By Steve Latin Kasper, NTEA Director of Market Data & Research

This article was published in the September 2016 edition of NTEA News.

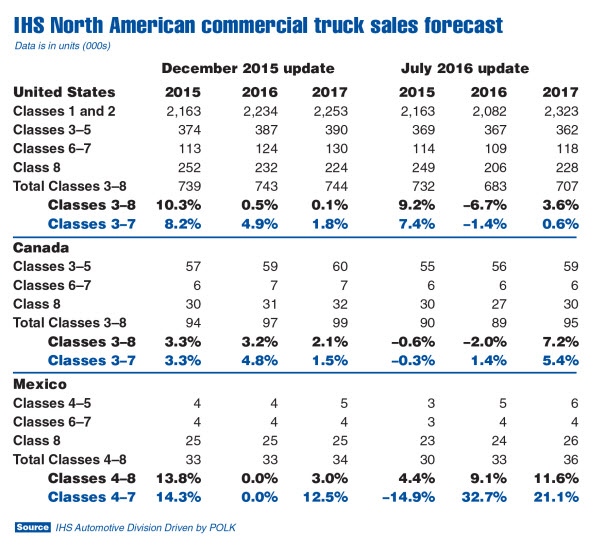

IHS Automotive Division provides a North American commercial truck sales forecast update twice a year in July and December. The 2016 commercial truck sales outlook was positive as of the end of 2015 (except for Class 8), but took a different turn by July.

According to December predictions, U.S. Class 3–8 sales were expected to grow 0.5 percent in 2016 (see chart at right). As of July, this was downgraded to –6.7 percent. The good news is the slowdown is only expected to last until the first quarter next year. In July, the 2017 estimate ramped up to 3.6 percent from the 0.1 percent projected in December.

IHS staff explained the reduced commercial truck sales prognosis is based on lower U.S. gross domestic product (GDP) expectations. Currently, IHS thinks U.S. GDP will gain only 1.9 percent this year and 2.4 percent in 2017. U.S. commercial truck sales have historically grown faster than GDP — the downside is they typically decline at higher rates. In this vein, if U.S. GDP was expected to rise, commercial truck sales growth would be anticipated. It’s interesting to note the IHS forecast indicates the relationship between U.S. GDP and commercial truck sales is different this year.

Taking a closer look, IHS’s outlook is based primarily on data from Wards Auto. Unlike data from NTEA’s OEM Monthly Chassis Statistics Program, Class 3 includes pickups and commercial vans. Pickups and vans actually account for more units than the rest of Classes 3–7 combined, and pickup sales are expected to taper off in the second half of the year. In Class 8, IHS data includes tractors, which compose about 70 percent of the class total and are expected to be the worst-performing industry segment in 2016. These sectors tend to skew the overall Class 3–8 forecast.

The Class 4–7 IHS prediction most closely represents the box-off data published monthly by NTEA (visit ntea.com/chassisreportoverview). Estimates for this segment remain positive for 2016, with sales expected to rise 3.6 percent. Class 4–7 sales will likely gain an additional 5.4 percent in 2017.

Other factors

Even still, anecdotal evidence indicates there are reasons beyond a slower growing U.S. economy which will continue to impact commercial truck sales in the second half of 2016. Concerns include a lack of qualified labor, extended lead times for chassis in certain class or cab-type segments and political uncertainty. All three factors have the potential to limit growth — more so in some regions of the U.S. than others. It’s important for individual companies to consider these challenges, along with the historically high 2016 production levels.

Canada and Mexico

Canada’s update is similar to the U.S. The Class 3–8 commercial truck sales forecast was revised downward from 3.2 percent to –2.0 percent, but 2017 expectations have been adjusted upward. The 2016 Mexico estimate is the exception in North America. After finding 2015 projections had been far too optimistic, IHS doubled down, revising its initial 2016 number upward from flat to 9.1 percent, with additional growth of 11.6 percent in 2017.

If you have any questions, contact Steve Latin-Kasper at stevelk@ntea.com.

For additional resources and statistics to help your company plan ahead, login to

ntea.com/marketdata. There, members can find information on U.S. truck sales and registrations, box-off truck chassis production and shipments data, commodity pricing, global commercial truck market data, leading indicators and industry forecasts.