This article was published in the March 2017 edition of NTEA News.

The work truck industry has made significant strides in the last year and is poised for continued growth. Given the stable economic condition, many companies are evaluating strategic opportunities for the coming year. NTEA delivers important market data to help members navigate the decision-making process and stay current on key trends related to hiring prospects, sales levels and business growth patterns.

On a biannual basis, the Association seeks input from Distributor and Manufacturer member companies to gauge business climate and future expectations. Aggregate data addresses:

- Sales levels and quoting activity

- Backlogs

- Production capacity

- Employment levels

- Key factors influencing member business

- Upcoming challenges and opportunities

This article highlights the latest survey results, integrating data from previous research initiatives to capture year-to-year comparisons and directional trends. The next survey will be emailed to Distributor and Manufacturer members in July 2017.

Recent survey findings

Fifty-eight percent of respondents are distributors, and 42 percent manufacturers. Annual sales range from less than $2 million to more than $70 million, with the largest group representing $5–10 million (21 percent). Participants ranked construction and government/municipal sectors, respectively, as the most important application markets to their business in terms of total 2016 sales. Overall, data indicates strong sales levels and improved business expectations.

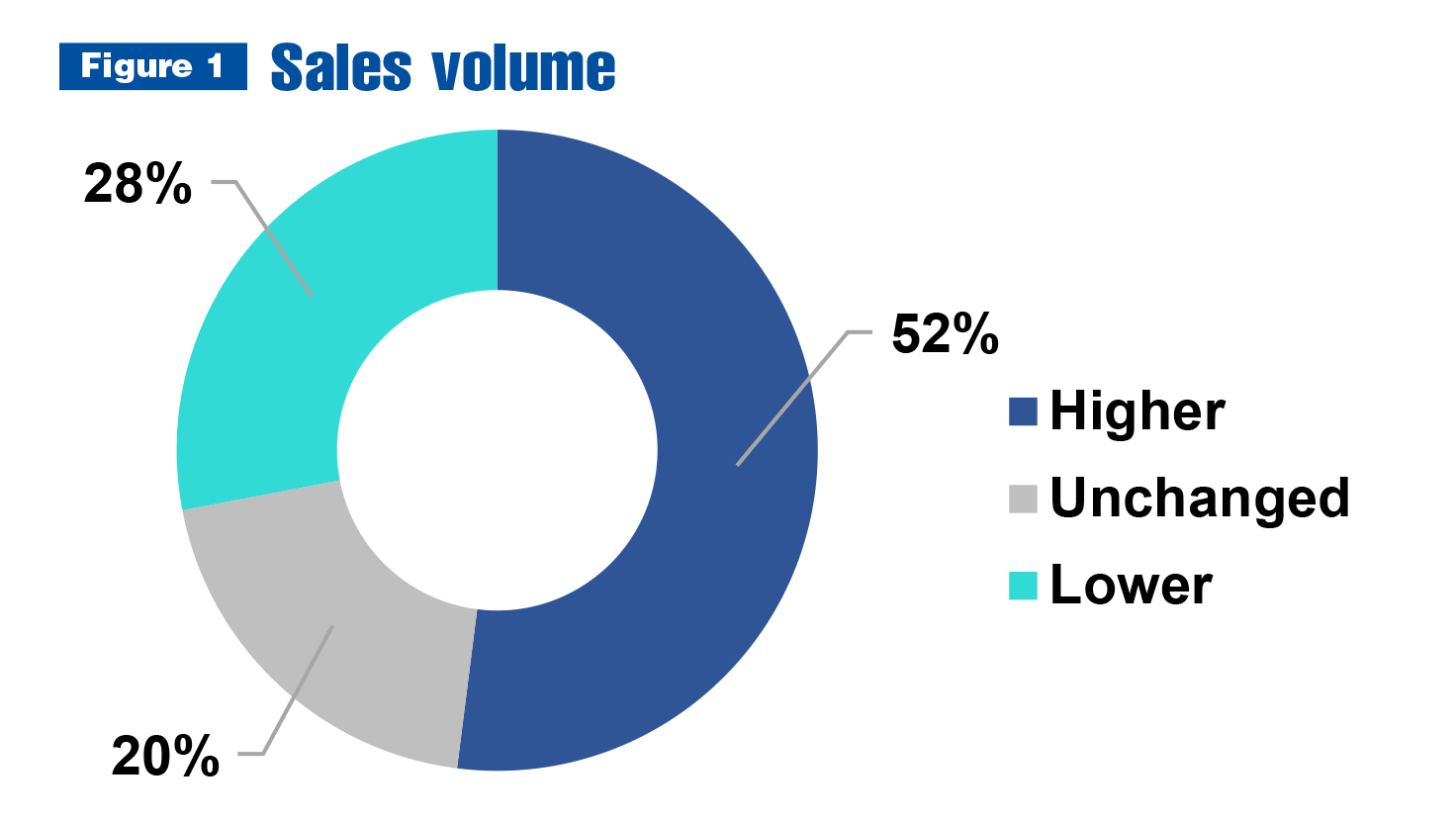

More than half of survey respondents registered higher sales in 2016 relative to 2015, while 28 percent reported a decline.

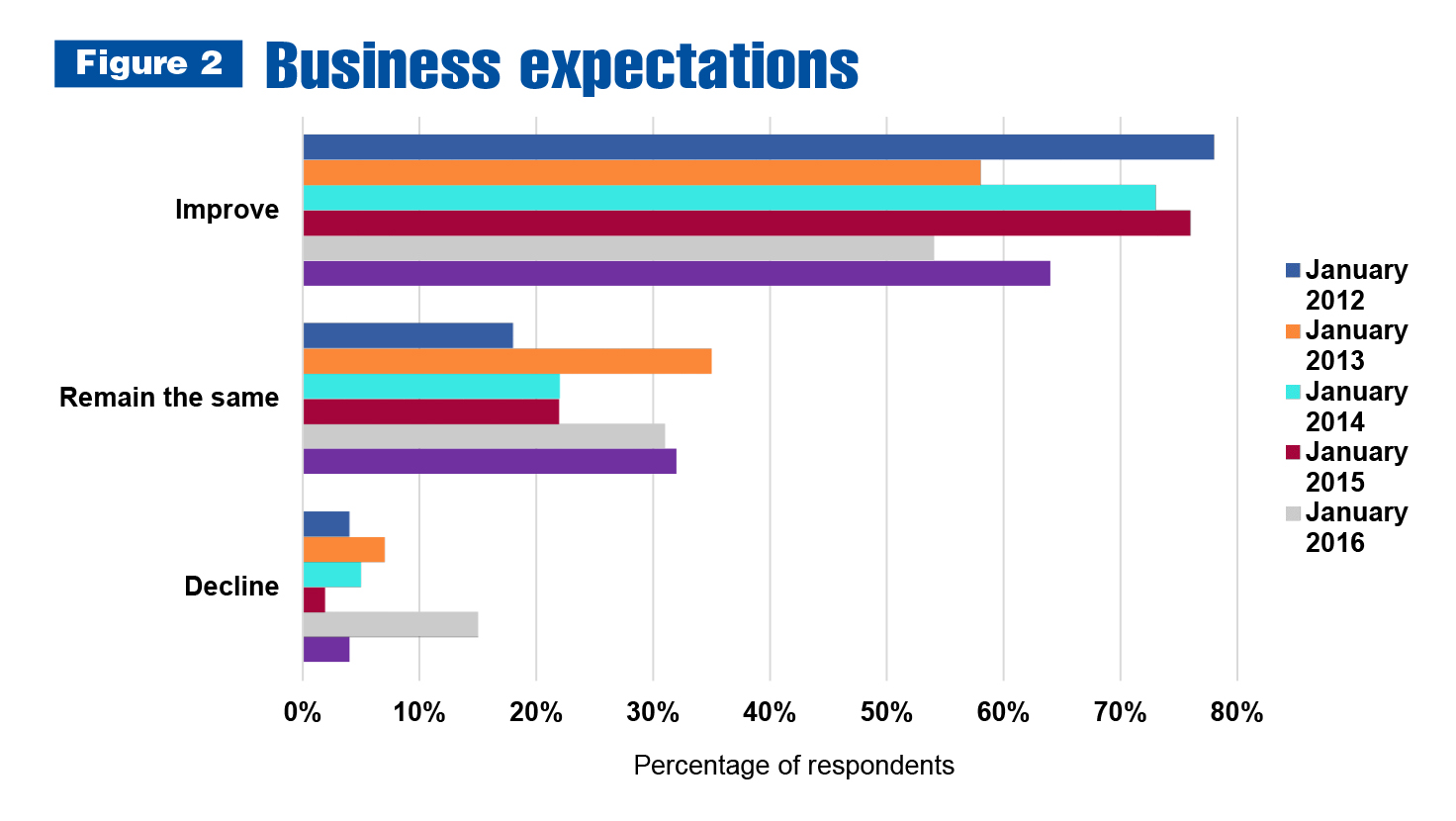

Sixty-four percent plan on business improving in 2017 — a 10-percent increase as compared to last year’s outlook. Expectations appear optimistic, with only 4 percent anticipating a decline as compared to 15 percent in 2016.

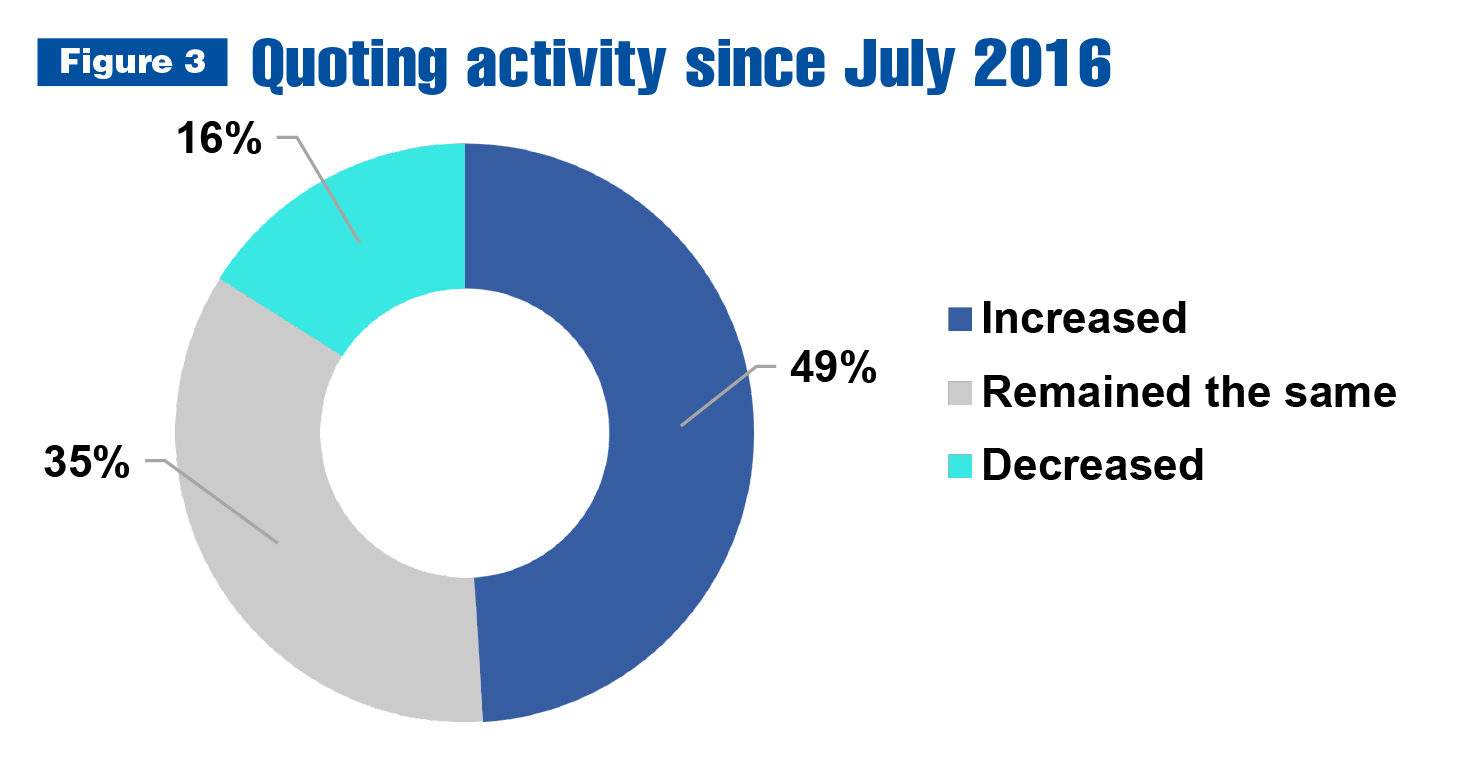

Almost half of survey respondents noted more quoting activity since July 2016. Thirty-five percent said levels are staying flat, and just 16 percent identified a decrease.

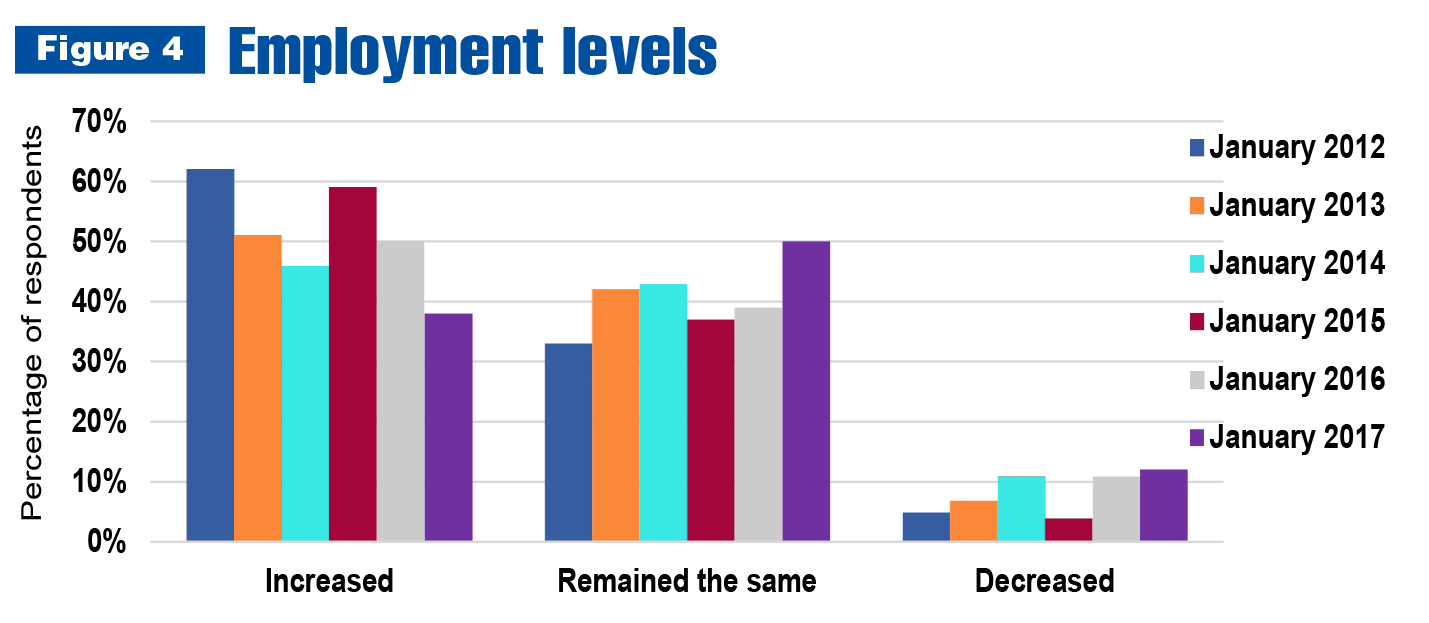

Only 38 percent of participants indicated rising employment levels — a noticeable dip from 59 percent in 2015 and 50 percent in 2016. Even still, half of respondents are keeping the same number of employees, reflecting stability on the whole.

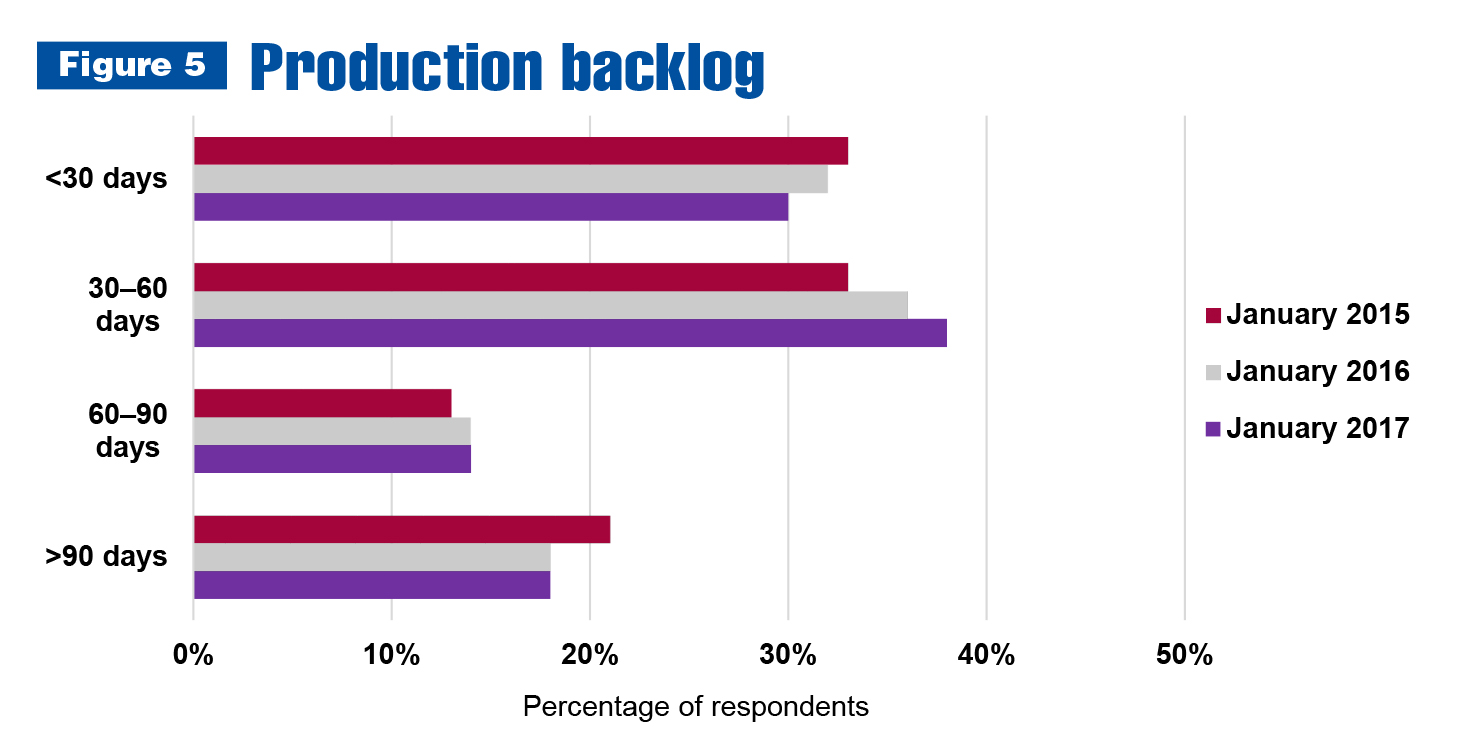

Eighty percent of survey respondents are dealing with a business backlog at some level. Of those with backlog, 30 percent indicated current levels have increased relative to July 2016, while 21 percent noted an improvement.

As compared to data from January 2016, backlog levels remain largely the same. The only shift was a slight dip in turnaround time less than 30 days, which transitioned to the 30–60-day window. Eighteen percent said backlog exceeds 90 days.

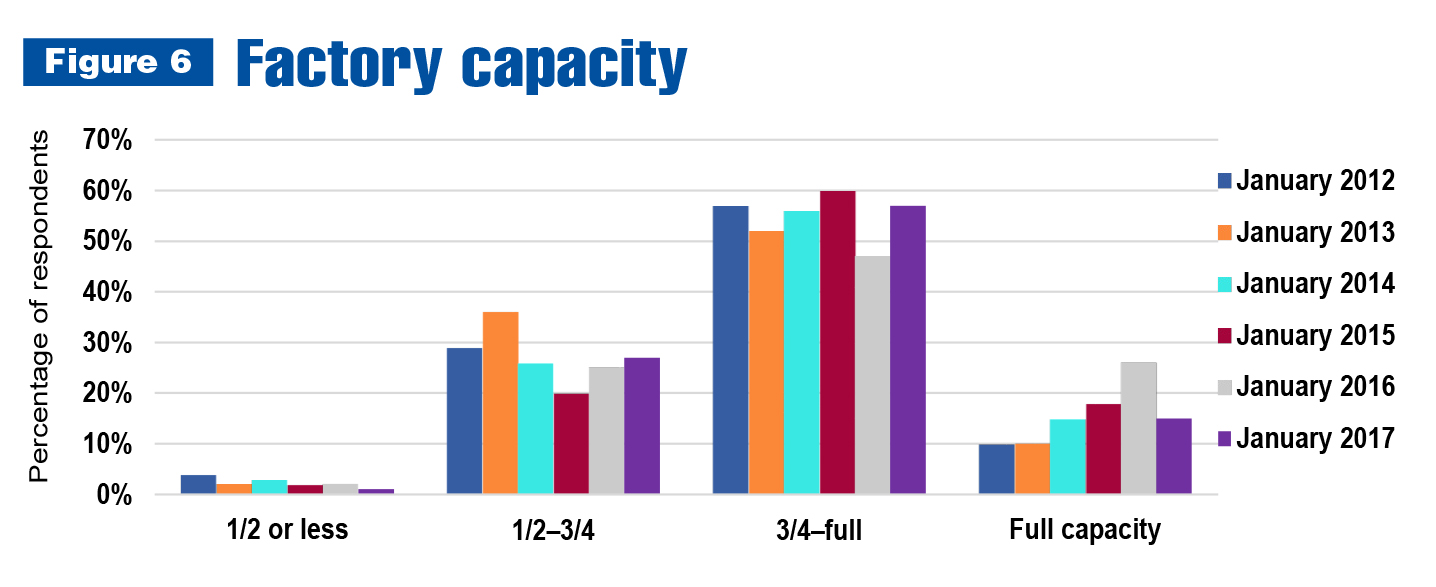

Seventy-two percent of reporting companies have little to no ability to increase workload above current capacity — barring a sizable business expansion or merger. Although this result is almost identical to the 73 percent noted last year, fewer companies are functioning at full capacity (15 percent in 2017 as compared to 26 percent in 2016). More than a quarter of survey respondents are running at 50–75 percent.

Factors affecting business

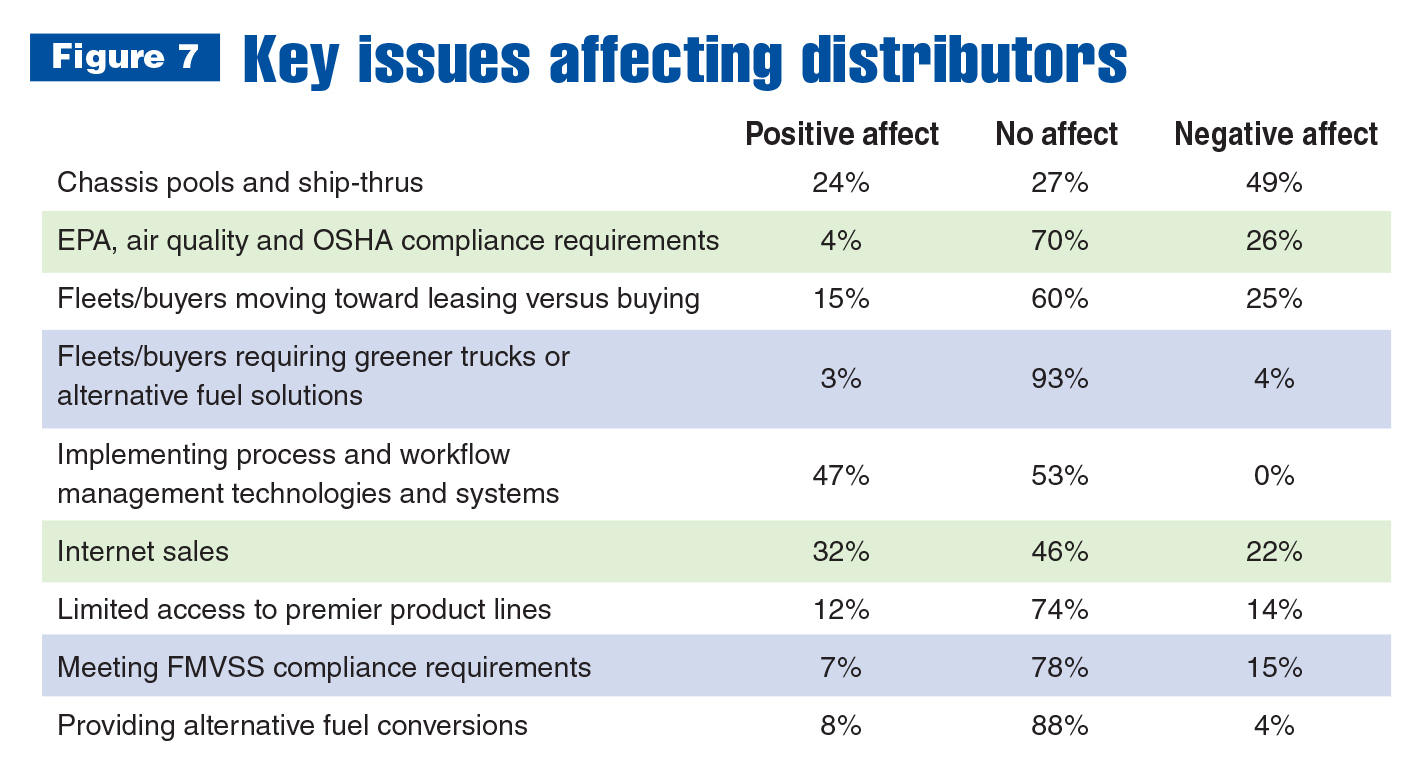

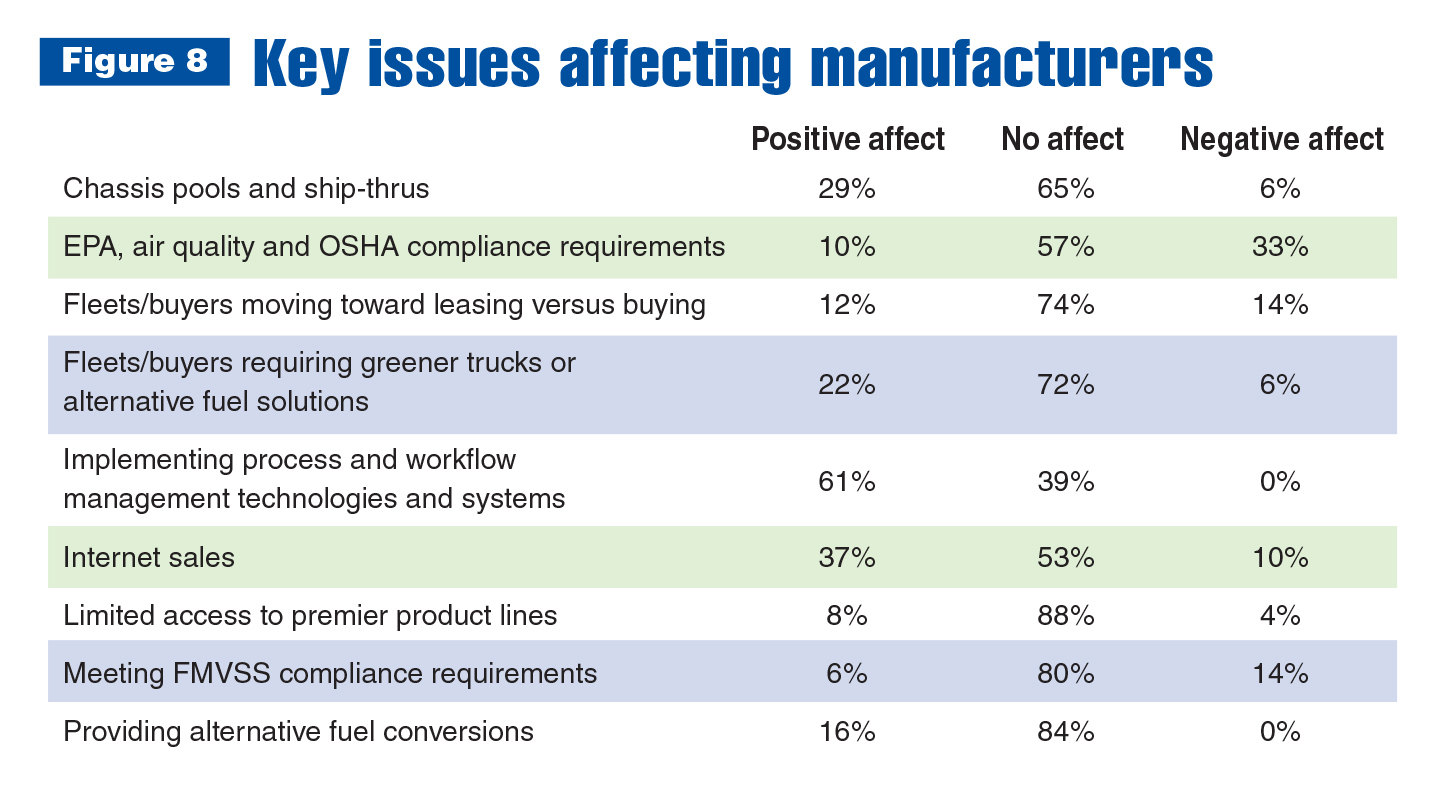

Work truck industry companies must confront a variety of market factors influencing their business transactions. Figures 7 and 8 isolate distributor and manufacturer viewpoints on a series of key issues.

By far, implementation of process and workflow management technologies and systems has the most positive affect on distributors, allowing them to benefit from key efficiencies. Chassis pools and ship-thrus were defined as most detrimental, followed by Environmental Protection Agency (EPA), air quality and Occupational Safety and Health Administration (OSHA) compliance requirements. Responding distributor companies were most neutral toward fleets and buyers requiring greener trucks or alternative fuel solutions.

Implementing process and workflow management technologies was even more important to manufacturers than distributors, with internet sales ranking a distant second. Limited access to premier product lines was least influential, followed by alternative fuel conversion options and FMVSS compliance requirements. EPA, air quality and OSHA compliance requirements have the most negative influence.

Industry challenges

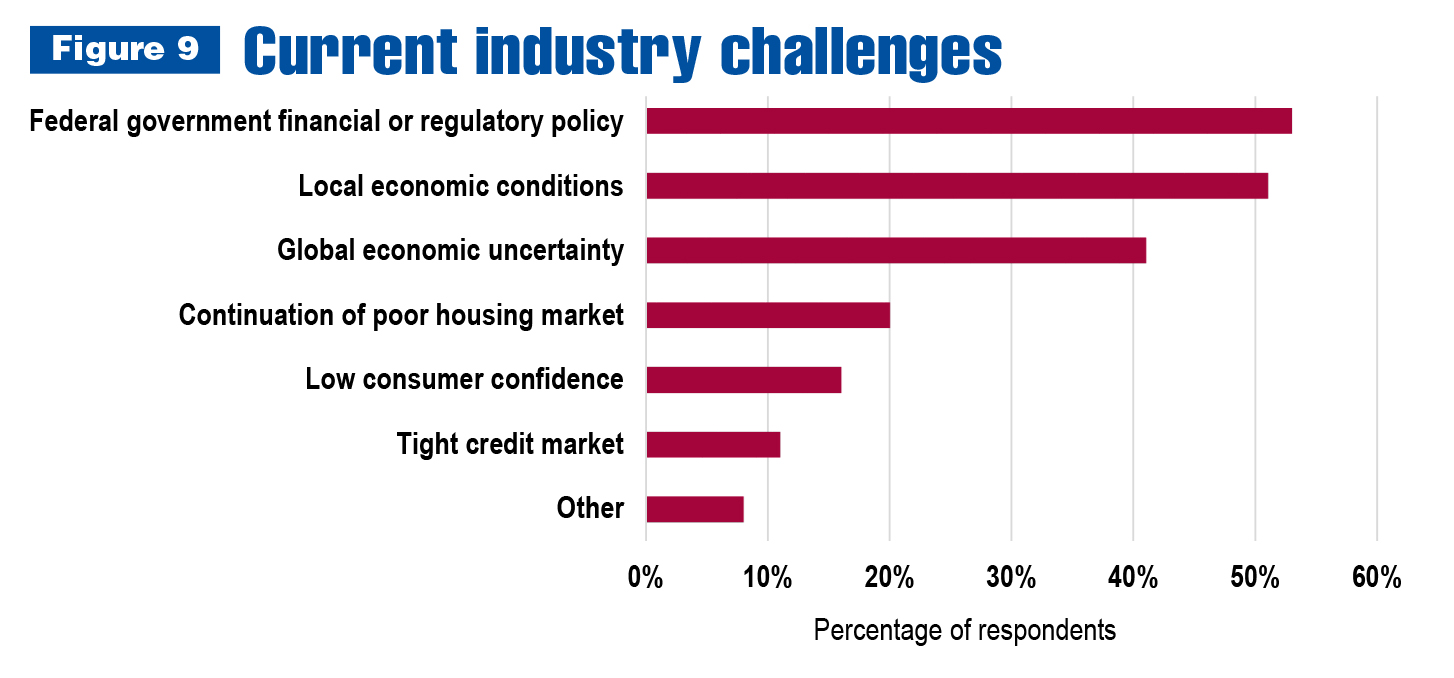

Though the 2017 outlook calls for growth, the economy still presents challenges for many member companies. As shown in Figure 9 (above right), more than 50 percent of survey respondents cited concerns about local conditions and 41 percent reported uncertainty surrounding global dynamics. However, the federal government’s financial/regulatory policies represent the biggest obstacle currently facing the work truck industry.

Note: Totals are not equal to 100 percent due to respondents’ ability to select multiple answers.

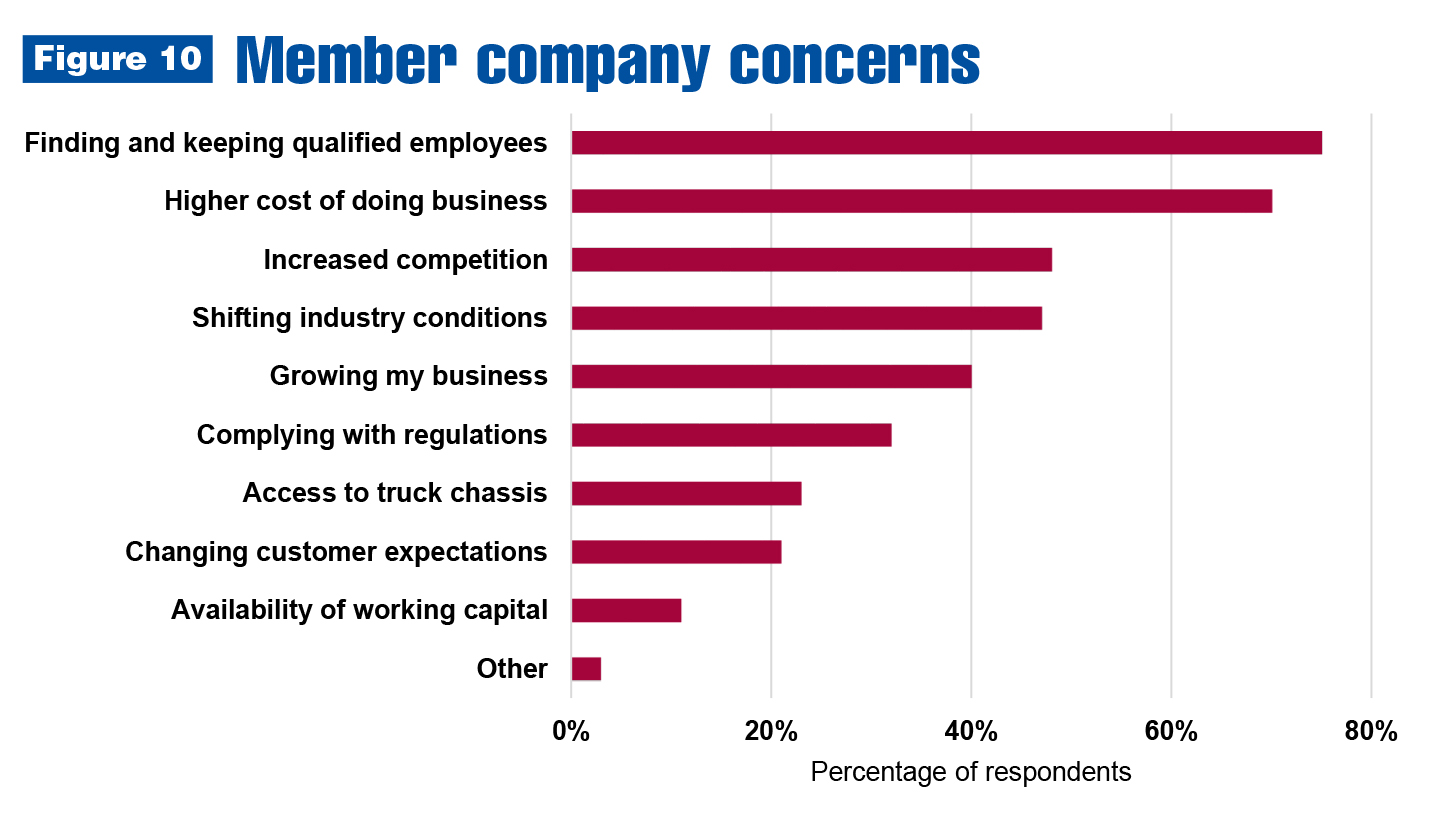

For three quarters of reporting members, finding and retaining qualified employees is the biggest issue. Seventy percent indicate difficulty surrounding the higher cost of doing business. Increased competition, changing industry conditions (including shifting customer and marketplace dynamics) and business growth opportunities are other noteworthy issues of consideration.

Note: Totals are not equal to 100 percent due to respondents’ ability to select multiple answers.

Success strategies

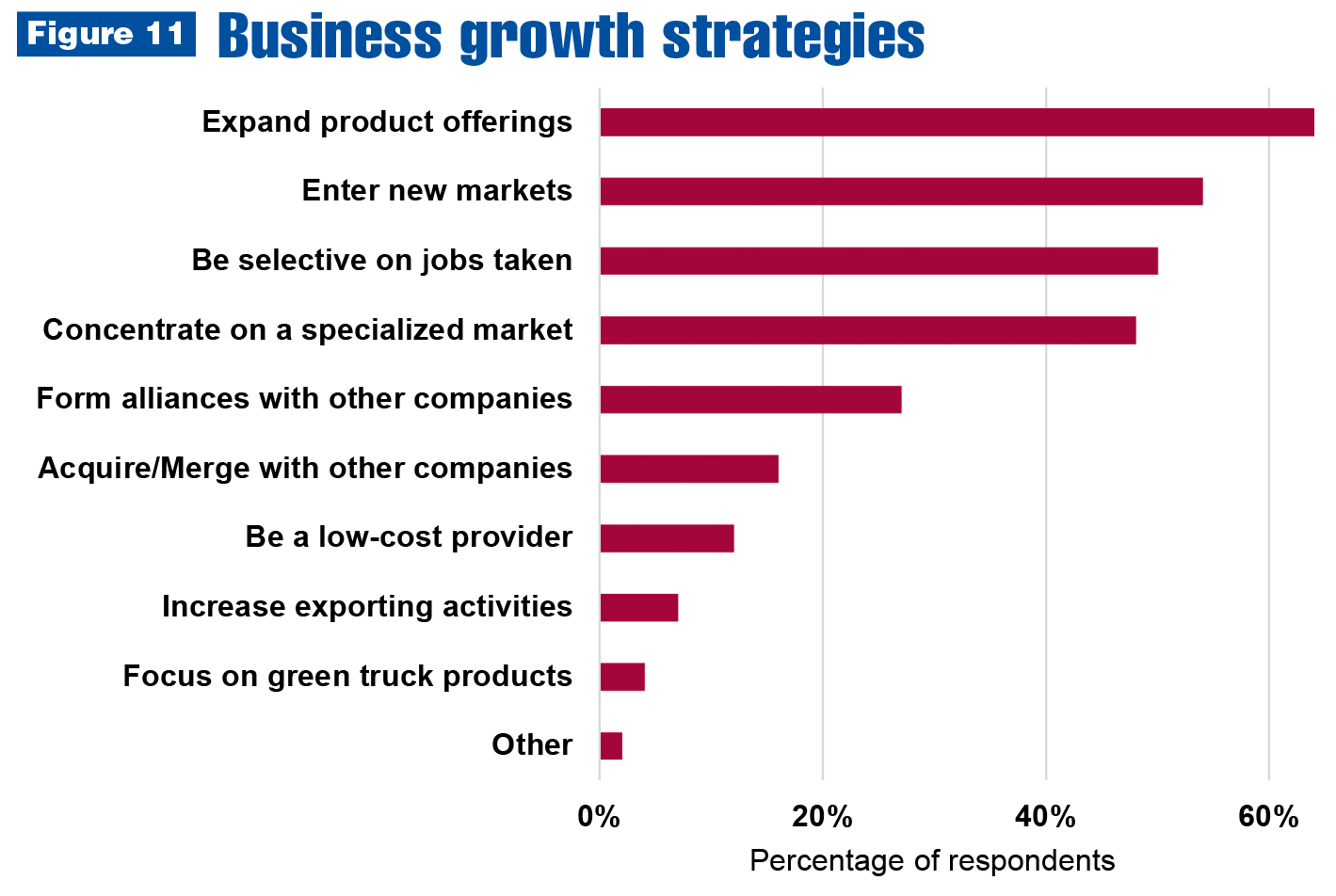

In terms of business growth, most common tactics include expanding product offerings or product lines, entering new markets and being selective on jobs taken to maintain higher profit margins. Other widely regarded approaches include focusing on a specialized niche market or forming alliances with other industry companies. The least popular method was concentrating on alternative fuel and green truck products.

Note: Totals are not equal to 100 percent due to respondents’ ability to select multiple answers.

Looking ahead

For 2017, the work truck industry forecast calls for steady growth. The market landscape suggests areas of opportunity and caution. Distributor and manufacturer survey respondents noted a variety of business growth options, such as:

- Obtaining a chassis pool

- Acquiring another company

- Exploring under-served markets

- Accessing new export markets

- Standardizing product offerings

- Utilizing technology for business promotion

- Embracing lean principles

Finding skilled employees, dealing with government regulations and navigating the economy are all major concerns echoed by survey participants. Other significant factors affecting company growth and long-term success include the following:

- Building sufficient cash flow

- Increasing brand exposure

- Finding optimal locations to conduct business

- Managing competition

- Rising insurance costs

- High taxation

- Project turnaround time

For questions or more information on this survey, contact Joy Knesnik, NTEA communications manager, at joy@ntea.com.