By: Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the March 2017 edition of NTEA News.

U.S. trade with Mexico and potential changes to the North American Free Trade Agreement (NAFTA) have become more prevalent news topics. NAFTA took effect Jan. 1, 1994, and tariffs fell to zero for practically all motor vehicle industry parts and products by 2004.

Due to the U.S./Canada free trade agreement in place prior to NAFTA, the countries’ motor vehicle industries were already more integrated by 1994. Over the first 10 years of NAFTA, the same type of integration occurred between both countries and Mexico, and increased after tariffs fell to zero in 2004.

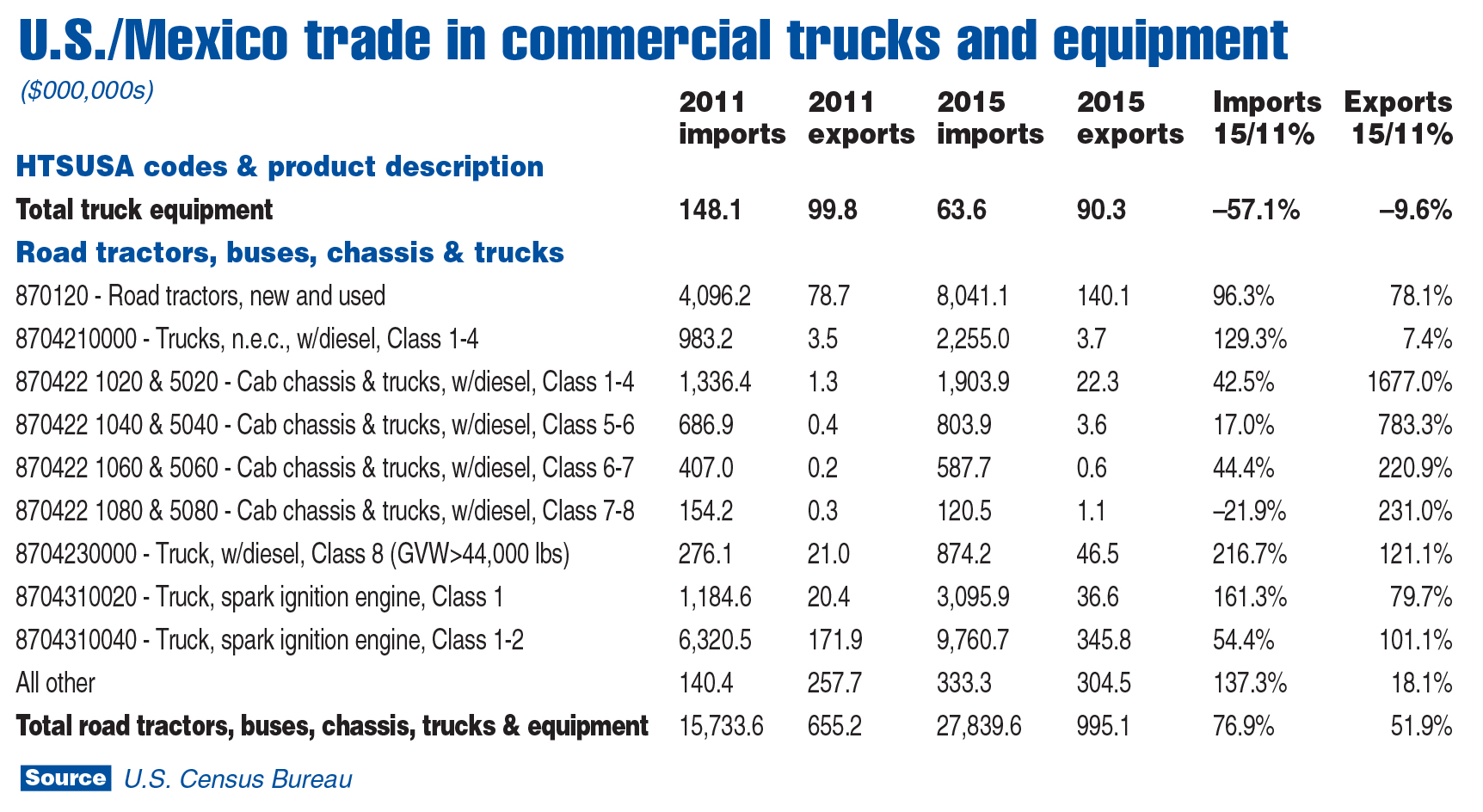

North American economic integration is ongoing. As shown in the chart above, between 2011 and 2015, U.S. work truck industry product imports from Mexico increased from $15.7 billion to $27.8 billion. Exports rose from $655.2 million to $995.1 million. The total value of imports is greater than exports, but doesn’t account for the value of parts imported from the U.S. for final assembly in Mexico.

In looking at the history of U.S. work truck industry imports from Mexico and Canada combined, in 2001, the total was $18.1 billion ($10.8 billion from Canada and $7.3 billion from Mexico). By 2007, as the U.S. entered into recession, it was $20.8 billion ($10.9 billion from Canada and $9.9 billion from Mexico). As integration with Mexico proceeded, OEMs took advantage of the country’s lower production costs.

The recession flipped the comparison. In 2009, imports fell to the lowest level since NAFTA was implemented — $5.7 billion ($2.4 billion from Canada and $3.3 billion from Mexico). Shuttered Canadian plants were replaced by new ones in Mexico, and as North American sales started increasing again, imports from Mexico grew proportionately.

By 2011, U.S. total imports of work truck industry products climbed to $17.5 billion ($1.8 billion from Canada and $15.7 billion from Mexico). In 2015, a new record import total of $30.2 billion was set. Of that, $2.4 billion was from Canada and $27.8 billion (more than the combined pre-recession total) was from Mexico.

It’s important to note, North American-based motor vehicle manufacturers aren’t the only companies that recently built plants in Mexico. Other industries, including those primarily based in the European Union (EU) and Asia, are pursuing this as well. And the primary factor for manufacturing in Mexico isn’t necessarily lower production costs.

For many companies, what drives the decision is that Mexico has free trade agreements with EU, Japan and South America as well as North America. In fact, Mexico has free trade agreements with 45 countries. By comparison, the U.S. has free trade agreements with 20. For any business wanting to sell its products tariff-free to the Western Hemisphere, Mexico is the place to be. For North American companies that want tariff-free access to EU and Japan, it makes sense to be in Mexico.

If the U.S. government makes changes to NAFTA in the near future, it may have a significant impact on U.S trade with Mexico. It is unlikely, though, that it will influence the way the rest of the world views Mexico. Even if it is no longer the right location for exporting to the U.S., it will likely remain the destination to export to 44 other countries.

For more industry market data, visit ntea.com/marketdata.