By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the December 2018 edition of NTEA News.

Key highlights

- With producer price index (PPI) increases mostly less than 4 percent, commercial truck and equipment prices are not yet rising as suspected.

- Dump body and light-duty trailer prices saw more substantial increases in the most recent quarter.

- Light- and heavy-duty trailer pricing can be influenced by the application markets to which they’re sold.

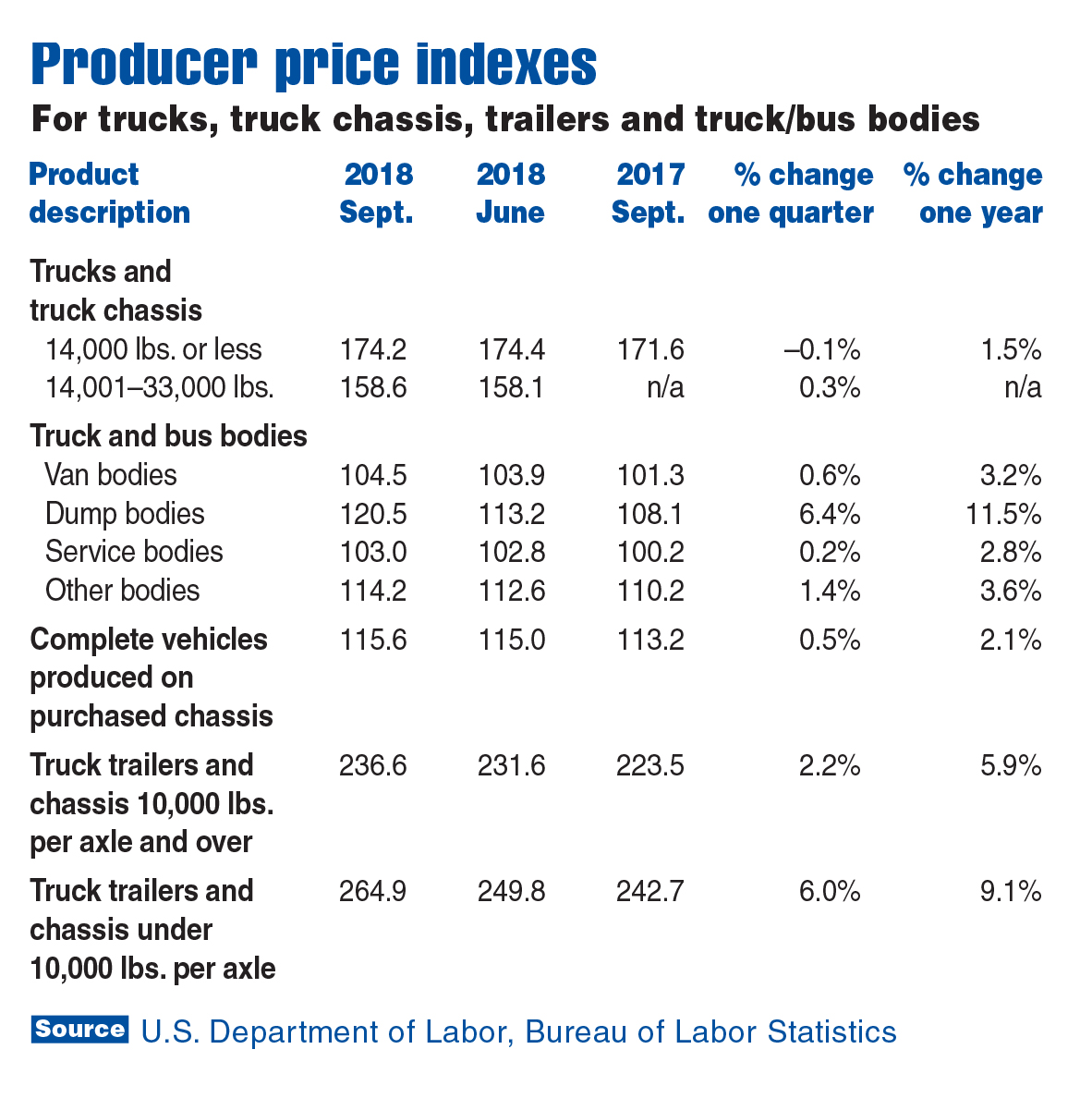

Truck and truck equipment prices were expected to rise substantially this year due to implementation of 25 percent steel and 10 percent aluminum tariffs in April. However, as shown in the chart below, most have not climbed that much.

Class 1–3 light truck and chassis prices rose only 1.5 percent in September 2018 as compared to September 2017, and fell slightly in the most recent quarter. Class 4–8 prices jumped only .3 percent in the most recent quarter. (Current price indexes for Class 8 trucks/buses/chassis are not available.) Truck body prices, with the exception of dump bodies, increased slowly in the most recent quarter, as did the average price for complete vehicles built on purchased chassis.

For all of the indexes listed in the chart, price rate of growth has been decelerating, which is in line with what’s occurring in the steel and aluminum product markets. Hot-rolled steel sheet/strip prices were up 23.5 percent in September 2018 as compared to the same month last year, but rose only 5.7 percent since June. The same deceleration pattern was evident in markets for cold-rolled steel sheet/strip and hot-rolled plates/bars/shapes.

There were more substantial increases in dump body (11.5 percent) and light-duty trailer (5.9 percent to 9.1 percent) prices per the PPI. These increases in the most recent quarter, and for the 12 months to September, stand out. Dump body prices rising faster than other truck body prices can be attributed to the fact that dump bodies, by weight, have more steel than other body types. Therefore, steel accounts for a greater percentage of dump body bill of materials totals, which means the 25 percent tariff on steel had a greater impact on pricing.

The above-average increase in light-duty trailer prices is more difficult to explain — although, as with dump bodies, it can be partly attributed to the steel factor. Steel accounts for a greater percentage of the total bill of materials for light-duty trailers than for heavy-duty, which use much larger tires and more of them. They generally have air springs. Additionally, van body trailers often have wood flooring and large aluminum bodies (the aluminum tariff was only 10 percent). While steel is a key heavy-duty trailer component, use of other expensive components lowers the percentage of the total accounted for by steel. If there was a price index for tank trailers, the quarterly and annual price increases would likely be much closer to the dump body and light-duty trailer price jumps.

Another factor influencing light- and heavy-duty trailer pricing is the mix of application markets to which they’re sold. A greater percentage of heavy-duty trailers are sold to large fleets on long-term contracts. Those contracts may include price escalators, which limit negotiation regarding short-term price changes because of factors such as tariffs. In the market for light-duty trailers, there is more opportunity for negotiation, so price changes tend to be more volatile — in both directions — in that market.

The PPI program measures average change over time in the selling prices received by domestic producers for their output. Prices included in the PPI are from the first commercial transaction for many products and some services. Learn more at https://www.bls.gov/ppi/videos.htm.

For more industry market data and business planning resources, visit ntea.com/marketdata.

Join us at The Work Truck Show® 2019

NTEA Director of Market Data and Research Steve Latin-Kasper will present the following sessions: