By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the February 2017 edition of NTEA News.

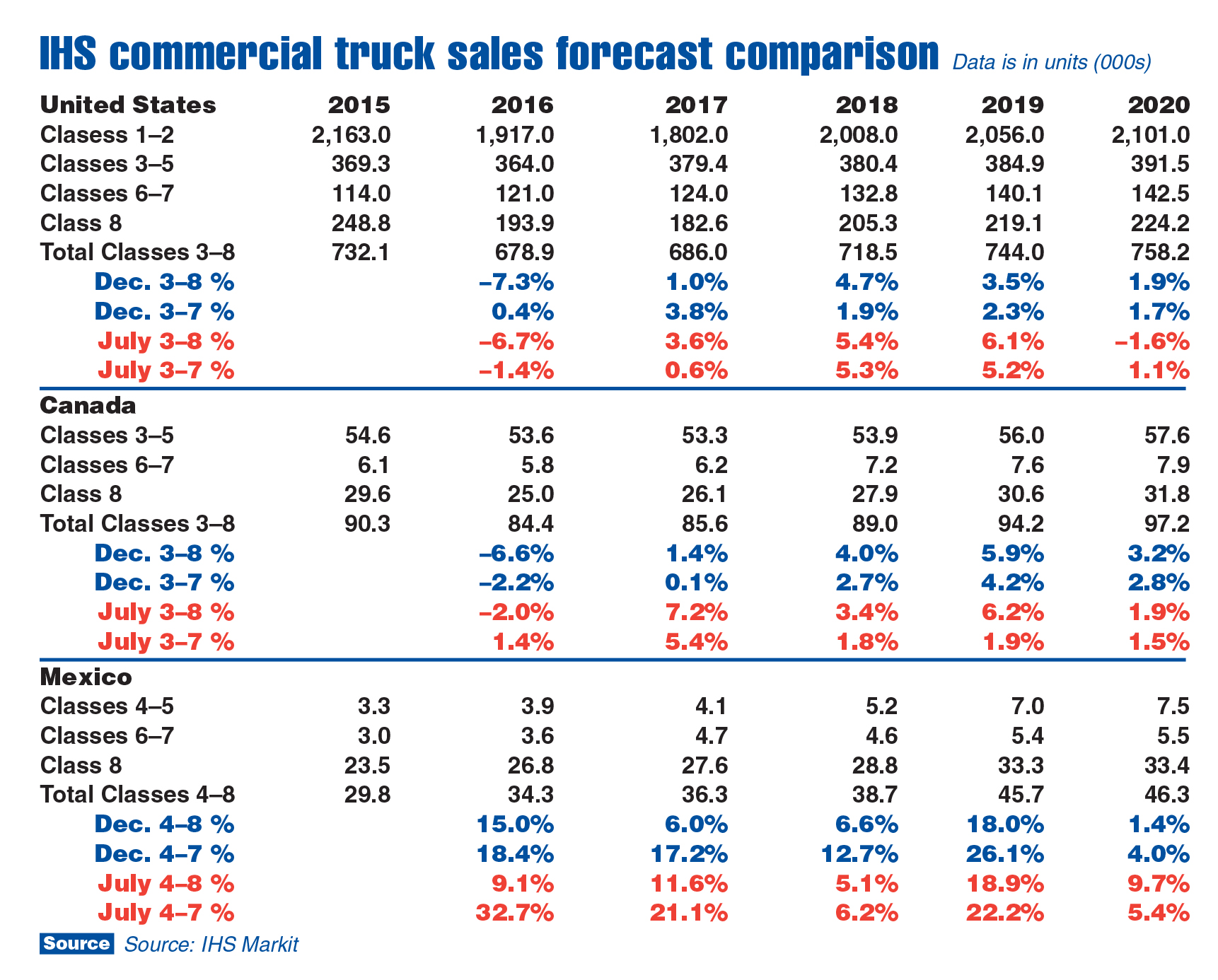

IHS’s commercial truck sales forecast for 2017 remains positive but has been revised downward. In July 2016, Class 3–8 sales were expected to grow 3.6 percent in 2017. In its December update, it modified the forecast to 1.0 percent. As shown in the accompanying chart, IHS made numerous adjustments to its predictions between July and December.

When reviewing, it is helpful to remove the heavy-duty segment from the total. Sales prospects for Classes 3–7 in 2017 improved in the December update. This was mainly due to higher expectations for Class 3–5 sales, which were anticipated to reach 367,000 units in 2016 and fall to 362,000 units this year. As of December, outlooks were lowered for 2016 to 364,000 units, and IHS now believes Class 3–5 sales will reach 379,000 units in 2017.

U.S. Class 1–2 and Class 8 forecasts were revised substantially downward in the December update — not just for 2017, but all the way through 2020. The July outlook predicted Class 1–2 sales would increase from 2.163 million units in 2015 to 2.418 units in 2020. As illustrated in the chart, the December update shows Class 1–2 sales falling in 2017 to 1.8 million units and rising only to 2.101 million units in 2020, which is less than the 2015 sales mark.

The Class 8 revision is similar. As of July, sales were expected to increase to 228,000 units from 206,000 units last year. Totals were revised downward in December for both years. Class 8 sales are now anticipated to be 45,000 units lower in 2017 than forecasted in July — a 20 percent change.

A key reason for this adjustment is that OEMs continued building tractors at a faster rate than they were selling throughout the second half of 2016 (the mid-year expectation was they would slow production significantly more). Still, a 45,000-unit correction may be extreme. According to data from NTEA’s OEM Monthly Chassis Statistics Program, total Class 8 (tractors and straight trucks) shipments were about 20,000 units greater than sales through October.

IHS became more pessimistic about the future of commercial truck sales in Canada and Mexico between July and December. Canadian Class 3–8 sales are expected to grow 1.4 percent in 2017 as opposed to 7.2 percent growth predicted in July. Mexico’s 2017 Class 4–8 sales projections were revised downward from 11.6 percent growth (July) to 6.0 percent (December).

Commercial truck application market forecasts for 2017 are mostly positive. Slow growth is anticipated for the construction sector, along with modest gains in the utility and telecommunication industries. Government (federal and state/local) spending is expected to grow slowly as well. As U.S. demand for fuel increases due to more commuter traffic, the energy sector should recover. However, the IHS forecast for light vehicle sales indicates 17.5 million units is likely a peak, and sales are projected to plateau through at least 2020.

At the macro level, the U.S. economy may move into a period of rising inflation and interest rates, which could present challenges for work truck industry companies. In addition, the labor market will remain tight. Businesses that find ways to increase existing labor force productivity could benefit more from slow growth this year.

For additional market data, resources and statistics, visit ntea.com/marketdata.