By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the May 2019 edition of NTEA News

Key highlights

- Private segment growth in the construction sector is expected to decelerate in 2019.

- Residential and nonresidential expenditures may decline in the second or third quarter of the year.

- House prices remain high relative to incomes, which is expected to continue through the year.

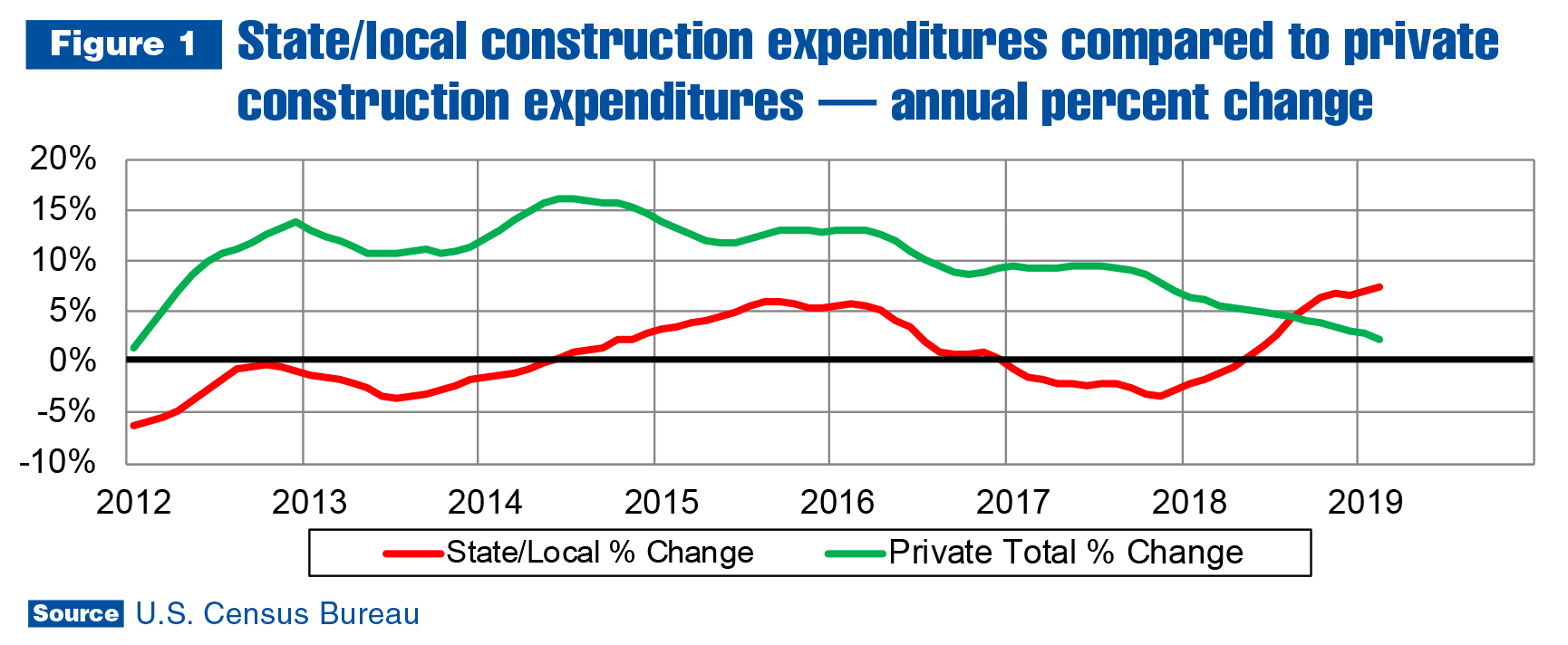

The construction sector of the U.S. economy has grown since 2012, but the rate of growth has decelerated since 2014. Different segments of the construction sector have grown at widely divergent rates throughout the current economic expansion. Figure 1 shows the government segment of the construction sector didn’t emerge from recession until 2014, and fell into recession again in 2017 before accelerating in 2018. The private segment registered its peak growth rate in 2014 and has decelerated since. Private construction expenditures totaled $993 billion in 2018 — overshadowing the $301 billion government (state/local/federal) total.

Because it accounts for a much larger share of the market, private segment growth was more than enough to push the industry total up in the years when government segment expenditures were falling or growing slowly. In 2019, the size difference means relatively fast growth in the government segment won’t be enough to prevent the total from declining on an annual basis if private segment growth becomes negative. On current trend, it will likely occur in the second or third quarter of this year.

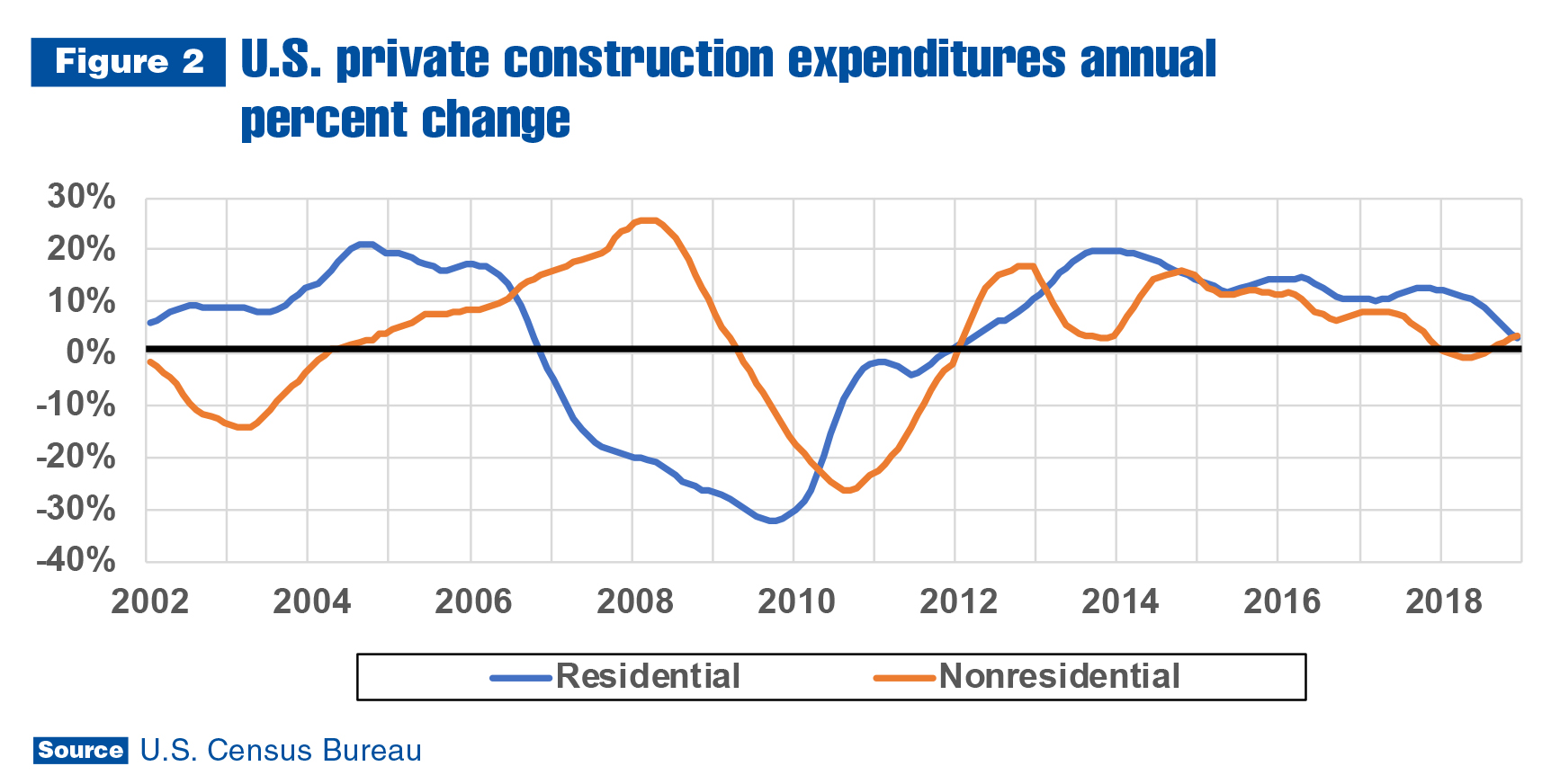

Additional segmentation of the construction sector reveals divergence within the private segment as well. As shown in Figure 2, private segment residential and nonresidential components trend in the same direction in the long-run, but in any given short-run period, they can deviate substantially. In the second half of 2018, residential expenditures steadily decelerated, while nonresidential expenditures accelerated.

As of the first quarter of 2019, though, nonresidential expenditures appear to have stabilized and growth should start decelerating in line with residential expenditures in the second quarter. It’s probable that residential and nonresidential expenditures will decline in the second or third quarter of the year, but remains to be seen whether the decrease will extend into 2020.

Housing starts, which are a good leading indicator of construction expenditures, had a rough start this year. In January 2019, they fell 7.1 percent as compared to January 2018, and 9.3 percent in February. In the National Association for Business Economics March Outlook, the

consensus was housing starts would increase 2.4 percent this year. The National Association of Home Builders March forecast called for 2.1 percent growth. Both appear too optimistic as of the first quarter of 2019.

House prices remain high relative to incomes — a ratio that will probably get worse in 2019. Many millennials will continue to see affordability as an issue. In addition, a tight labor market could make it difficult for home builders to increase production, which means the supply side of the market will likely put upward pressure on price. If housing starts decline for the third consecutive month in March, the next round of forecasts may be revised significantly downward.

Since the construction sector of the economy is an important application market for trucks and truck equipment, it’s not surprising that commercial truck sales growth has been decelerating at roughly the same rate. Current predictions call for commercial truck sales to grow slightly in 2019, and decline a bit in 2020. Construction sector activity will substantially impact the accuracy of the forecast, so NTEA will continue to monitor it closely.

For more industry market data, visit ntea.com/marketdata.