By Doyle Sumrall, NTEA managing director

This article was published in the October 2016 edition of NTEA News.

IHS Markit™ hosted its Automotive Conference in Detroit, Michigan, in September, providing valuable insights for the more than 300 industry professionals who attended. The event opened with a wide range of automotive industry presentations, which indicated a compressed current and near-term future for automakers.

Nariman Behravesh, IHS Markit’s chief economist, addressed the surprisingly muted impact of Brexit (the United Kingdom’s departure from the European Union). According to him, the United Kingdom is seeing reduced business confidence and heightened uncertainty, likely to constrain investment and employment plans. Behravesh said the pound has fallen sharply, with more losses to come. He anticipates 0.6-percent growth in the United Kingdom next year.

Behravesh also offered an interesting perspective on the European Union and related trade zones, clarifying the complex and interrelated situation.

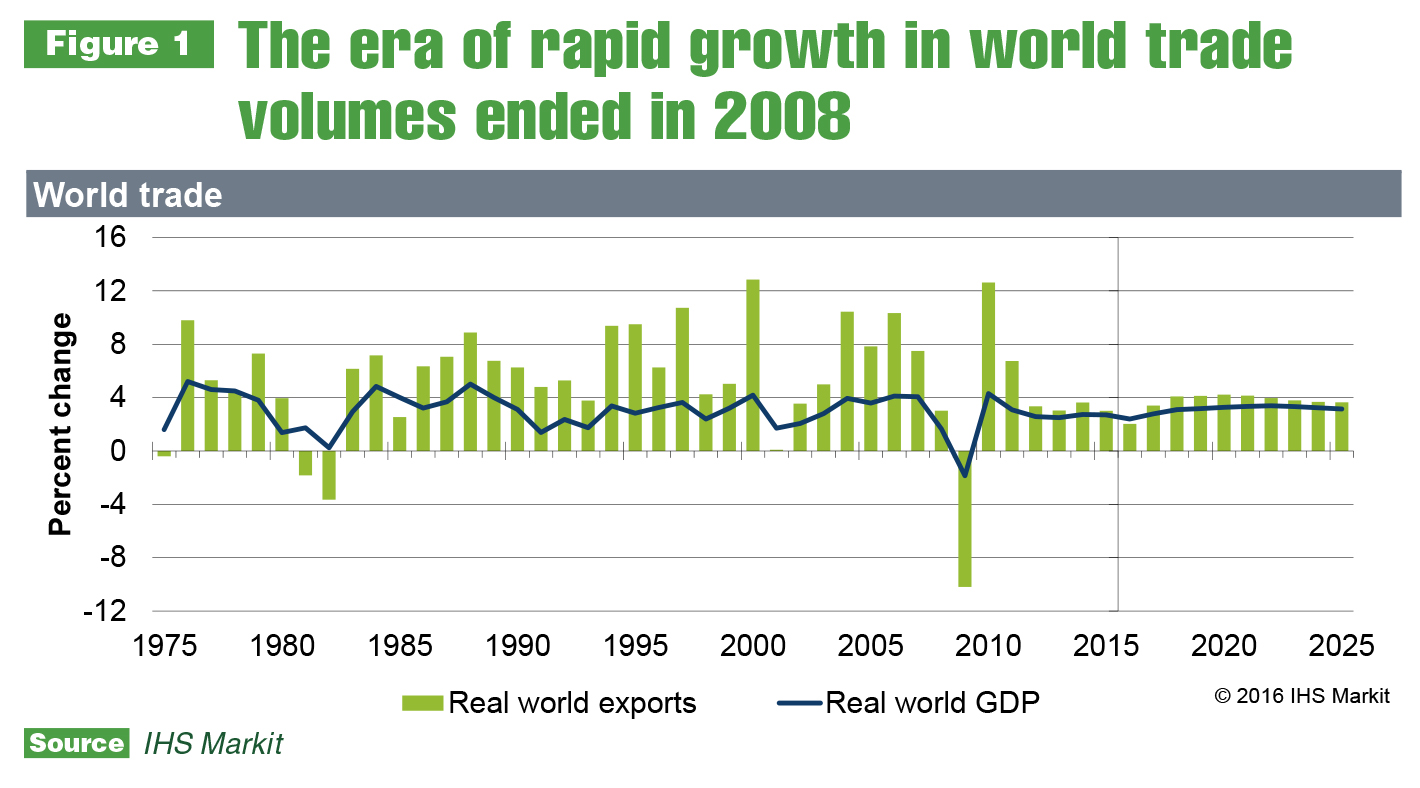

He then transitioned to global trade growth, which has slowed sharply since 2007. Support for globalization has ebbed and flowed in the last century. Brexit and trending trade/immigration issues referenced in the U.S. presidential campaign are the latest phase. Behravesh believes the majority of the nation’s voters (especially the young) approve free trade and immigration. U.S. unemployment is forecasted to stabilize in the 4.9-percent range and remain at this level into 2018, with gross domestic product staying at roughly 2.5 percent.

Several more automotive-specific presentations covered connected vehicles, engine size and type trends, and model offerings. Attendees learned a limited number of badges and models are likely to represent most of the modest growth projected in the near-term. Four breakout sessions tackled timely topics related to commercial vehicles, connected cars, the changing face of mobility and emerging markets.

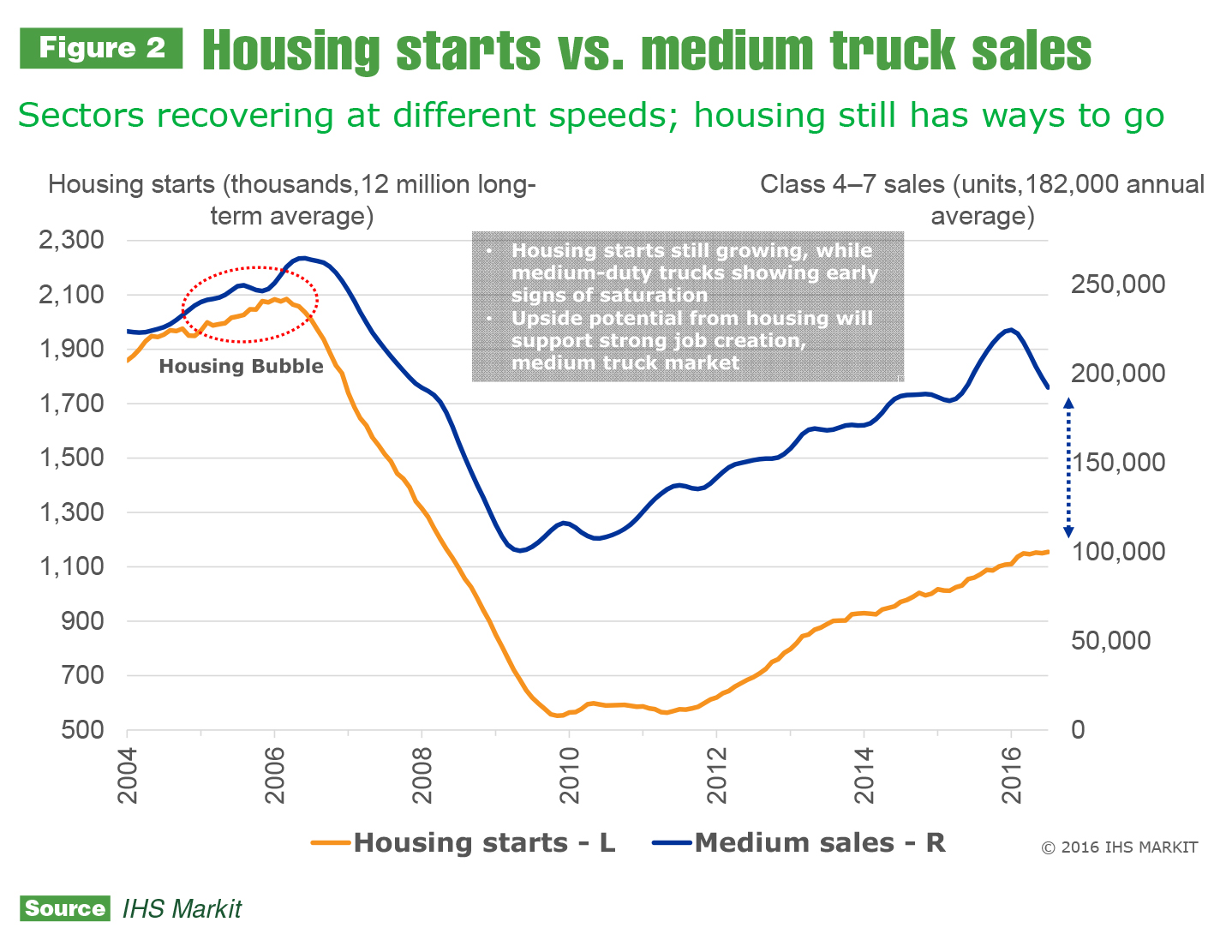

Antti Lindstrom, IHS Markit’s principal analyst – MHCV NAFTA, presented factors driving and affecting the truck market. He said this has been a nontraditional recovery — a position shared by other economists. Many traditional indicators have different relationships as compared to historical trends. Lindstrom shared insights on housing starts as related to Class 4–7 truck sales, identifying where the correlations had been strong previously and the disconnect in recent years. Even still, it seems the housing market is experiencing some growth.

In closing, Lindstrom said small commercial truck sales continue at a healthy pace, supported by emerging recovery in housing and construction as well as right-sizing trends. The medium-duty market has been gaining ground at a slower pace. Heavy-duty peaked in 2015 and is now adjusting to market demand, and the NAFTA market will accelerate after the current slump. He stated growth will support steady freight flow expansion, increased vocational market and resource sector activity and public sector spending.

Gary Meteer Sr., IHS director of commercial vehicle solutions, explained the IHS data pool and provided examples of the robust reports available.

With millions of records offering in-depth information linked to vehicle identification numbers, it seems the insights are endless.

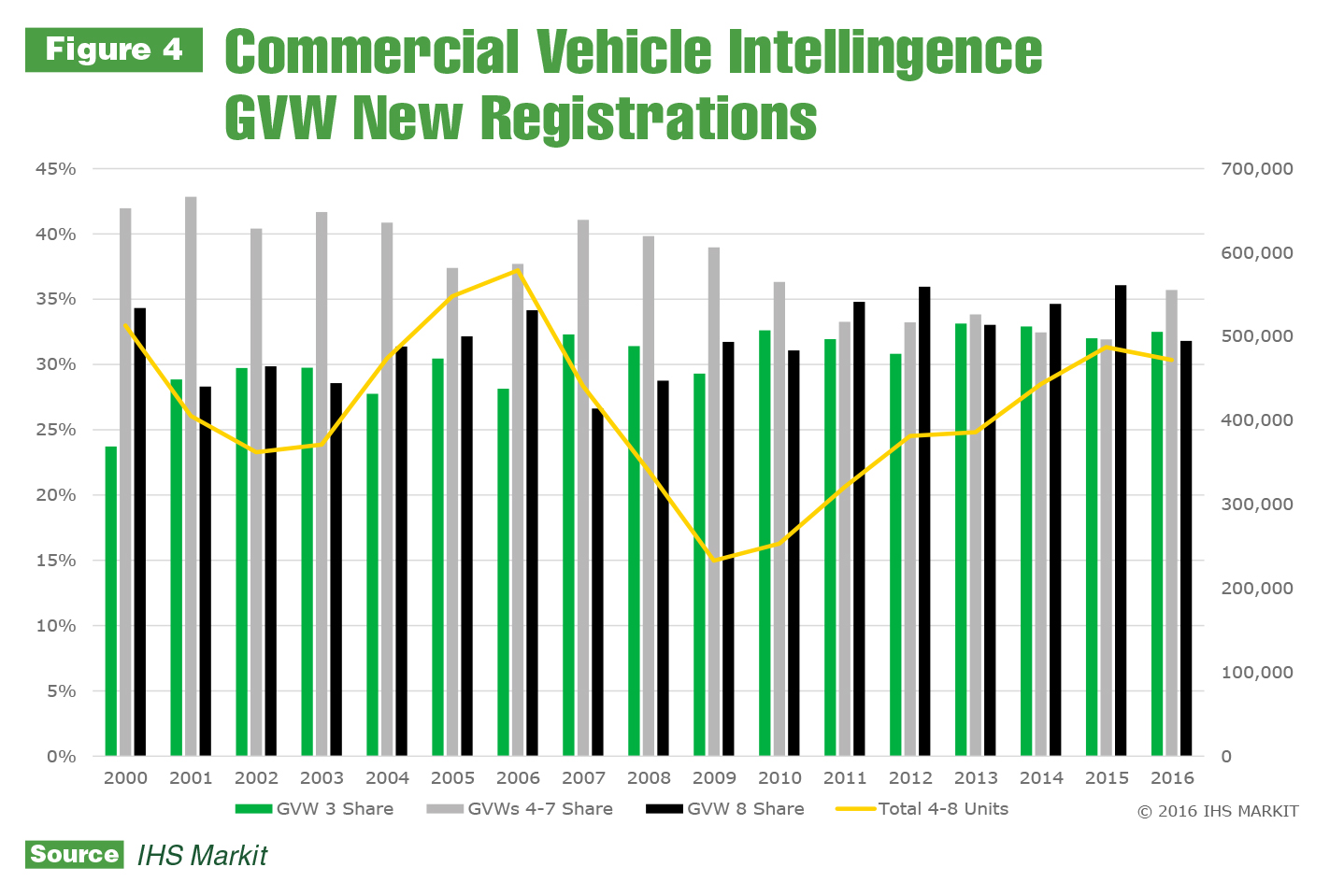

Considering new registrations, Class 8 is off more than the other weight classes, and, for this reason, total registrations will likely drop for the first time since 2009. It still appears 2016 will be a good year for the vocational truck market. Class 8 is predicted to recover a bit starting in 2017. Slow but steady growth through 2020 is forecasted for Classes 4–7.

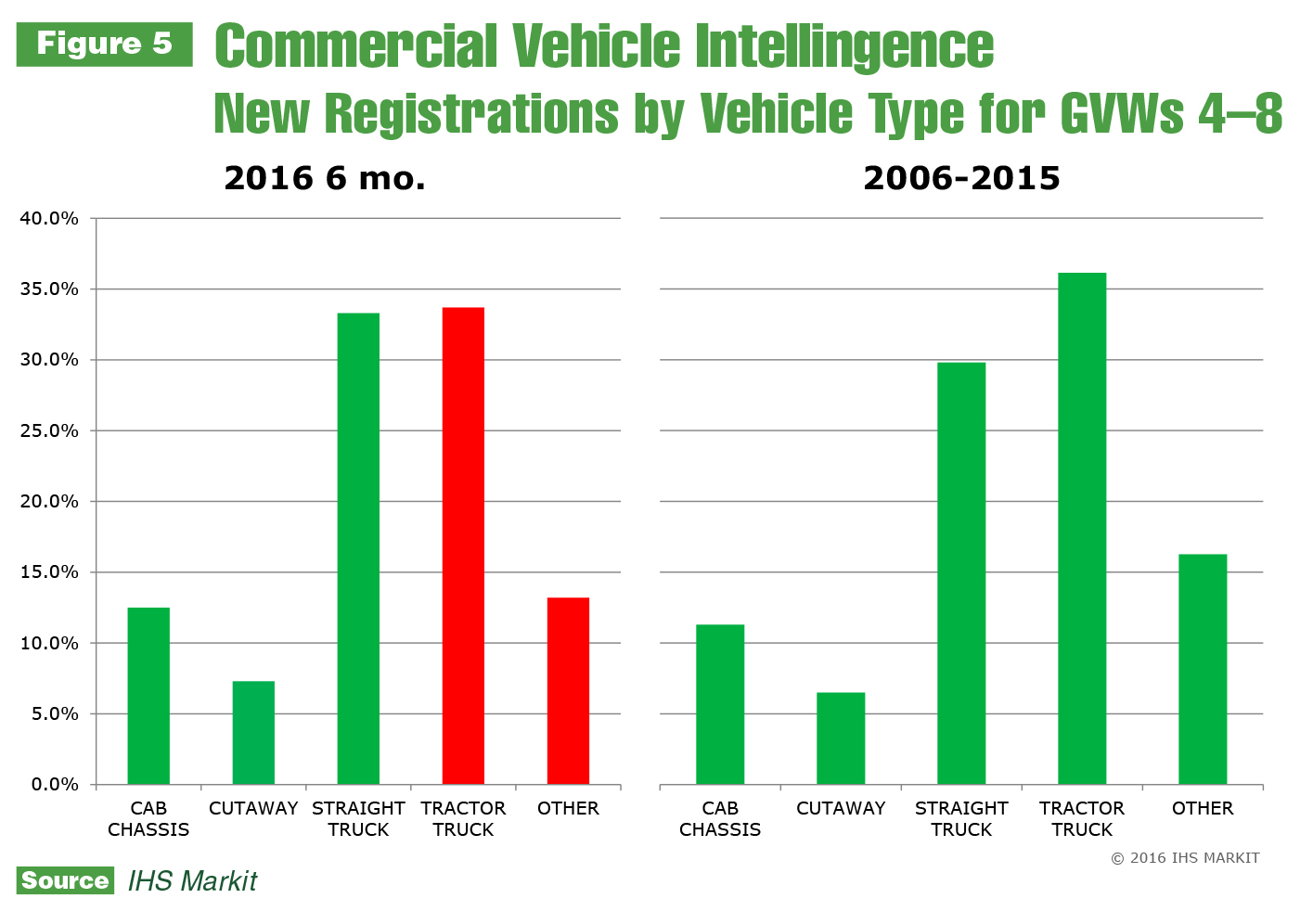

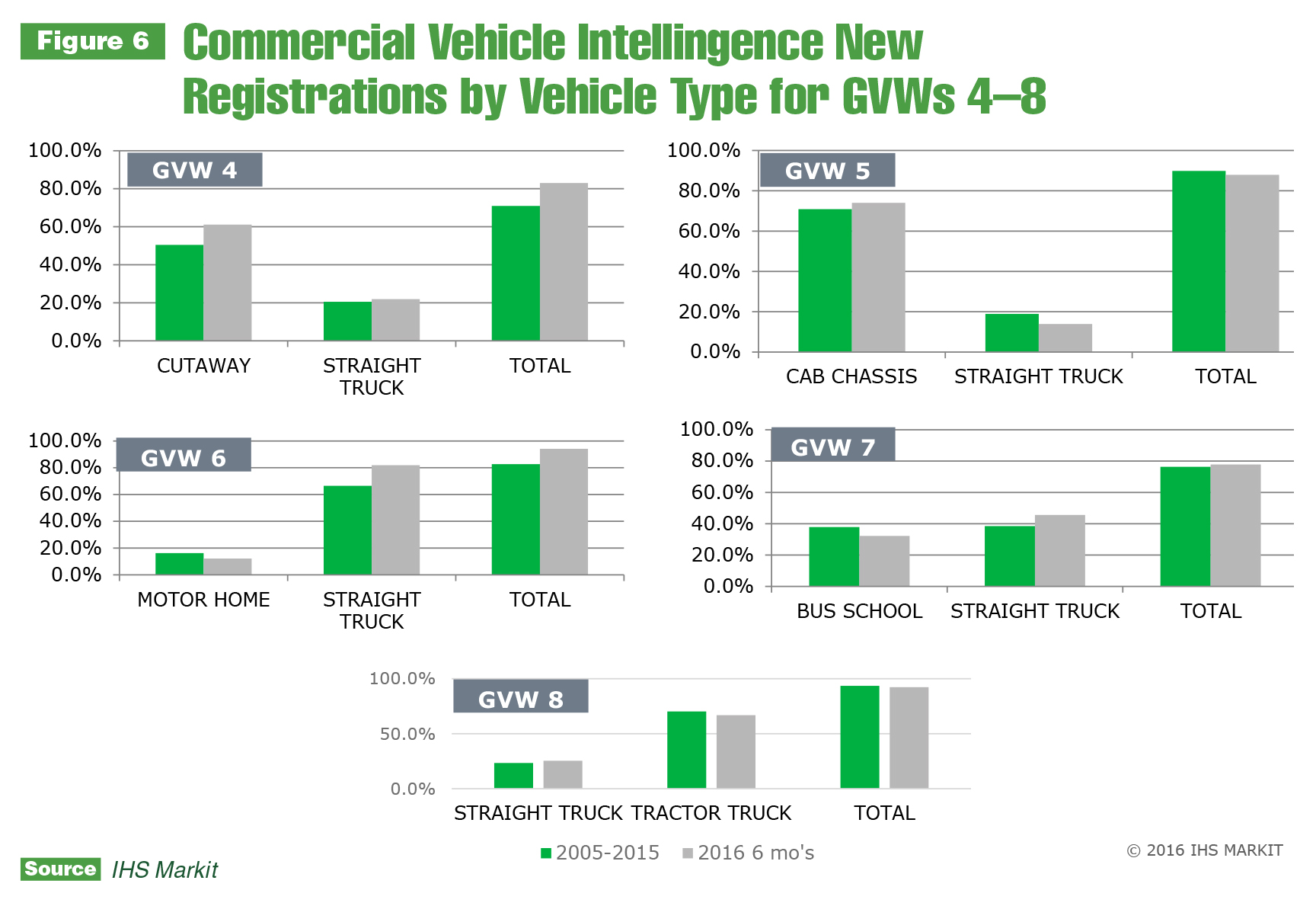

Meteer showed the cab-type data supports share by class, with vocational registrations beating the 10-year average and tractors coming up short.

Consider vehicle type by gross vehicle weight rating for more insight into vocations. Interestingly, Class 6 represents one of the highest average ages of trucks in use. With Class 6 registrations lagging the 10-year average in all but motorhomes, this trend will likely continue.

Toward the end of the Automotive Conference, Environmental Protection Agency and NTEA discussed the recently released greenhouse gas Phase Two rule. NTEA Managing Director Mike Kastner’s October Capitol Hill column summarizes implications. Although the IHS Markit Automotive Conference indicated compression of the entire North American vehicle market and reduced Class 8 sales, the overall outlook was positive. Industry conditions appear stable, with slight growth anticipated on the horizon.

If you have any questions, contact Doyle Sumrall at doyle@ntea.com.

Learn more about

GHG regulations at

The Work Truck Show® 2017.