By Mike Kastner, NTEA Managing Director

This article was published in the May 2016 edition of NTEA

News.

Recently, Canadian Finance Minister Bill Morneau

presented the government’s highly anticipated Budget 2016: Growing the

Middle Class in the House of Commons. The new budget supports an ambitious

agenda that seeks to fulfill key election promises and will see new federal

investments in everything from infrastructure, to the creation of the Canadian

Child Benefit, to re-engaging indigenous communities. The Liberal Party’s

campaign promise of keeping budget deficits to below $10 billion was not kept,

with the projected deficit now at $29.4 billion.

Following is a closer look at provisions relevant to the

work truck industry: infrastructure, energy and mining.

Infrastructure

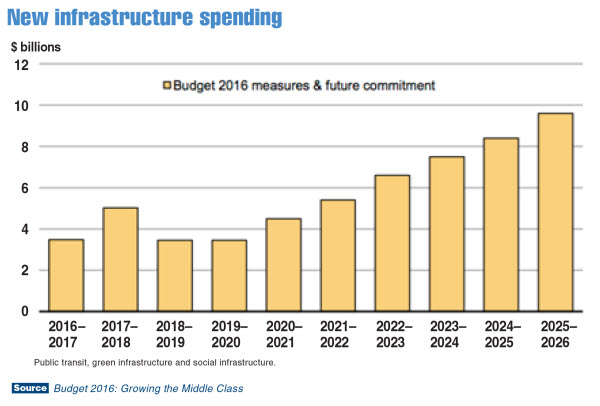

One of

Budget 2016’s largest expenditures is infrastructure, with plans to

invest more than $120 billion over the next 10 years, divided into two phases.

The first concentrates on Canada’s short-term needs (e.g., upgrading public

transit, allotting funds for wastewater facilities, etc.) with investments

totaling $11.9 billion over five years and set to begin immediately.

The second phase concentrates on Canada’s long-term

infrastructure needs to help create a more modern economy better positioned to

capitalize on global trade. Investments will focus on making Canada’s largest

cities better places to live through cost-effective, sustainable and integrated

transportation networks. This will also create fast and efficient corridors to

help Canadian exporters benefit fully from international trade. Noteworthy

investments include:

- $3.4 billion over the next five

years, on a cash basis, to maintain and upgrade federal infrastructure assets

such as airports and border infrastructure

- Approximately $3 billion each

year in dedicated funding for municipal infrastructure projects through the Gas

Tax Fund and the Goods and Services Tax Rebate for Municipalities

- $9 billion available under New

Building Canada Fund’s Provincial-Territorial Infrastructure Component and other

existing infrastructure programs

- $3.4 billion in public transit

over three years, starting in 2016 to 2017. Funding will be provided through a

new Public Transit Infrastructure Fund

- Continued investment toward

construction of the Gordie Howe International Bridge project between Windsor,

Ontario, and Detroit, Michigan, including requests-for-proposals to select

private-sector partners for construction and ongoing operation of the new

crossing

Energy

Canada’s energy sector,

particularly Alberta oil sands, has been hit hard by the drop in global oil

prices, high labor costs and constraints on infrastructure to move the product

to market (i.e., pipelines). Most energy-related commitments in Budget

2016 pertain to increased investment in green and renewable energy

technologies to spur energy-sector diversification and combat climate change.

New spending includes:

- $82.5 million over two years to

Natural Resources Canada to support the research, development and demonstration

of clean energy technologies

- $128.8 million over five years

to Natural Resources Canada to deliver energy efficiency policies and programs

to support improved energy efficiency standards and codes for products,

buildings, industry and vehicles

- $56.9 million over two years to

Transport Canada and Environment and Climate Change Canada to support the

transition to a cleaner transportation sector, including the development of

regulations and standards for clean transportation technology

- $62.5 million over two years to

Natural Resources Canada to support infrastructure deployment for alternative

transportation fuels, including electric vehicle charging and

natural gas

and hydrogen refueling stations.

Mining

Canada heavily relies

on its resource extraction and export sector. Although this budget looks toward

new industries and technologies, it also builds on Canada’s strengths in more

traditional segments. Key investments for this area:

- One-year extension of the

15-percent Mineral Exploration Tax Credit. This helps junior mineral exploration

companies raise capital by providing an incentive to individual investors in

flow-through shares issued to finance “grassroots” mineral exploration

- $1 billion over four years to

support clean technology, including in the forestry, fishery, mining, energy and

agriculture sectors (specific details are being provided through the

government’s Innovation Agenda).

Motor vehicle safety

Motor

vehicle safety is one of the priority regulatory areas NTEA monitors and on

which it engages policymakers. Budget 2016 proposes $7.3 million over two

years to increase inspection capacity and support development of a regulatory

framework for emerging technologies, such as automated vehicles.

Looking ahead

The new budget

presents a dramatic shift from the previous government. The last time Canada

projected double-digit deficits was after the 2008 financial crisis when

then-Minister of Finance Jim Flaherty engaged in heavy deficit spending through

stimulus packages. The Liberal government has promised to continue reducing the

debt to GDP (gross domestic product) ratio, while running deficits for all four

years of their mandate.

As the details surrounding specific initiatives are

released, NTEA’s government relations office in Ottawa, Ontario, will continue

to follow key developments.

If you have any questions regarding the information in this article,

please contact Mike Kastner at 202-552-1600 or mkastner@ntea.com.