Guest editorial

Dawn Brusseau, Associate Director, Product Management, Commercial, IHS Markit

This article was published in the November 2019 edition of NTEA News.

Trucks on the road in the U.S. are getting older, and the industry needs to be prepared. This might mean readying service bays, preparing technicians or stocking up on parts. As shared during IHS Markit’s Fall Automotive Conference in Plymouth, Michigan, average commercial vehicle age is trending upward.

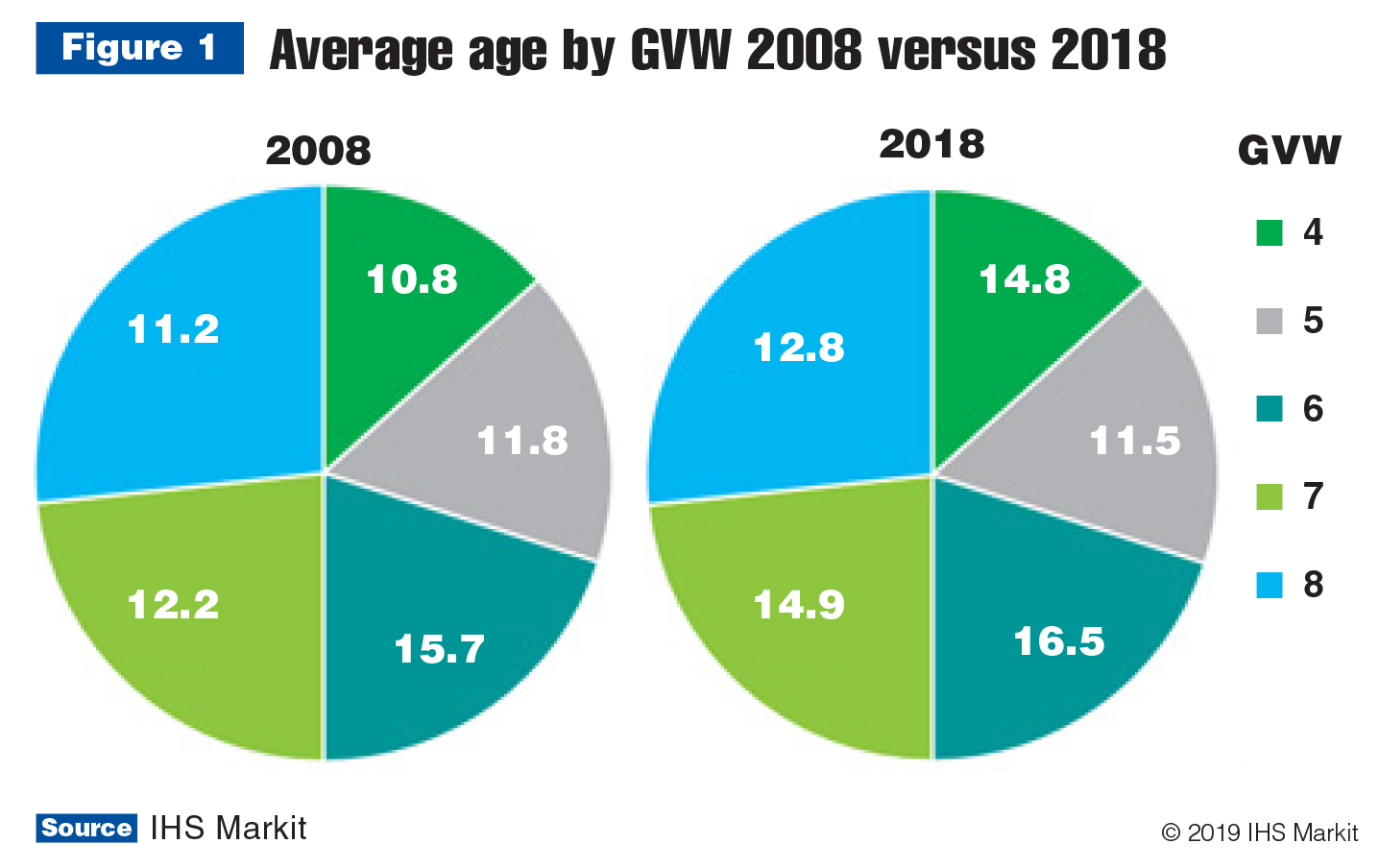

In 2008, average age of commercial trucks in the U.S. was 12.8 years, and rose to 14.2 years in 2018, according to recent analysis by IHS Markit. The increase in truck age can be correlated to numerous factors, including truck population growth, trade packages and fuel trends.

Last year brought historic registration volumes that made commercial headlines soar. While all of these new trucks may, in time, drive down average vehicle age, there is a large population of older, registered trucks still running on our roadways.

Figure 1 shows an evaluation by model year for Class 4–8 commercial vehicles for calendar year 2008 versus 2018.

What about large fleets?

Average age of the vehicle population is influenced by the number of clean used vehicles that become available, primarily as trade when large fleets complete trade packages. In 2018, new commercial vehicle registrations (Classes 4–8) for large fleets increased by 20%, resulting in availability of clean used equipment. Large fleets typically trade in their vehicles every three years, so with each cycle and the increase of the truck population in this segment, we should continue to see replacement buying, rejuvenating overall fleet age.

Does fuel have an impact?

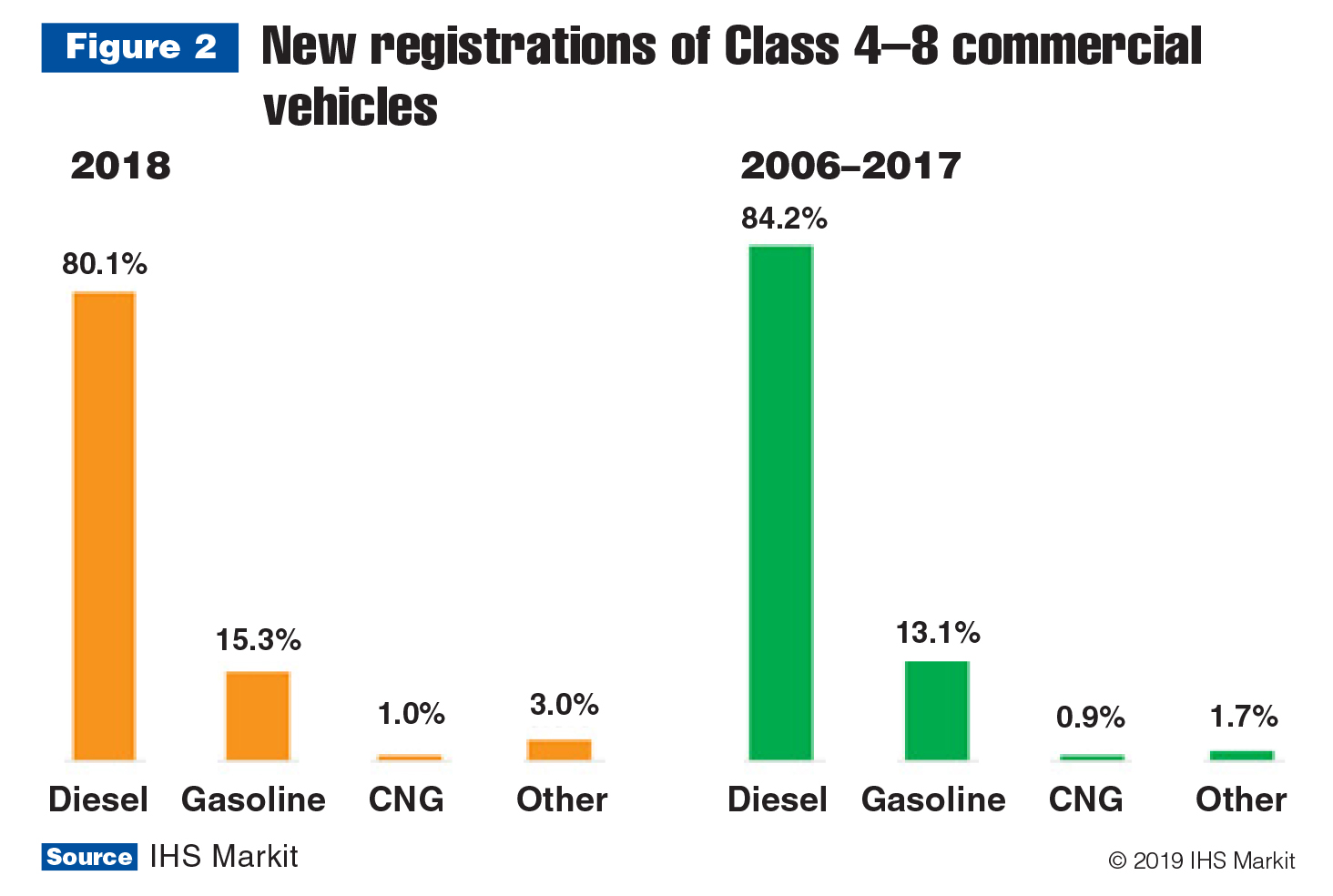

Technology continues to advance at a rapid pace, and competition is fierce to maintain a positive profit margin. Volatile fuel prices and ongoing regulations promote acceptance of fuel alternatives and may force vehicle age downward. This trend is already moving the needle, lowering the percentage of diesel in new registrations of Class 4–8 commercial vehicles, as reflected in Figure 2.

Diesel continues to remain dominant with the bulk of market share, but has declined over prior years. A couple of factors came into play, shifting the market share away from diesel, including growth in the medium-duty segment and acceptance of alternative fuels. Last year marked a significant increase in the medium-duty vehicle market (16% growth in new registrations in the Class 6 market in 2018), which created a nice boost for gas-powered engines. Alternative power, including electrification, shows solid growth over prior years, but still accounts for less than 4% of the overall commercial vehicle market.

What about parts replacement opportunities?

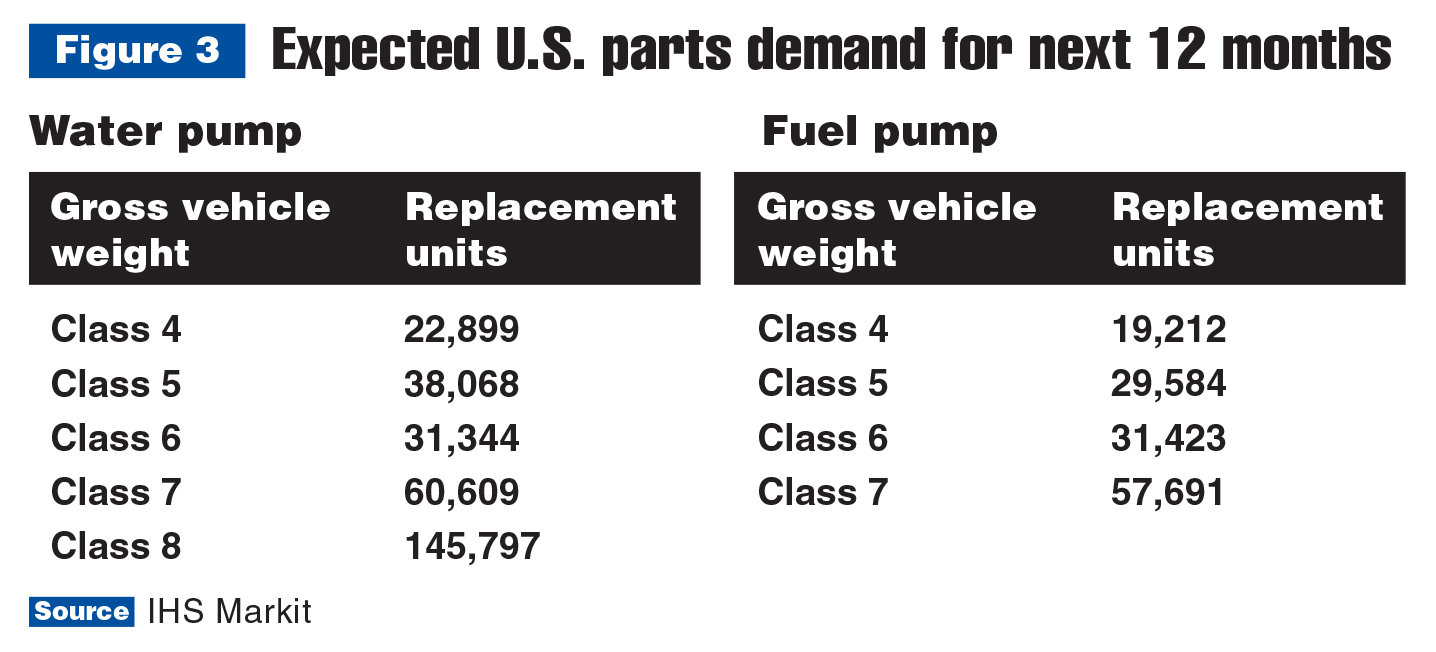

Truck maintenance is critical to operating a profitable aging fleet and provides business opportunities for service shops. Based on IHS Markit Commercial Aftermarket Parts Demand Models, IHS Markit has the capability to forecast demand for commercial vehicle components. Through extensive research with repair shops, service stations and dealer repair facilities, IHS Markit developed replacement factors for 12 groups of component modules. These replacement factors are then used with vehicles in operation data to determine overall demand for each module and components within. Figure 3 provides a summary of expected parts demand for water and fuel pumps in the U.S. by gross vehicle weight for the next 12 months.

Trucks will continue to age until total cost of ownership shifts from far to near term. Technology advancements, regulatory requirements and economic factors have the potential to move the aging trend downward, but it remains a key metric the industry should continue to watch and use for strategic business planning purposes.

For more work truck industry market data, trends and insights, visit ntea.com/marketdata.