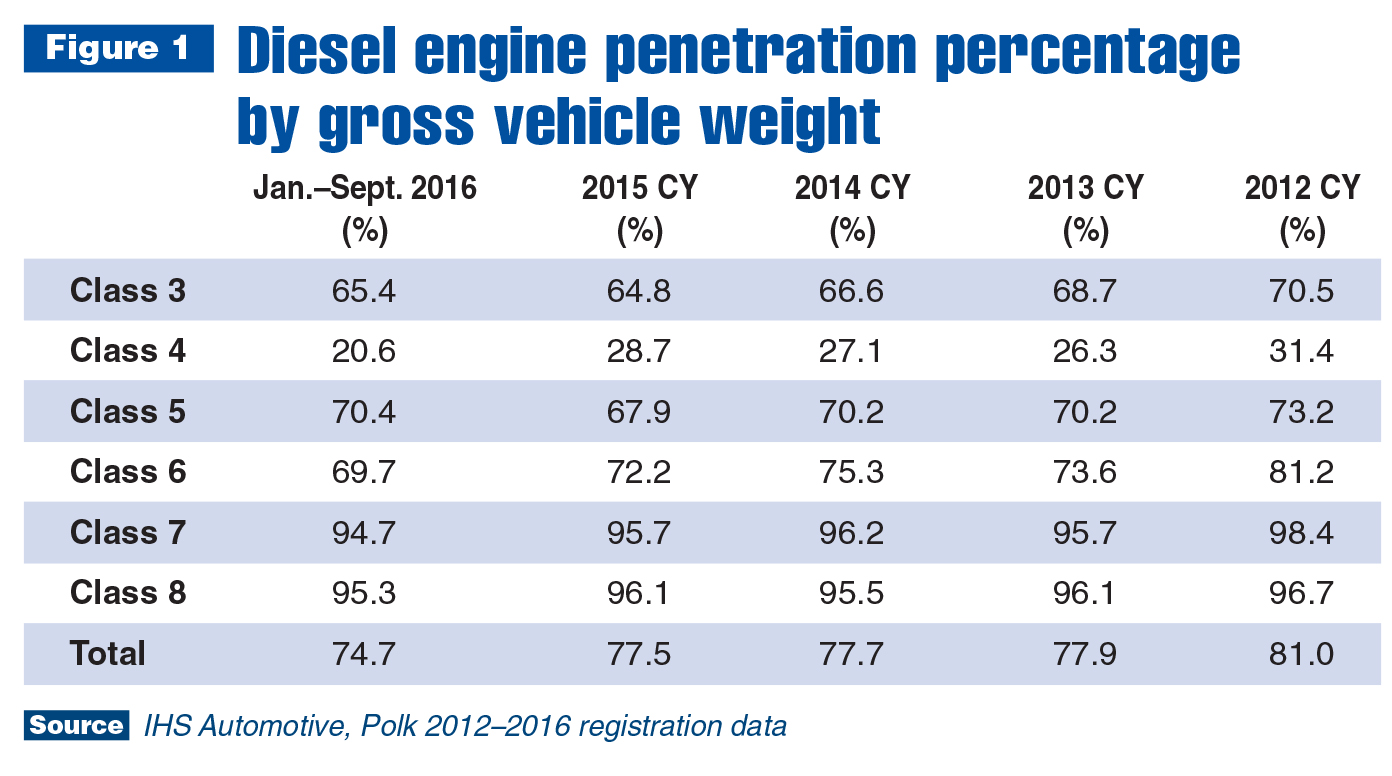

Conversation at the 2017 National Biodiesel Conference and Expo (recently held in San Diego, California) prompted a different perspective on common perceptions of diesel. There are roughly 12 million Class 3–8 trucks in operation, and as of September 2016, IHS data indicated more than 74 percent of new registrations for the year had diesel engines. Figure 1 shows this is a decline of almost 3 percent as compared to 2015 levels — an outcome primarily due to low Class 8 sales and an increase in gasoline engines for Classes 4–6. It’s interesting to see alternative fuels (in this case, gasoline) are making advances in the work truck community, but diesel is still dominant.

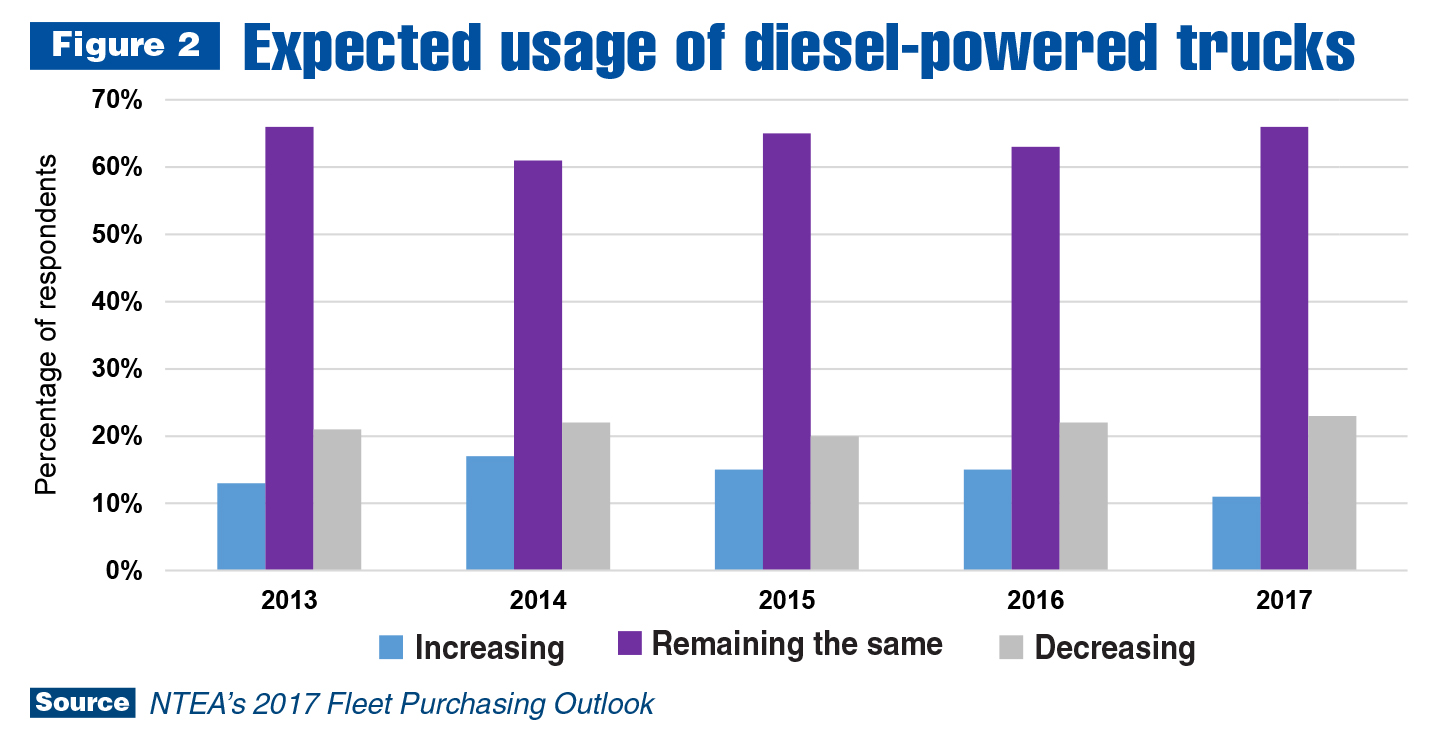

It’s clear buyers and fleets see diesel as an important part of their work truck strategy. Survey responses documented in NTEA’s 2017 Fleet Purchasing Outlook indicate the percentage of diesel-powered trucks will remain the same for the majority of fleets by a slightly higher percentage than the previous three years (see Figure 2).

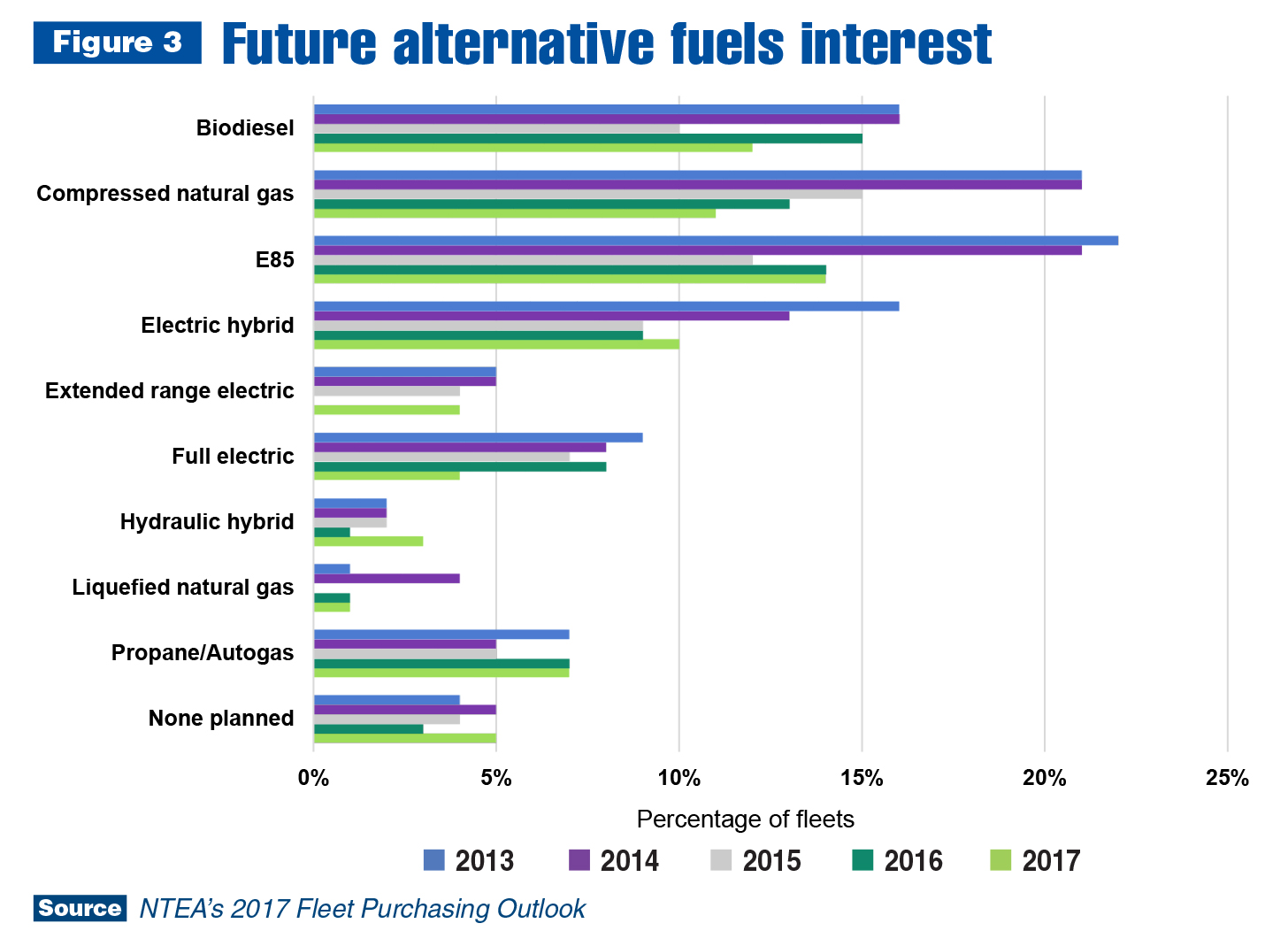

Regarding alternative fuel vehicle options planned for acquisition in 2017, biodiesel ranked second among overall survey participants, with E85 coming in first (see Figure 3). Fifteen percent of responding fleets currently use biodiesel. Learn more about Fleet Purchasing Outlook at ntea.com/fpo.

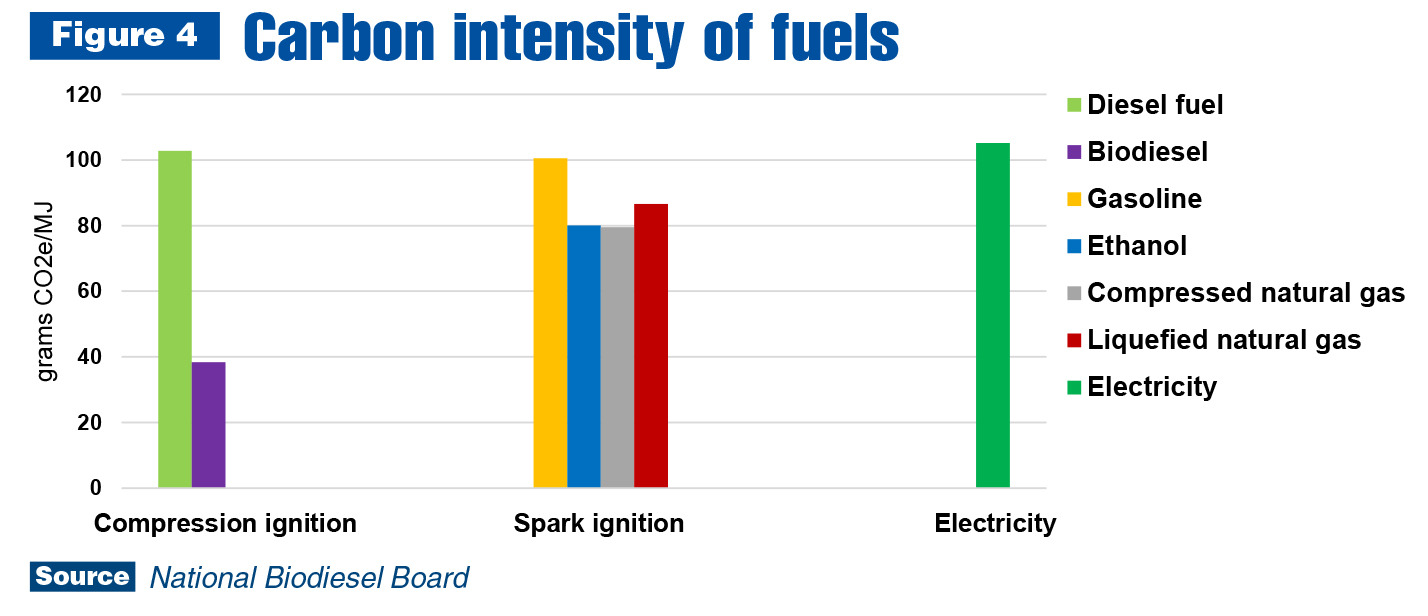

According to National Biodiesel Board, biodiesel has the lowest carbon intensity of commonly used fuel — less than 40 grams of carbon dioxide equivalent per megajoule.

Several factors make biodiesel an attractive fuel option. It’s a drop-in diesel alternative, so it does not require introduction of technology and trucks, and can be integrated into existing fuel systems. Before adding biodiesel, most fleets recommend cleaning fuel tanks and changing filters on trucks and fuel pumps. Due to the solvent effect of biodiesel, this process can be repeated a few times as vehicles acclimate to the new fuel type. Challenges may arise for fleets with systems that have not been cleaned properly.

Another positive aspect of biodiesel is that B20 (a 20-percent blend of biodiesel with petroleum diesel) has a higher cetane number than diesel fuel and provides similar fuel economy, horsepower, torque and haulage rates. (According to “What You Need to Know about Fuel’s Cetane and Octane Ratings” by Ray Bohacz, a cetane number measures “the fuel’s eagerness to ignite from the heat created in the bore from the compression of the air. The higher the cetane number, the shorter the ignition delay and the better the ignition quality.”

In addition, biodiesel seems to have superior lubricity and is viable in cold weather climates. Members of the Illinois B20 Club recently spoke about their year-round usage of B20, and one affiliated Chicago fleet has detailed insights on running up to B100 in trucks and mowers during the summer.

OEM positions on biodiesel usage is a frequent question. The U.S. Department of Energy’s Alternative Fuels Data Center addresses this topic and other key concerns, including proper protocol for using various biodiesel blends, proximity to biodiesel stations, and applicable incentives and laws. Visit afdc.energy.gov/vehicles/diesels_availability.html.

Hydrogenation-derived renewable diesel (HDRD) is another facet. Essentially, HDRD is developed in a hydrogenation process and has a slightly different molecular form, making it a direct replacement for diesel fuel. It’s compatible with existing fuel distribution systems. Learn more at afdc.energy.gov/fuels/emerging_green.html.

Having this variety of diesel options available is beneficial. The work truck industry, including the fleet community, is highly invested in diesel engine trucks. Incorporating biodiesel and renewable diesel options is a way to bring sustainability to the forefront with limited resources and minor operational change.

For questions on this article, contact Doyle Sumrall.