Dr. Albert D. Bates

Principal

Distribution Performance Project

This article was published in the July 2020 edition of NTEA News.

When sales volume is soft, companies sometimes assume that reducing prices is the best way to keep things going. This may be a viable course of action but consider that indiscriminate price cutting could make things worse.

Bottom-line impact

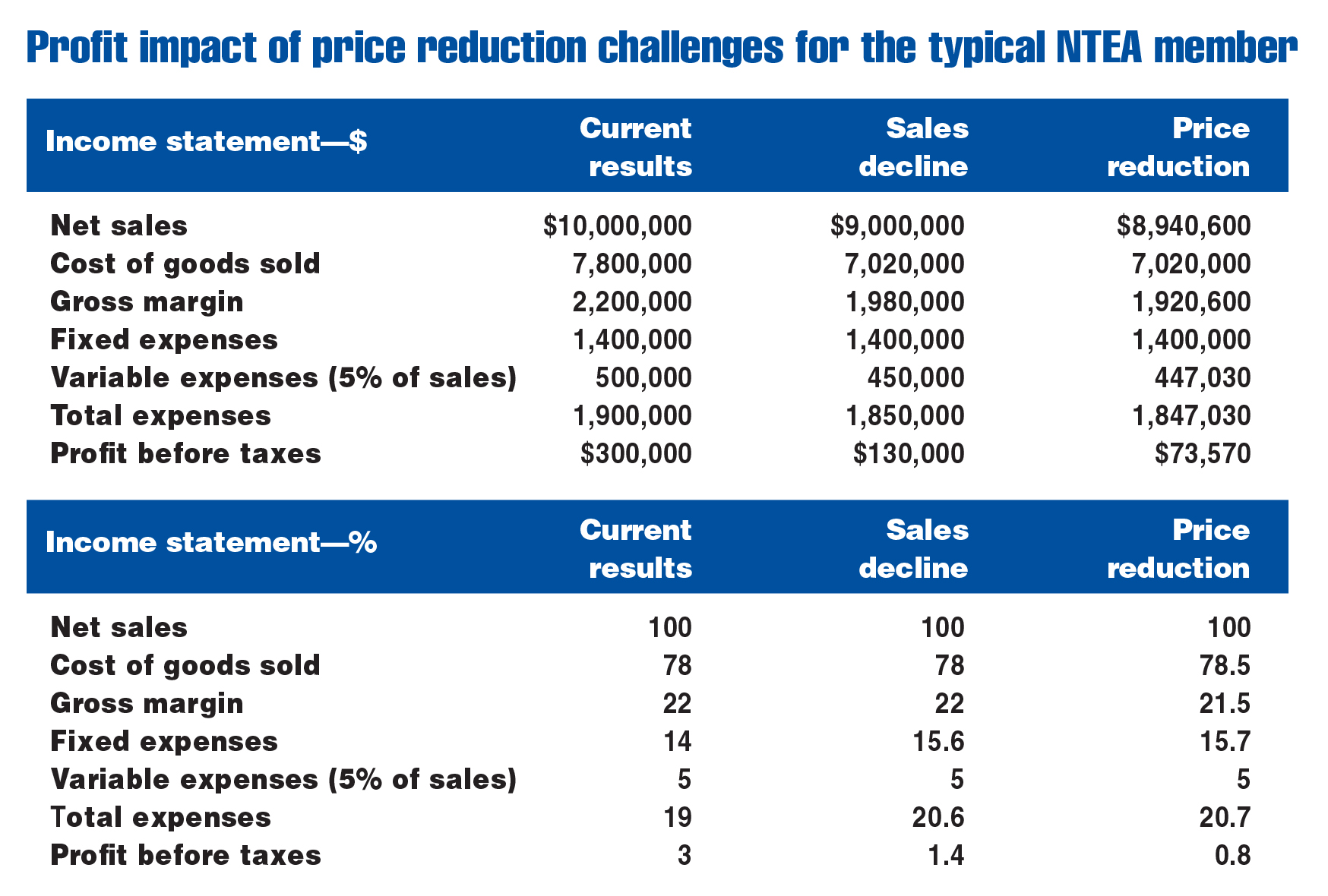

The chart below presents financial information for the typical NTEA member company. As shown in the first column of numbers, the business generates $10 million in sales, operates on a 22% gross margin of sales and brings $300,000 (3%) of sales to the bottom line on a pre-tax basis. It represents comfortable performance.

As with every industry company, this typical NTEA member has fixed and variable expenses. Fixed expenses are overhead costs that can be difficult to shed as sales fall. Reducing travel and employee training expenses are typical ways fixed expenses can be cut during a market downturn.

Variable expenses, including things like commissions, rise and fall in proportion with sales volume. In the chart, these are assumed to be 5% of sales.

In the final two columns of numbers, sales have been affected by economic pressures. The 10% sales decline (second column) results in sharply reduced profit due to inability to shed overhead expenses. With a 10% sales decrease, profits fall to 56.7%.

In slower economic times, there can be a tendency to first consider lowering prices in order to jump-start sales volume. The next column combines the 10% sales decline with a drop in gross margin percentage from 22% to 21.5% — reducing gross margin dollars on lower sales by 3%. This column assumes price reduction has no impact on unit sales volume. It represents a situation where demand is not influenced by price decreases — a not entirely uncommon outcome during difficult economic times. Under this assumption, profit is driven down to $73,570.

When times are tough, a company may look at price reductions for a variety of reasons — competition, boosting sales, keeping people employed, etc. If you are thinking about this course of action, what should be considered?

Price cutting alternatives

When reviewing pricing, there are ways to help minimize the effect of reductions while maintaining profitability.

Targeted price cutting

The chart above assumes prices were cut across the board (every SKU reduced by the same percentage).

For most businesses, relatively few items are exceptionally price-sensitive. These are the products for which the firm needs to be price-competitive. Further, communicating price cuts on such items could be a consideration in helping maintain competitive positioning.

Unfortunately, the few SKUs that are most price-sensitive could be delivering the largest sales activity. The issue is determining exactly how many are in the assortment.

As a general rule, items delivering the top 60% of sales volume are the genuinely price-sensitive SKUs. This means if all SKUs are arranged from highest to lowest dollar sales, those at the top of the list (probably 10%) provide 60% of sales. These items could receive a careful pricing review.

From a financial perspective, a 5% price cut on products producing the top 60% of sales amounts to a 3% reduction in gross margin dollars for the total firm. This figure is used in the chart’s price reduction column.

Luckily, not all SKUs in this group are equally price-sensitive. With prudence, it might be possible to appear price-aggressive where awareness is strong while minimizing overall margin impact by holding prices elsewhere.

It may be tempting to cut prices beyond this point. In fact, select items beyond the top 10% of SKUs may require price cuts, but there are likely only a few. The essential marketing point remains — if the firm must cut highly price-sensitive SKUs, a helpful strategy could be to increase customer awareness.

Margin buildbacks

At the other end of the product spectrum, many SKUs are not price-sensitive at all. In addition, during slower sales periods, competitors may have reduced inventory of such products or may not have them in stock. These items now would be less price-sensitive and allow you to build back some gross margin sacrificed in the targeted price cutting.

Potentially, somewhere around half of the SKUs may qualify as margin buildback candidates. However, as they only generate around 5% of total sales, appropriate pricing should be considered to help mitigate other adjustments. On these items, the value-add would be availability, which could be one of the focal points of the sales effort.

Moving forward

Price reductions abound in slow economic times. The challenge is to maintain a competitive position without undermining profit structure. If a company can price competitively where needed and build back margin where possible, it may be an option to consider in minimizing impacts of an economic downturn.

For more industry profitability resources, visit ntea.com/profitreport.