By Dr. Albert D. Bates, Director of Research, Profit Planning Group

During the Great Recession, distributors faced low cash positions. This resulted in a decade-long movement, which continues today, to lower inventory levels to free up cash.

Programs that eliminated dead or redundant items to generate cash were highly successful initially. However, there has been an almost endless effort to keep further reducing inventory investment. In too many instances, reductions have crimped service levels and probably resulted in lost sales.

Inventory/sales trade-off

Most inventory reduction programs are based on the assumption that decreasing inventory will have a two-pronged financial impact. First, it will be converted to cash to provide financial stability for the company. Second, it will increase profits because the cost of carrying the inventory will be reduced. There is seldom any consideration that sales could be negatively impacted.

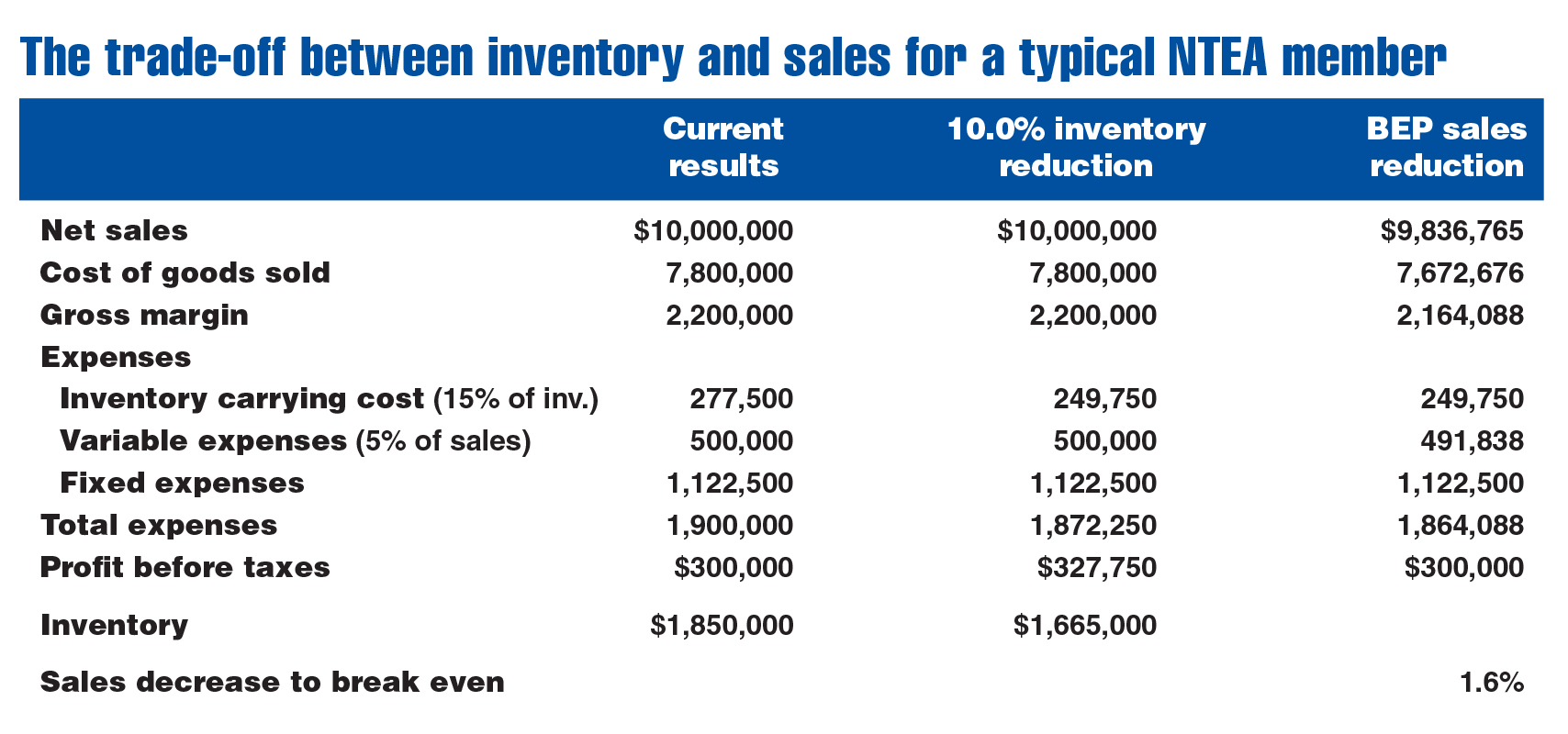

The chart above examines the nature of the trade-off between inventory and sales for the typical NTEA member. As shown in the first column of numbers, the business generates $10.0 million in revenue, operates on a gross margin percentage of 22.0 percent of sales and produces a pre-tax profit of $300,000 or 3 percent of revenue.

There is also a memo item for total inventory investment ($1.85 million for the typical firm). The idea of reducing inventory is enticing.

To understand the impact on inventory and sales, break the company’s expenses into three categories: inventory carrying costs (ICC), variable expenses and fixed expenses.

ICC is the cost of carrying inventory for a year. It includes interest, obsolescence, shrinkage, etc. It is typically estimated by specialists to be around 15.0 percent of the inventory investment each year. Using that figure, the ICC is $277,500.

Variable expense are the costs that rise and fall with sales — the most important of which is commissions. In this example, variable costs are assumed to be 5.0 percent of sales or $500,000.

Fixed expenses are overhead expenditures — costs that must be covered each year regardless of sales volume. For ease of calculation, they represent remaining expenses, or $1,122,500.

The second column of numbers examines the impact of a 10.0 percent inventory reduction. That is a sizeable number and would require concerted effort from the business. Inventory becomes $1,665,000 due to the 10.0 percent reduction. ICC also falls by 10.0 percent and is now $249,750. Sales, gross margin and other expense items remain the same. As a result, the entire ICC reduction goes to the bottom line.

The final column addresses how much sales would need to fall to offset the profit impact of the inventory reduction. In other words, the sales decline necessary to return profit to the original $300,000 level.

For the typical NTEA member, the sales decline is only 1.6 percent. Sales, cost of goods sold, gross margin and variable expenses all fall by this percentage, while fixed expenses stay constant. As a result, profit returns to its initial level. The impact of even a modest sales decline is pronounced.

The company retains its improved cash position, of course, even if sales drop. However, in the long term, cash is produced by generating sales at a profit. The inventory cutback effort has somewhat blocked that effort, which indicates reduction programs should be approached with caution.

Inventory reduction guidelines

Few analysts would argue with the idea that the inventory investment can be fine-tuned. Offsetting that is the almost universal desire of customers for distributors to actually increase their inventory investment.

Almost every research project conducted over the past four decades reports the same top two customer wants:

- Enhanced in-stock position Customers continually argue that distributors are out of stock too often.

- Greater depth of assortment Buyers want one-stop shopping.

Both approaches suggest distributors should carry more inventory, not less. Reconciling this need with the desire to develop a strong cash position requires fine-tuning the inventory. It cannot support the heavy-handed across-the-board cuts utilized too frequently.

The real solution is two-fold, involving eliminating redundancies and continual sales monitoring.

Most of the problems with dead inventory are due to redundant items — those that are slow-selling and basically duplicates of faster-selling ones. In some industries, the slow sellers are non-sellers. There are large chunks of items that haven’t sold at all in the past six months or a year, and these need to be eliminated — even if it means selling them below cost.

Items are moving through their life cycle quicker than ever before, with great sellers soon becoming good sellers. Eventually, they may become problem items. Make the effort to clear inventory as soon as the item is past its prime. If not, the excess inventory issue will arise again. Constant sales tracking is essential to this process.

Moving forward

Companies are constantly challenged to maintain an adequate cash position, particularly as they increase their sales. However, efforts to increase cash by reducing inventory must be carefully planned. Any inventory reduction program that lowers sales, or even diminishes sales growth, should be avoided. The trade-off is clearly in favor of sales over inventory.