This article was published in the September 2015 edition of NTEA

News.

As the work truck industry maintains a steady economic position, many

companies are gaining ground and starting to develop plans and strategies for

the coming year. To help members effectively navigate current and future market

conditions, NTEA provides targeted resources and information on key issues, such

as hiring expectations, sales levels and business growth patterns.

Twice a year, the Association surveys Distributor and Manufacturer

members to gain their perspective on today’s business climate, as well as

upcoming expectations. Aggregated data provides details on:

- Sales levels and quoting

activity

- Backlogs

- Production capacity

- Employment levels

- Key issues impacting member

businesses

- Future challenges and

opportunities

This article summarizes the most recent survey results and incorporates

year-to-year comparisons, making overall directional trends easier to identify.

The next survey will be emailed to Distributor and Manufacturer members in

January 2016. Please note your input is invaluable; a higher participation rate

helps ensure results are representative of the industry.

For more information, contact Summer Marrs, NTEA director of

communications and public relations, at 248-479-8913 or summer@ntea.com.

July 2015 survey

results

Of the respondents, 56 percent are

distributors and 44 percent manufacturers. Participating companies report annual

sales volumes of less than $2 million to beyond $70 million, with the largest

group representing $10–20 million (27 percent). Respondents listed the

construction, government/municipal and utility/telecom sectors as the three most

critical application markets for their business (in order of expressed

importance). Overall results are positive, with members citing strong sales,

quoting activity and employee levels.

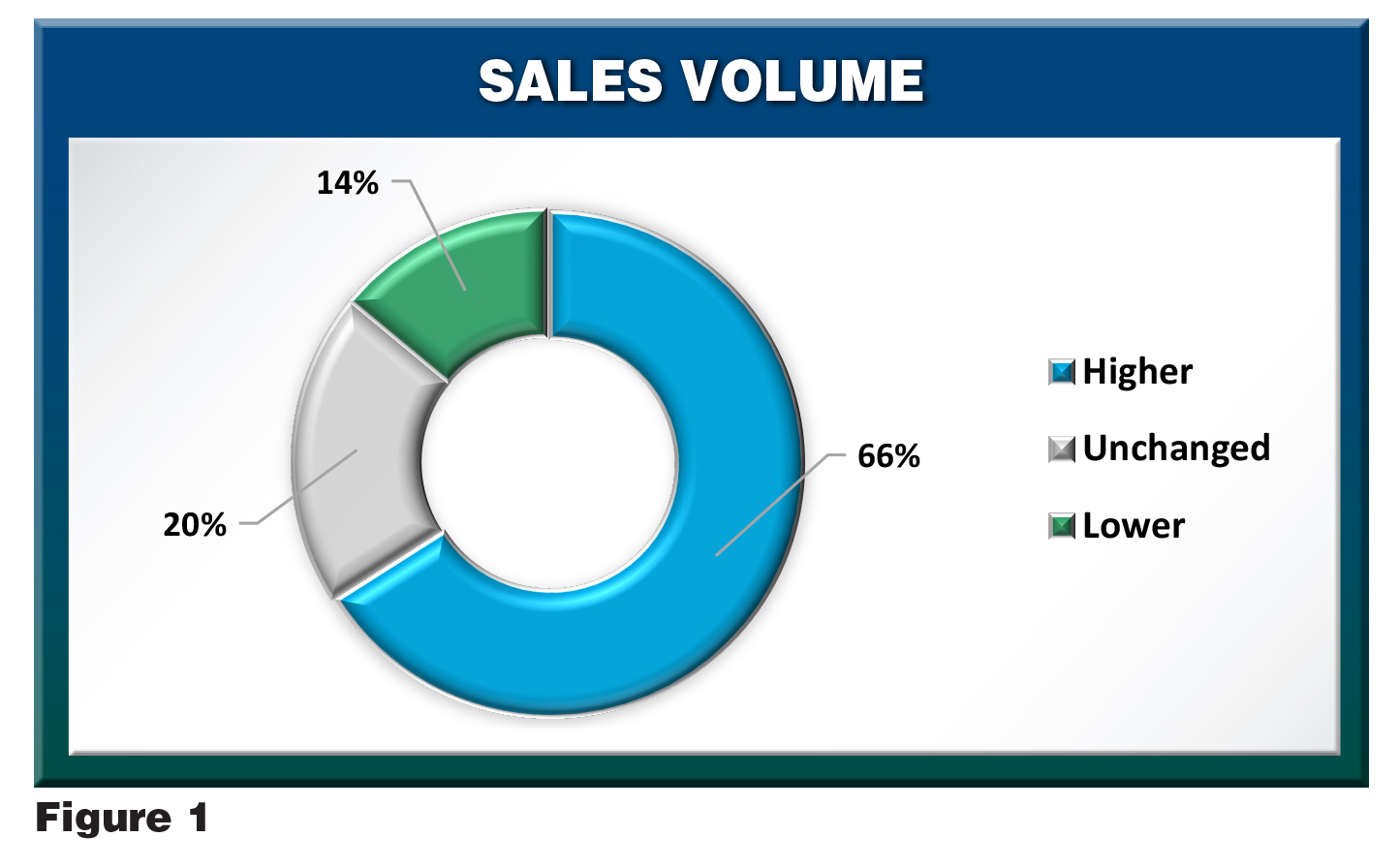

As shown in Figure 1, 66 percent of survey participants report higher

sales than in the last half of 2014, with only 14 percent indicating a drop.

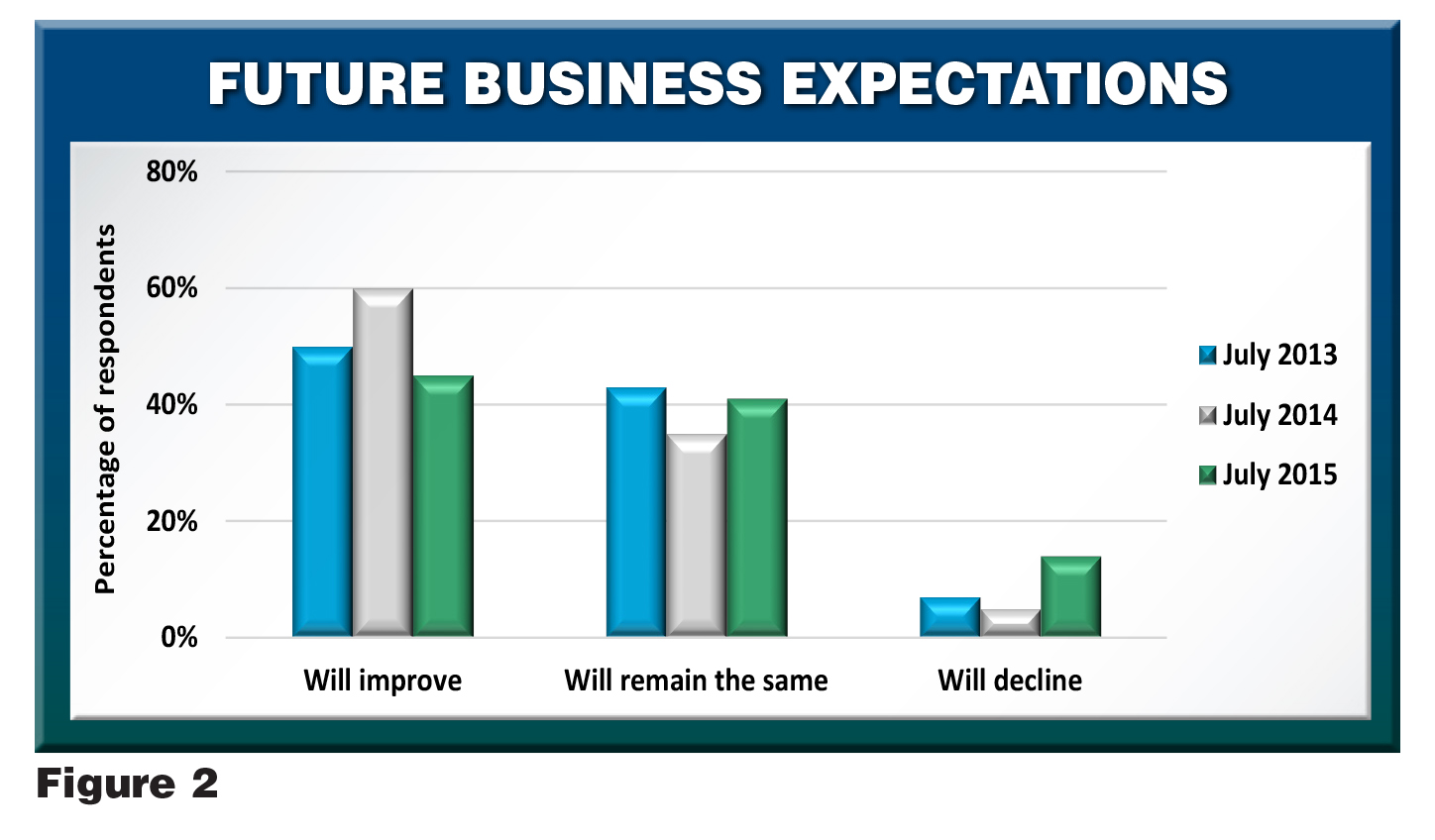

Forty-five percent believe business will keep gaining traction in 2015,

reflecting a reduced, but still reasonable, confidence level among industry

companies. A higher percentage anticipate a business decline for the

remainder of the year — 14 percent in July 2015 as compared to only 5

percent in July 2014 and 7 percent in July 2013.

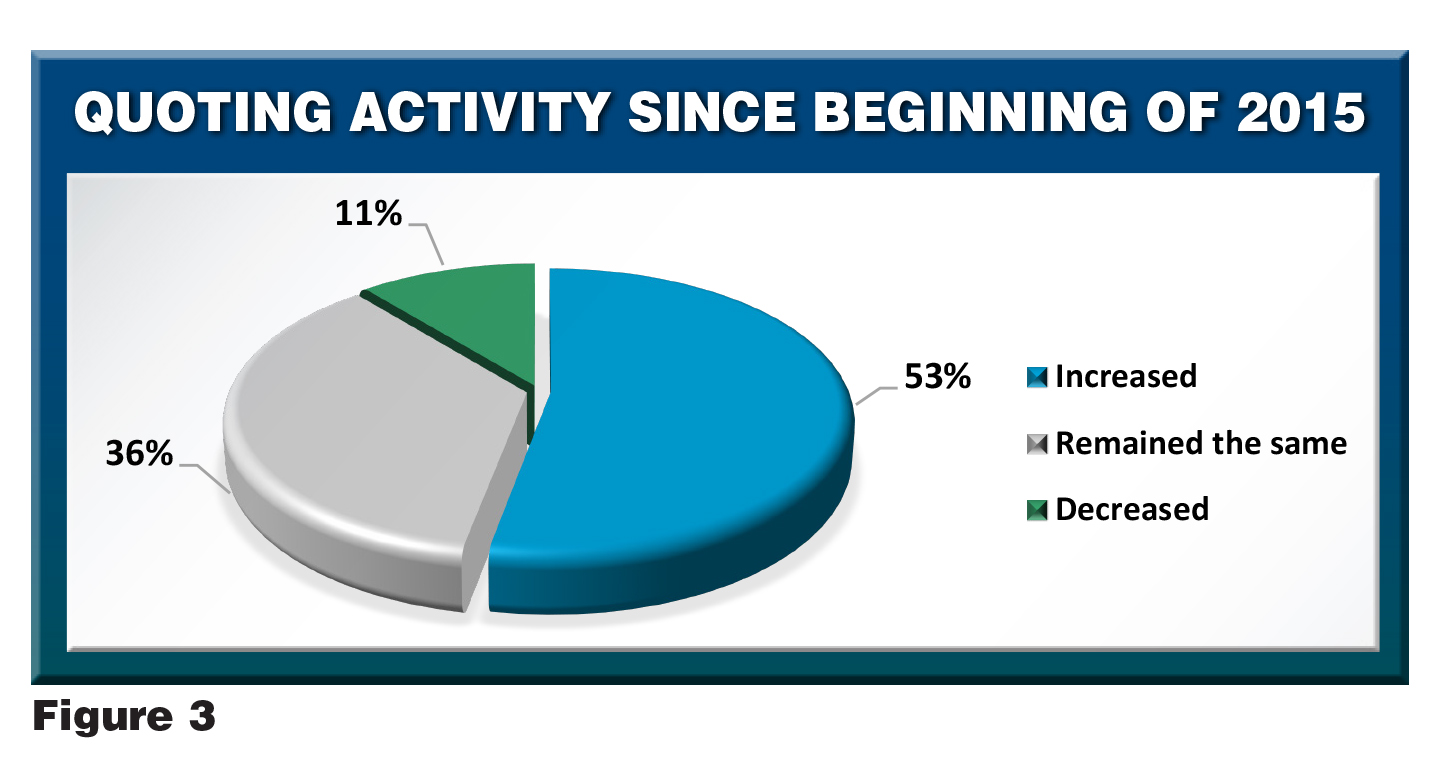

Regarding quoting activity, more than half of participants report

increases since January 2015, while 36 percent say levels have remained constant

and 11 percent cite a decline (see Figure 3).

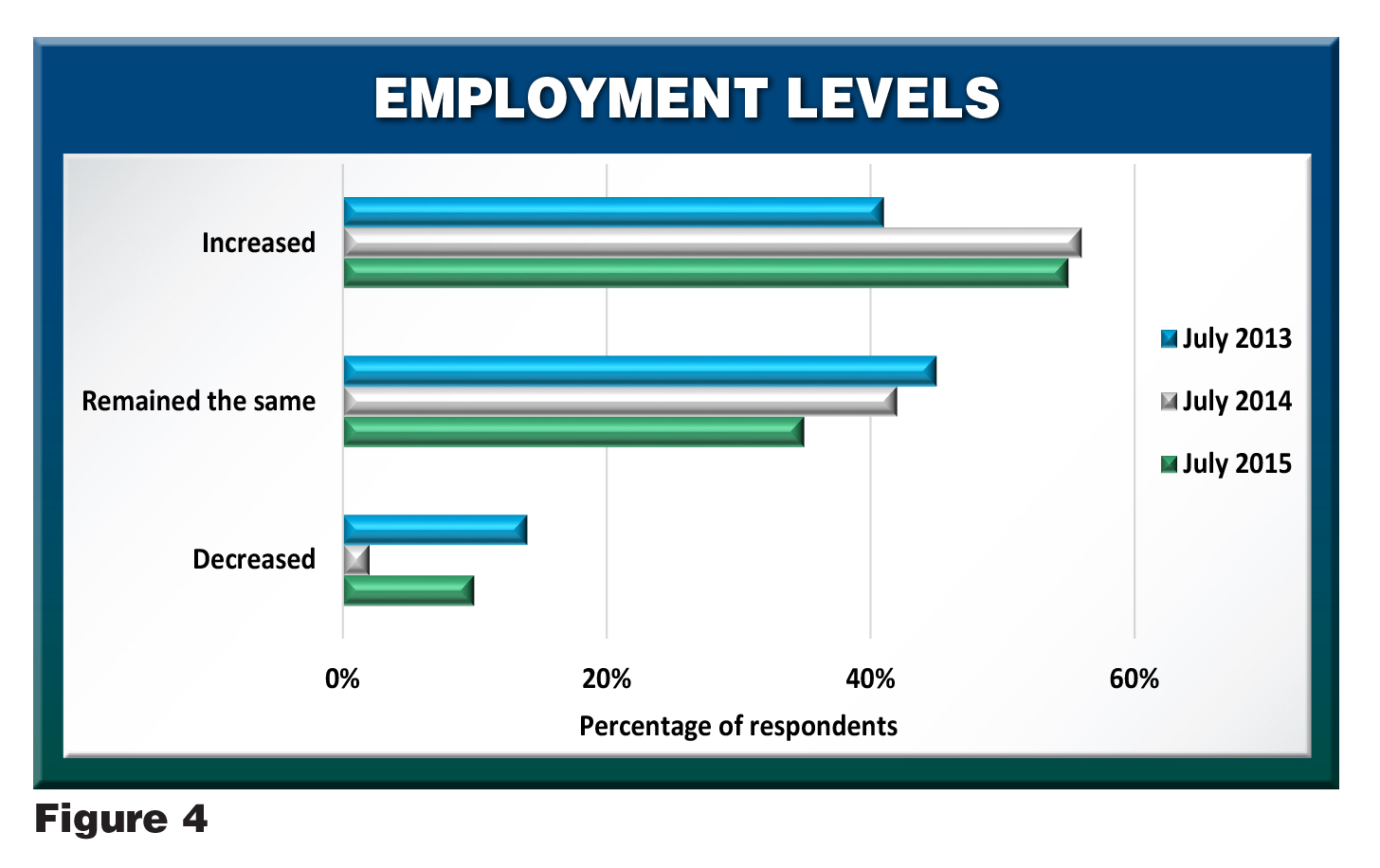

Employment opportunities remain consistent, with 55 percent of

respondents increasing staffing levels in July 2015 as compared to 56 percent a

year ago. However, 10 percent indicate a decrease in employees, as compared to

just 2 percent in July 2014.

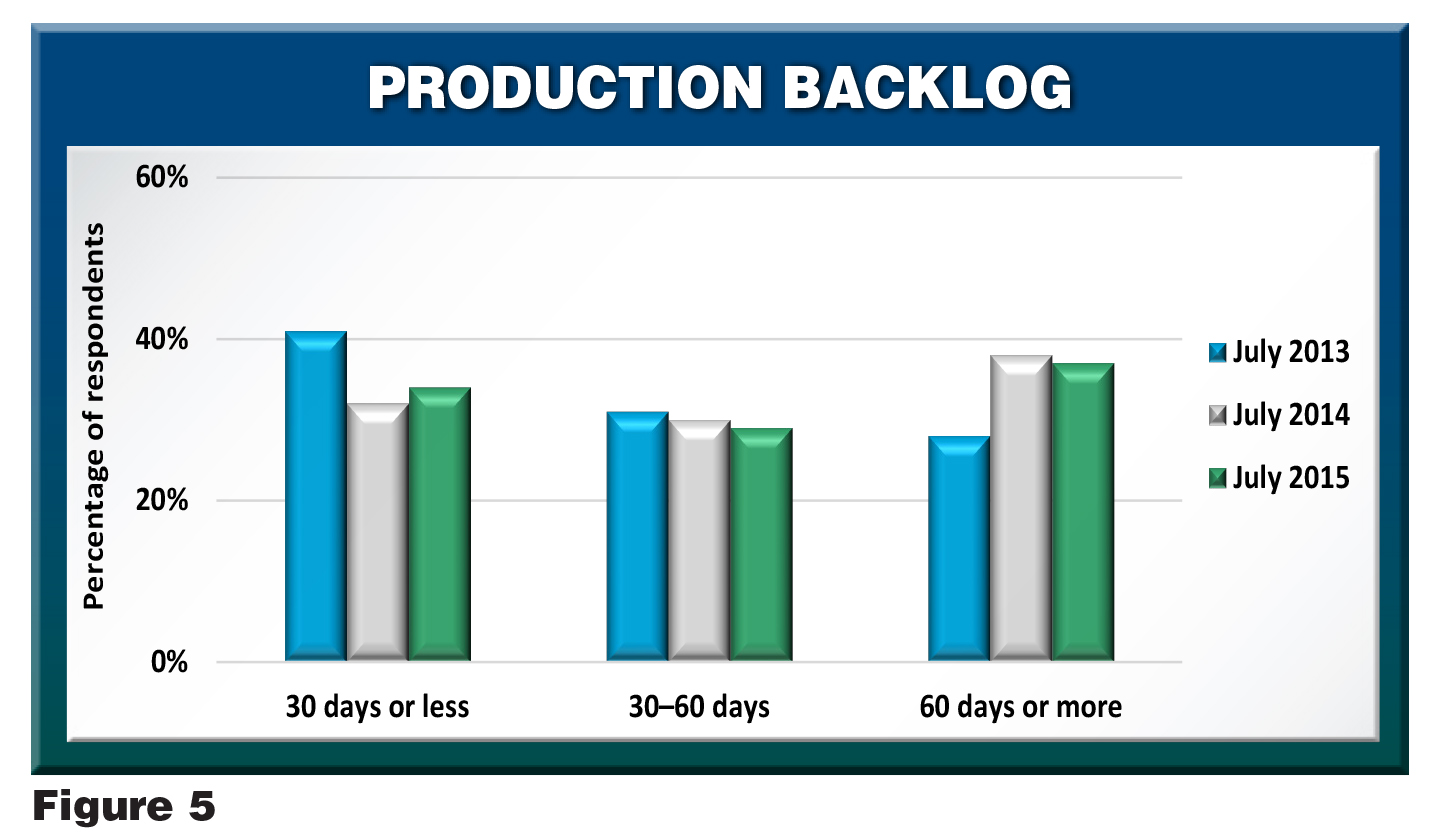

The number of backlogged companies remains relatively flat, with 83

percent in July 2014 and 81 percent currently. Of this total, 44 percent say the

amount of backlogs has increased since January 2015, while 21 percent cite a

decrease and 35 percent have a constant workflow.

Overall, backlogs are shortening slightly as compared to previous

years, indicating members are staying on top of heavy demand. Only 16 percent of

respondents have backlogs extending to 90 days or more (this data point is not

reflected in Figure 5, as it is a new variable). With steady industry growth

predicted through the remainder of 2015 and into 2016, business shortage is not

a top concern.

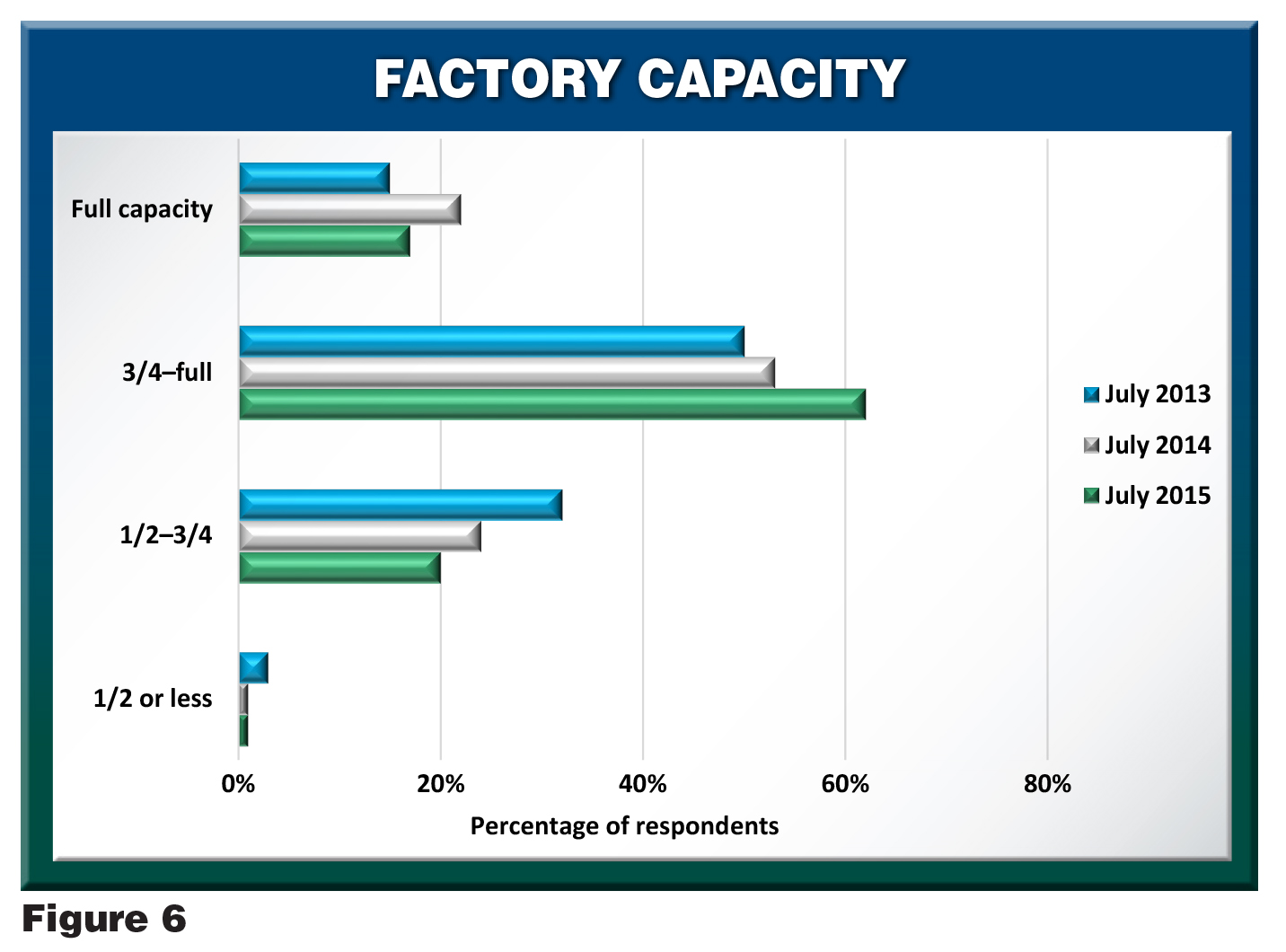

Survey respondents are working to keep pace with

backlogs by elevating operational capacity. Figure 6 indicates an increase in

factory volume, with 79 percent operating at 75 percent capacity or more, as

compared to 75 percent in July 2014 and 65 percent in July 2013.

Factors affecting

business

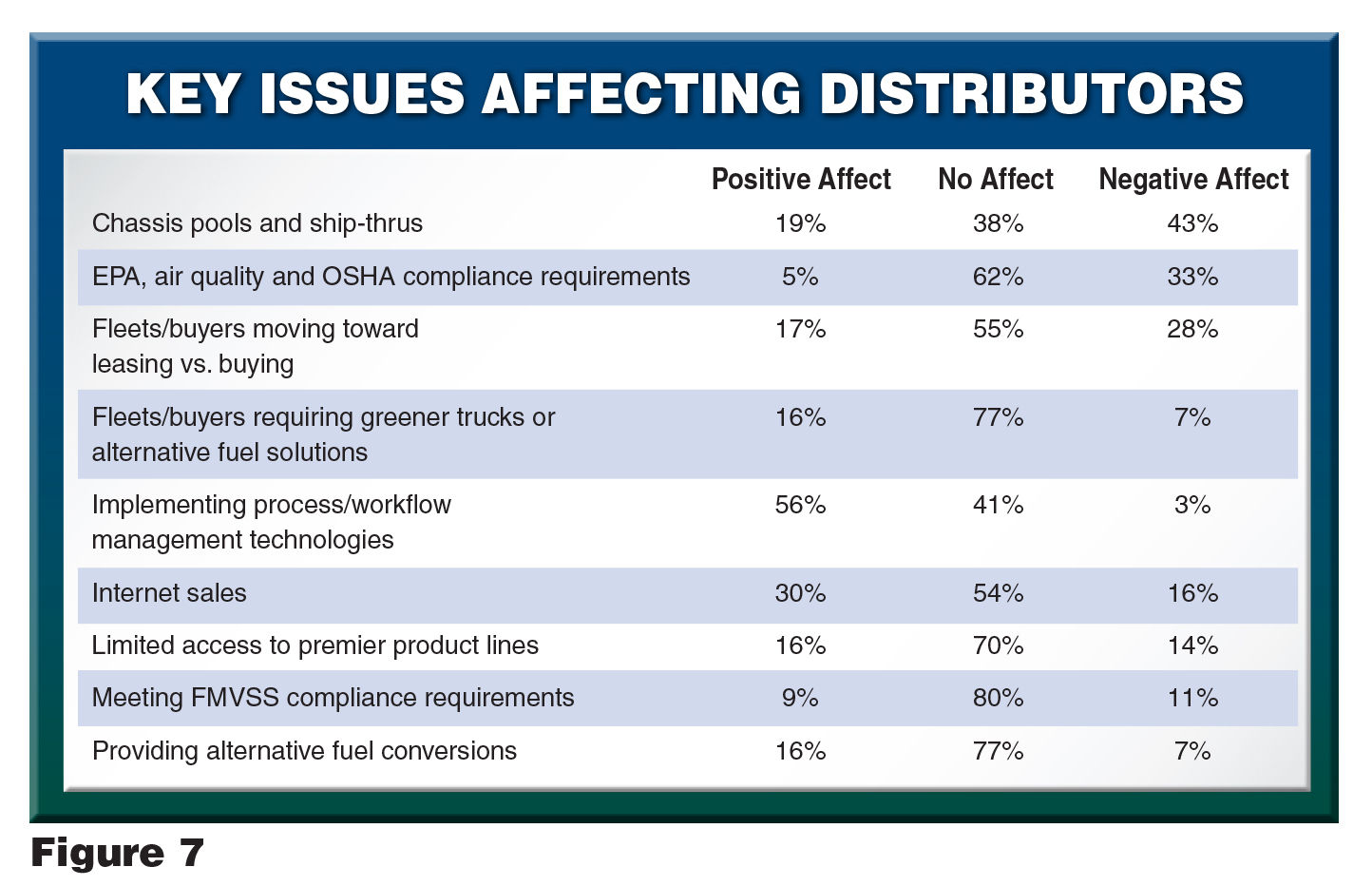

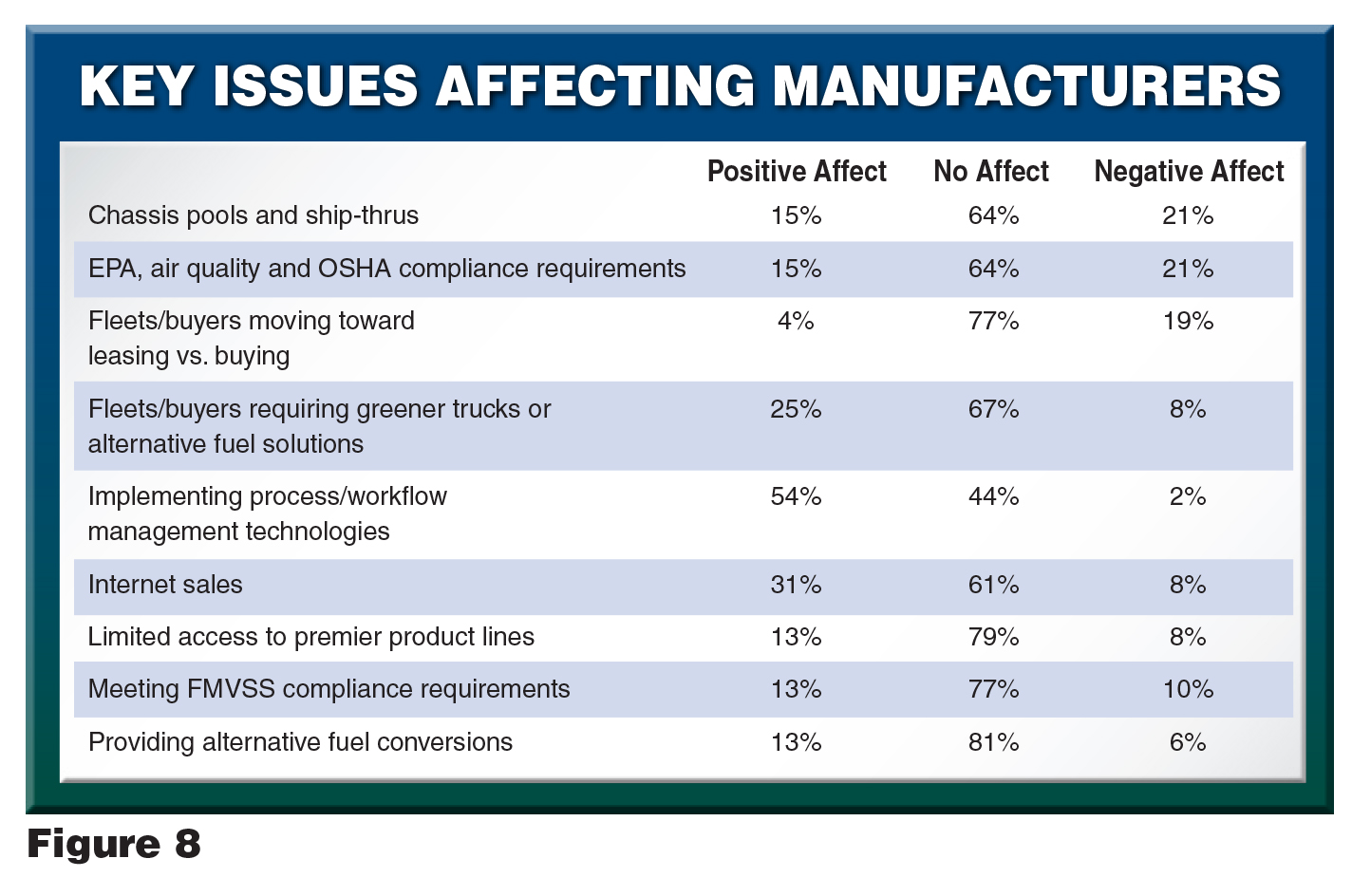

Many market dynamics influence work truck

industry companies. Figures 7 and 8 reflect distributor and manufacturer

perspectives on key issues.

As shown in Figure 7, distributors feel implementing process and

workflow management technologies has the most positive effect on their

businesses. Conversely, chassis pools and ship-thrus have the greatest negative

impact. Distributors remain largely indifferent toward Federal Motor Vehicle

Safety Standard (FMVSS) compliance requirements, alternative fuel conversions,

and fleets or buyers requiring greener trucks or alternative fuel

solutions.

Similar to distributors, implementing process and workflow management

technologies has the highest positive impact on manufacturer business.

Factors cited as having a negative effect are chassis pools and

ship-thrus, and EPA, air quality and OSHA compliance requirements.

Several issues identified as having no real influence on participating

manufacturers include:

- Providing alternative fuel

conversions

- Having limited access to

premier product lines

- Meeting FMVSS compliance

requirements

- Fleets/buyers moving toward

leasing vs. buying

- Fleets/buyers requiring greener

trucks or alternative fuel solutions

Industry

challenges

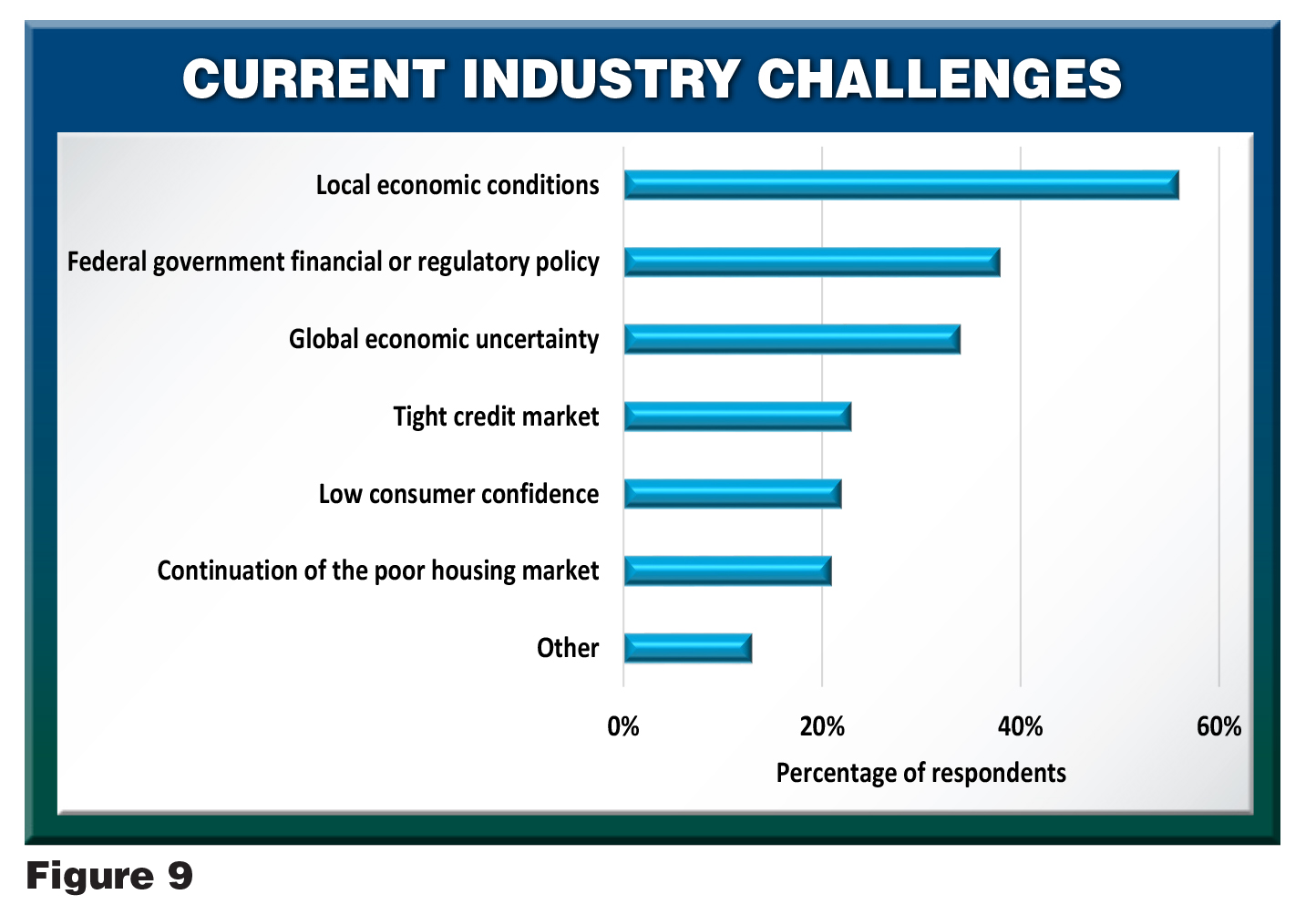

Despite 2015 growth projections, 56

percent of respondents believe local economic conditions pose the greatest

challenge to industry progress. Members are also troubled by federal government

financial/regulatory policy and global economic uncertainty.

Regarding individual company roadblocks, finding and retaining

qualified employees (69 percent) remains the most pressing concern for

respondents. The higher cost of doing business is another significant issue,

impacting more than half of participants. In addition, more than 40 percent

identify changing industry conditions as a problem.

Tactics for

success

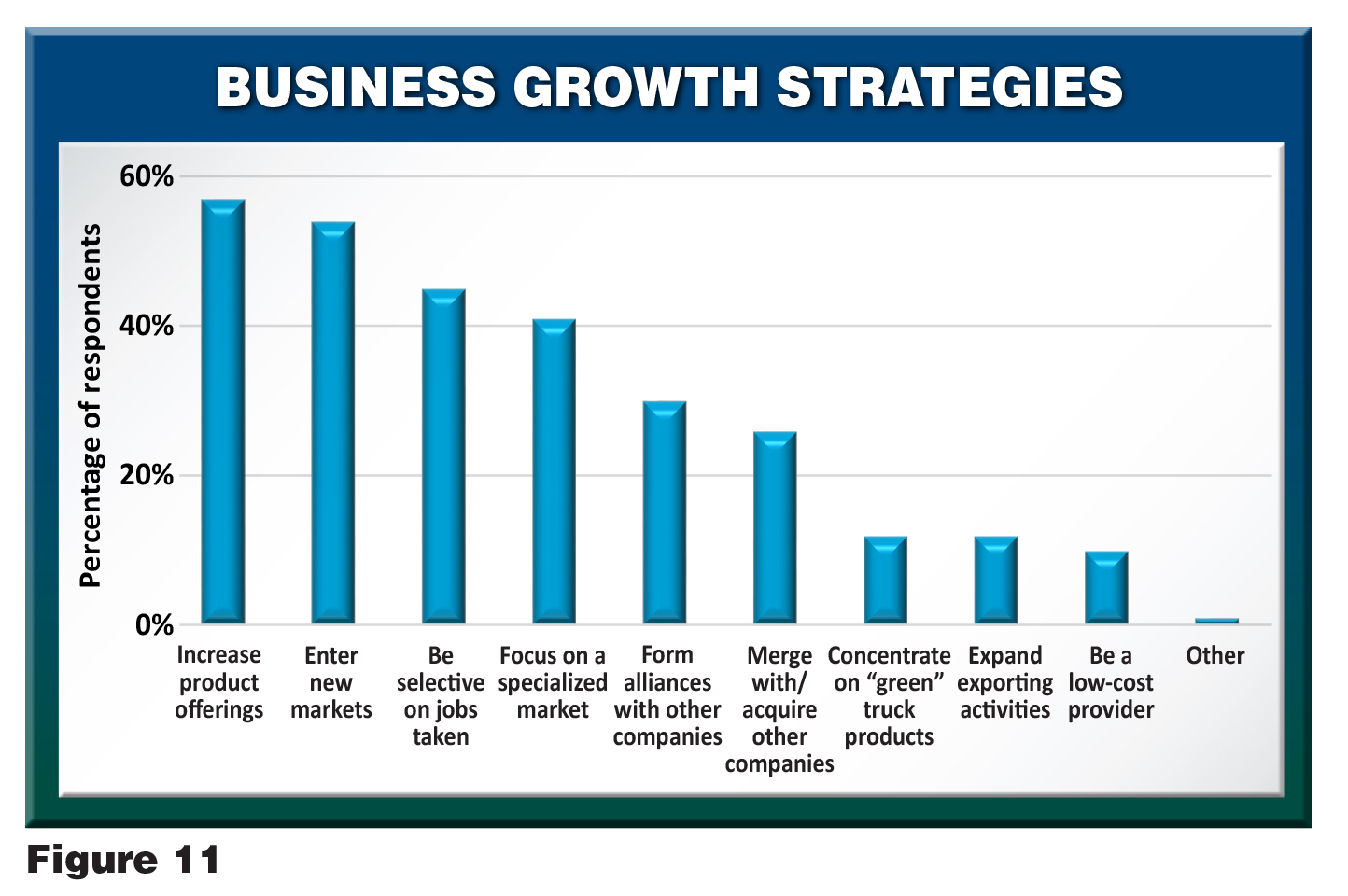

In terms of business development strategies,

expanding product offerings or product lines and entering new markets are

preferred approaches. Lesser considerations include being selective on jobs

taken to maintain higher profits and focusing on specialized markets.

Looking

ahead

The work truck industry has been stable for the

last several years, and the forecast remains consistent through the rest of

2015. While member companies face concerns about economic vitality, as well as

upcoming federal rulings, a general sense of optimism prevails.

Distributors and manufacturers anticipate a variety of future business

opportunities, including:

- Expanding facility size to

boost production

- Merging or acquiring another

company

- Building inventory

levels

- Streamlining the purchasing

process

- Obtaining large contracts to

build identical units

- Growing the dealer

network

- Exploring other fuel delivery

markets

- Improving the customer

experience

- Tapping into the green

initiative

As previously noted, members face challenges, such as locating quality

staff, accommodating higher business costs and responding to industry shifts.

Survey respondents identified additional threats to company

growth and future success, including:

- Competition

- Foreign markets

- Truck pools

- Employee healthcare and

benefits

- Slow research and development

advances

- Lack of working capital

- Physical space

constraints

Survey results suggest distributors and manufacturers are taking

advantage of current market conditions, aggressively testing growth strategies

to elevate their position. NTEA aims to help member companies achieve their

goals by providing targeted programs, tools and resources. To learn more about

Association offerings, visit ntea.com or contact

NTEA Senior Member Services Manager Luci Pfaff at 248-479-8148 or

luci@ntea.com.