This article was published in the September 2017 edition of NTEA News.

The work truck industry is advancing steadily, with expectations for a strong year-end finish. With the construction sector growing and state/municipal governments and fleets still spending, commercial vehicle demand remains positive. As 2018 approaches, companies are starting to build strategic plans to guide their future endeavors. NTEA delivers market data resources to help members stay updated on important trends related to hiring, sales and business growth.

Twice a year, NTEA engages Distributor and Manufacturer members in a survey to assess the current business environment and capture their outlook on the immediate future. Results from this evaluation offer perspective on:

- Sales levels and quoting activity

- Backlogs

- Production capacity

- Employment levels

- Key factors influencing member businesses

- Upcoming challenges and opportunities

This article showcases the most recent survey findings, incorporating data from previous research initiatives to convey trends and allow benchmarking.

July 2017 survey results

Of respondents, 62 percent are distributors and 38 percent manufacturers. Contributing companies report annual sales from less than $2 million to more than $70 million, with the largest group representing $2–5 million (27 percent). Construction, government/municipal and utility/telecom sectors were ranked, respectively, as the most important application markets for business in terms of total sales in the first half of 2017. Sales and quoting activity are in stable positions.

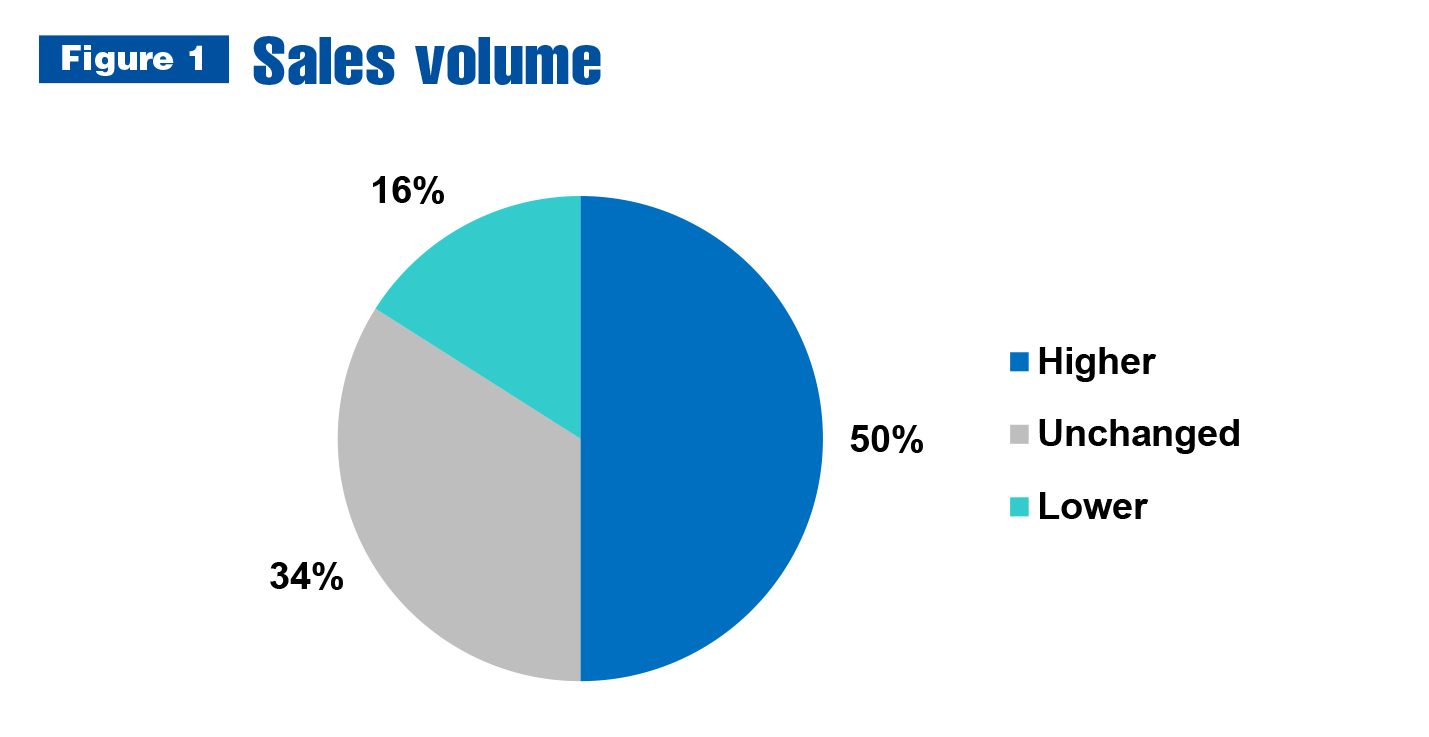

Figure 1 shows half of survey participants registered higher sales for the first half of 2017 as compared to the last half of 2016, with 16 percent reporting a decline.

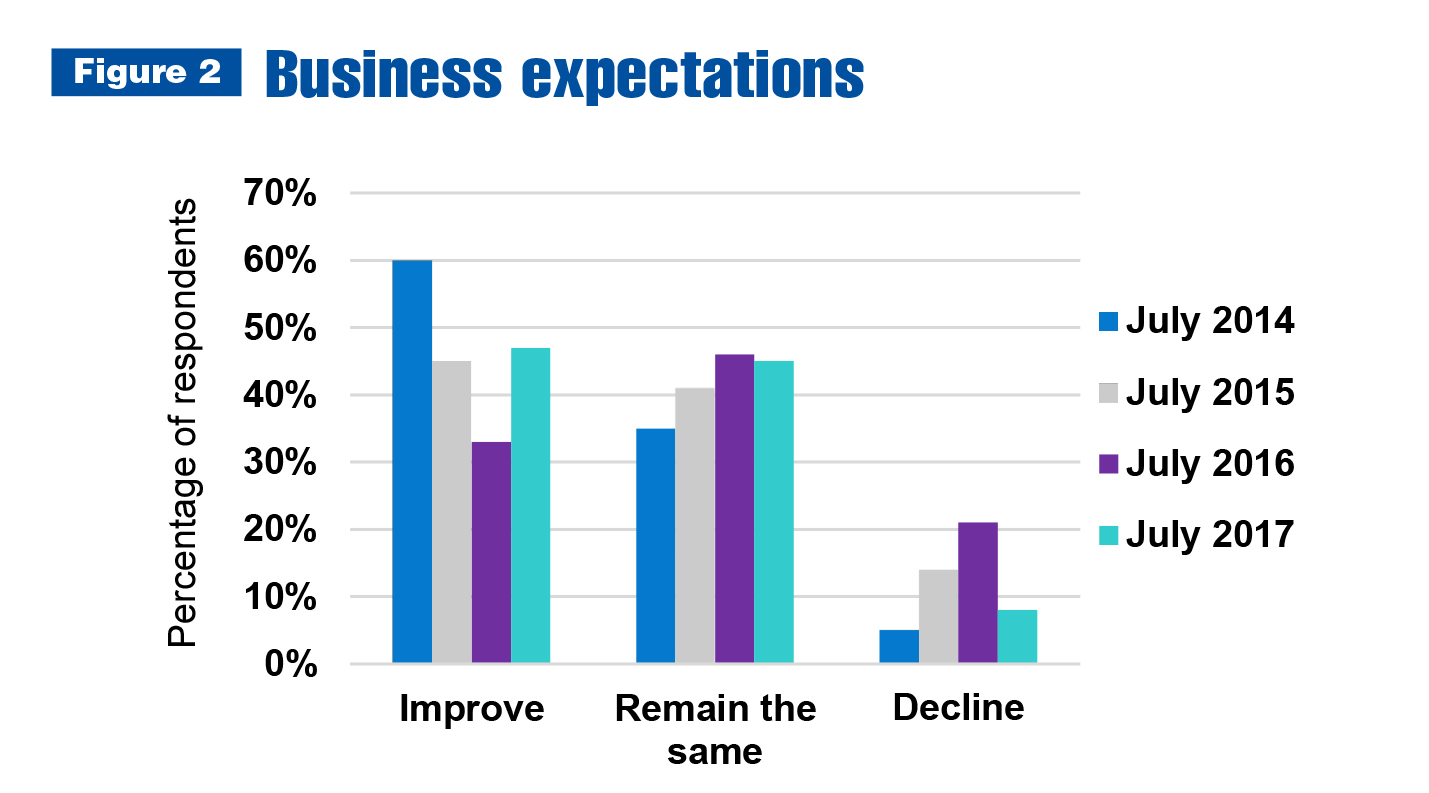

Forty-seven percent of respondents expect business to improve for the remainder of 2017 — a 14-percent increase from last year’s July outlook. Growth expectations are on the rise, with only 8 percent anticipating a drop as compared to 21 percent in July 2016.

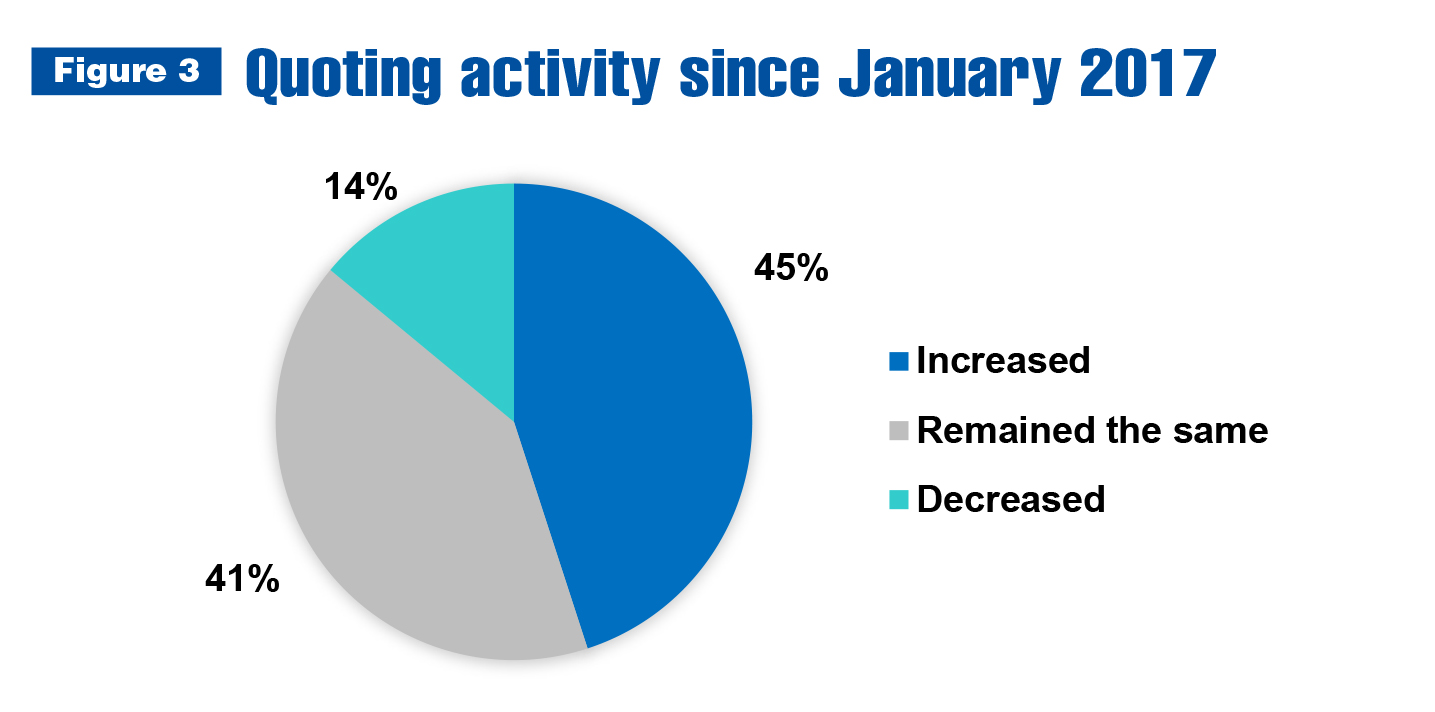

Since January 2017, 45 percent of respondents experienced a surge in quoting activity. More than 40 percent reported no change, and 14 percent identified a decrease (see Figure 3).

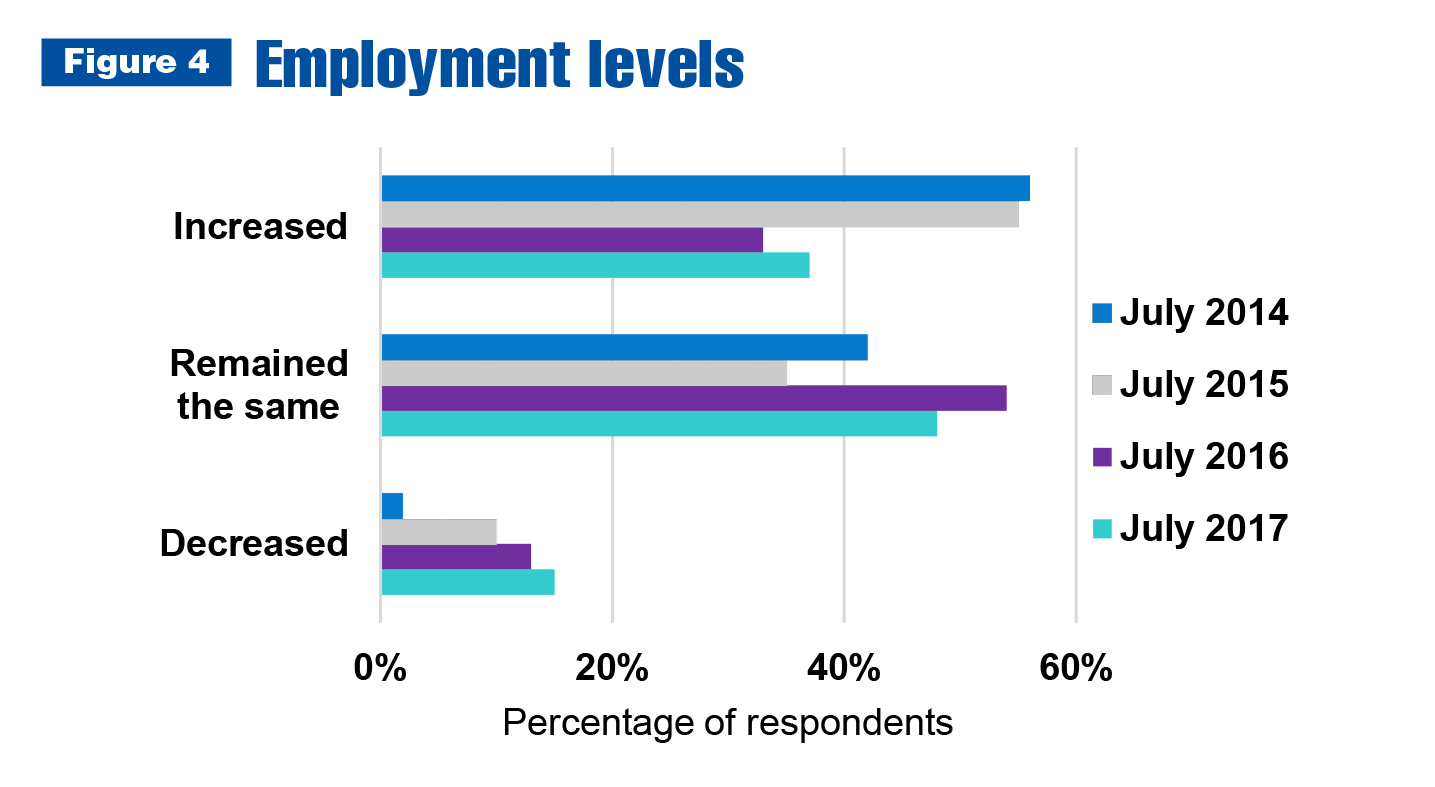

Thirty-seven percent of survey participants registered rising employment — a 4-percent uptick from the July 2016 report. At the same time, 48 percent of reporting companies are maintaining employment levels — a 6-percent drop relative to the previous year.

Backlog represents an issue for 75 percent of responding member companies. For 37 percent of backlogged respondents, levels have increased since January 2017. Eleven percent reported their status is improving.

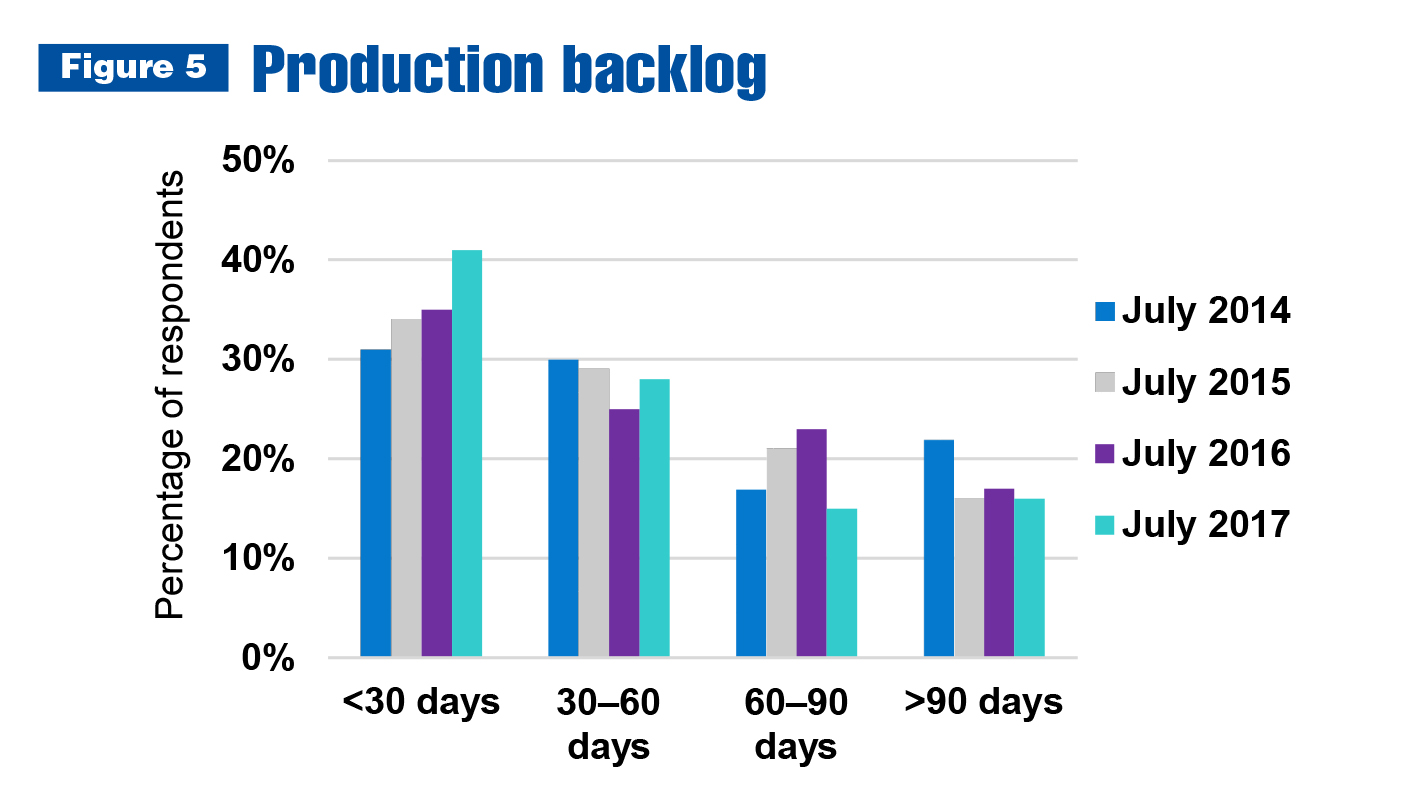

Overall, member companies seem to be managing workload; 41 percent indicated production backlog of 30 days or less as compared to 35 percent in July 2016. Even still, more than 30 percent of respondents have backlogs of 60 days or more — 16 percent cited levels of at least 90 days. While there are unique challenges associated with this backlog, lack of business is not a current concern.

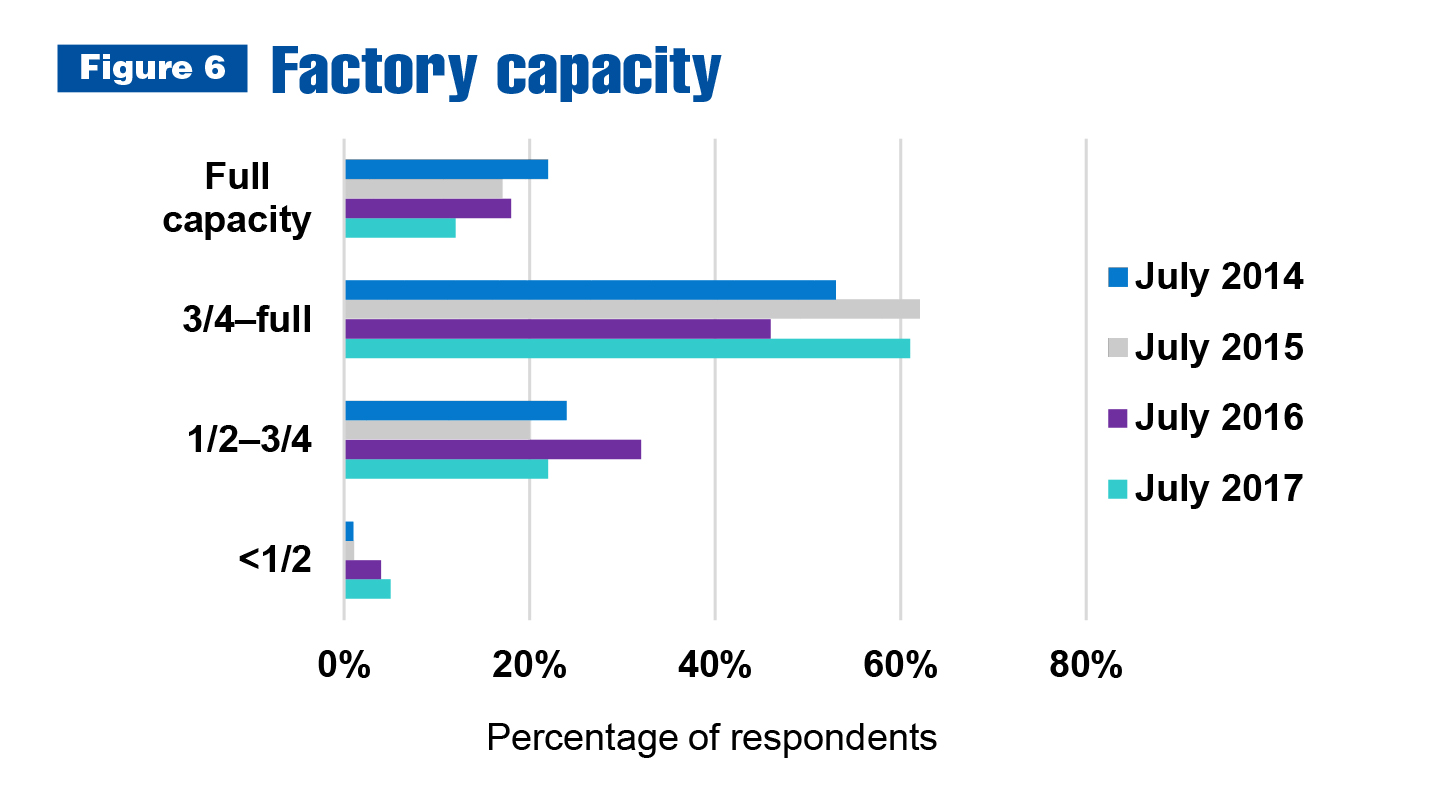

Participating companies recorded an increase in factory capacity (see Figure 6), with 73 percent operating with little to no ability to increase workload above current levels (without a significant business expansion or merger) — up from 64 percent in July 2016. Twenty-two percent are operating at 50–75-percent capacity, as compared to 32 percent in this position last year. Data suggests most reporting companies can continue to intensify their workload.

Business influencers

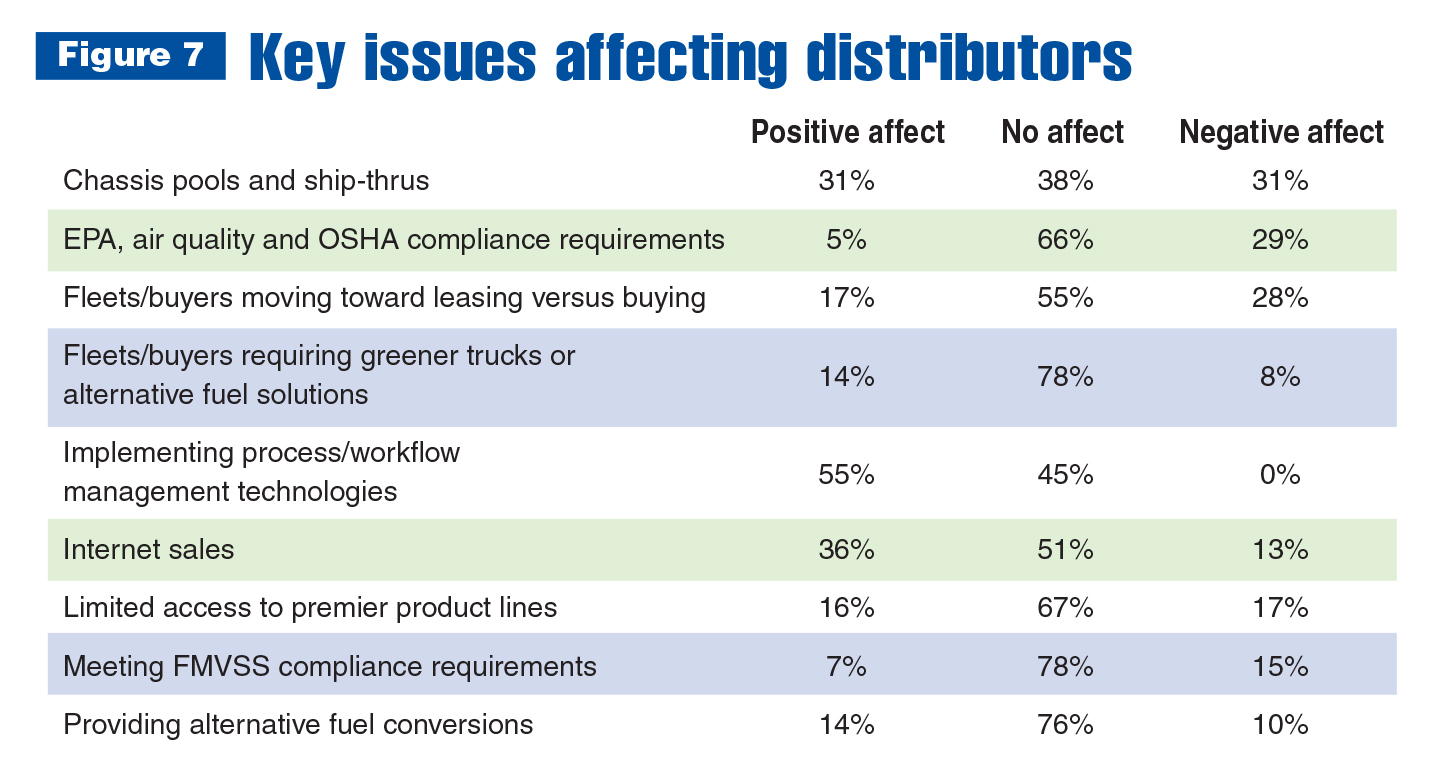

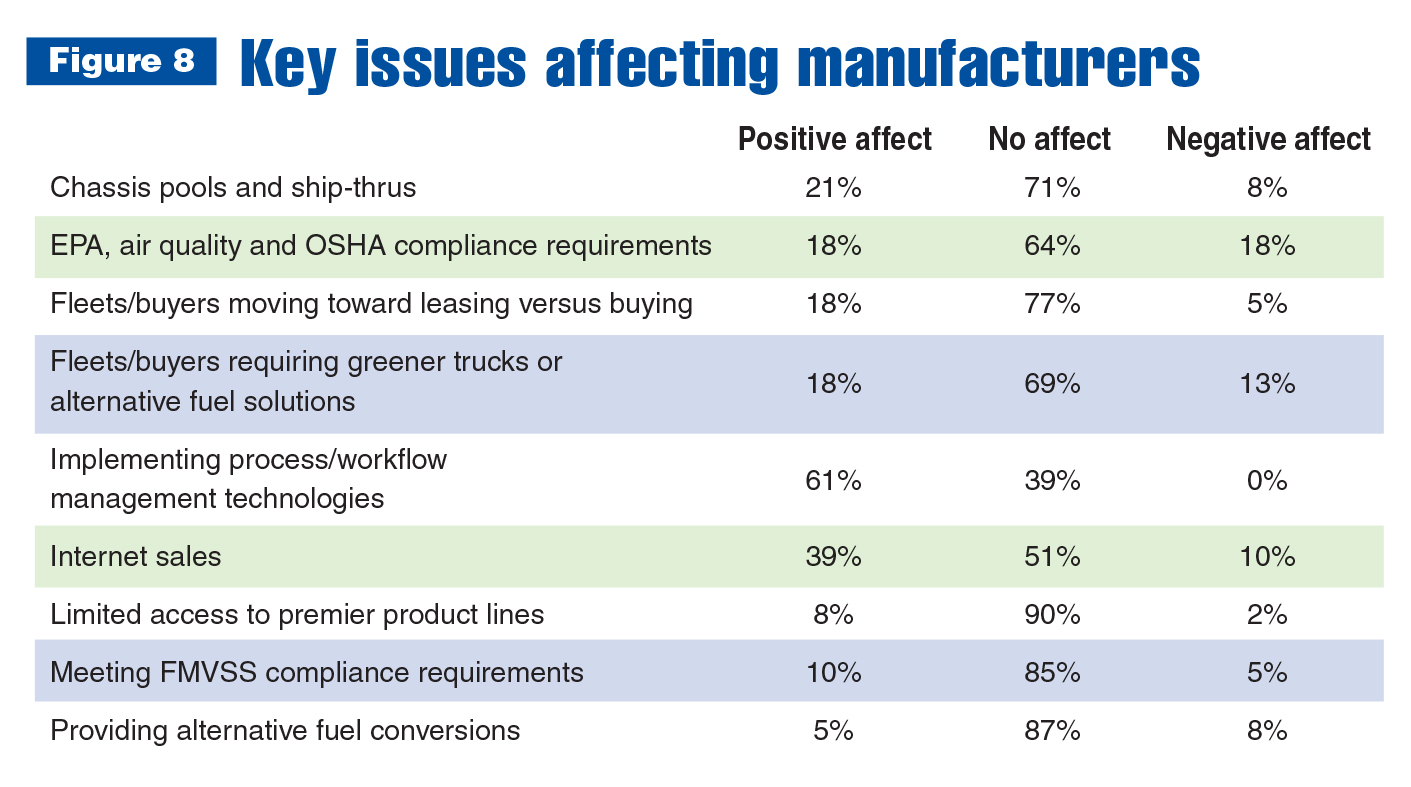

Work truck industry companies are affected by a wide range of market factors. Figures 7 and 8 evaluate distributor and manufacturer perspectives on current dynamics.

According to more than half of the distributor respondents, the most positive influencer

is implementing process and workflow management technologies and systems. In fact, no participants — distributor or manufacturer — felt this issue had any negative repercussions. Chassis pools and ship-thrus were deemed most negative, followed closely by EPA, air quality and OSHA compliance requirements, and fleets or other commercial truck buyers moving toward leasing versus buying. Meeting FMVSS compliance requirements and fleets/buyers requiring greener trucks or alternative fuel solutions had the most minimal impression on responding distributors.

Similar to distributors, manufacturers considered implementing process and workflow management technologies the best influence on business, by far. EPA, air quality and OSHA compliance is deemed most harmful, while limited access to premier product lines, providing alternative fuel conversions and meeting FMVSS compliance requirements are practically insignificant.

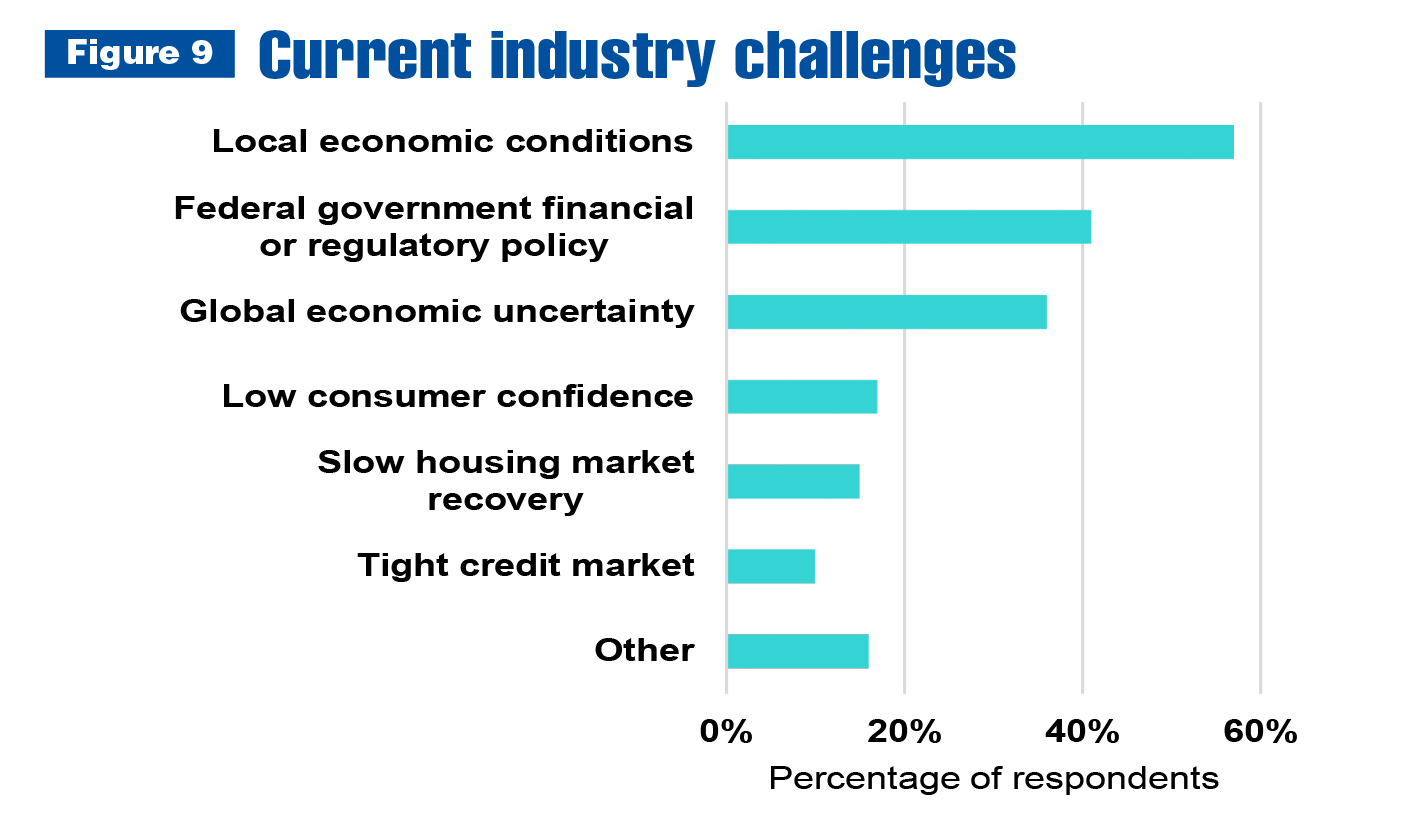

Industry challenges

Fifty-seven percent of responding members feel local economic conditions represent the biggest challenge affecting the industry. The federal government’s financial or regulatory policy (41 percent) and global economic uncertainty (36 percent) were the next highest concerns, respectively.

Note: Totals in Figure 9 do not equal 100 percent as respondents could choose multiple answers.

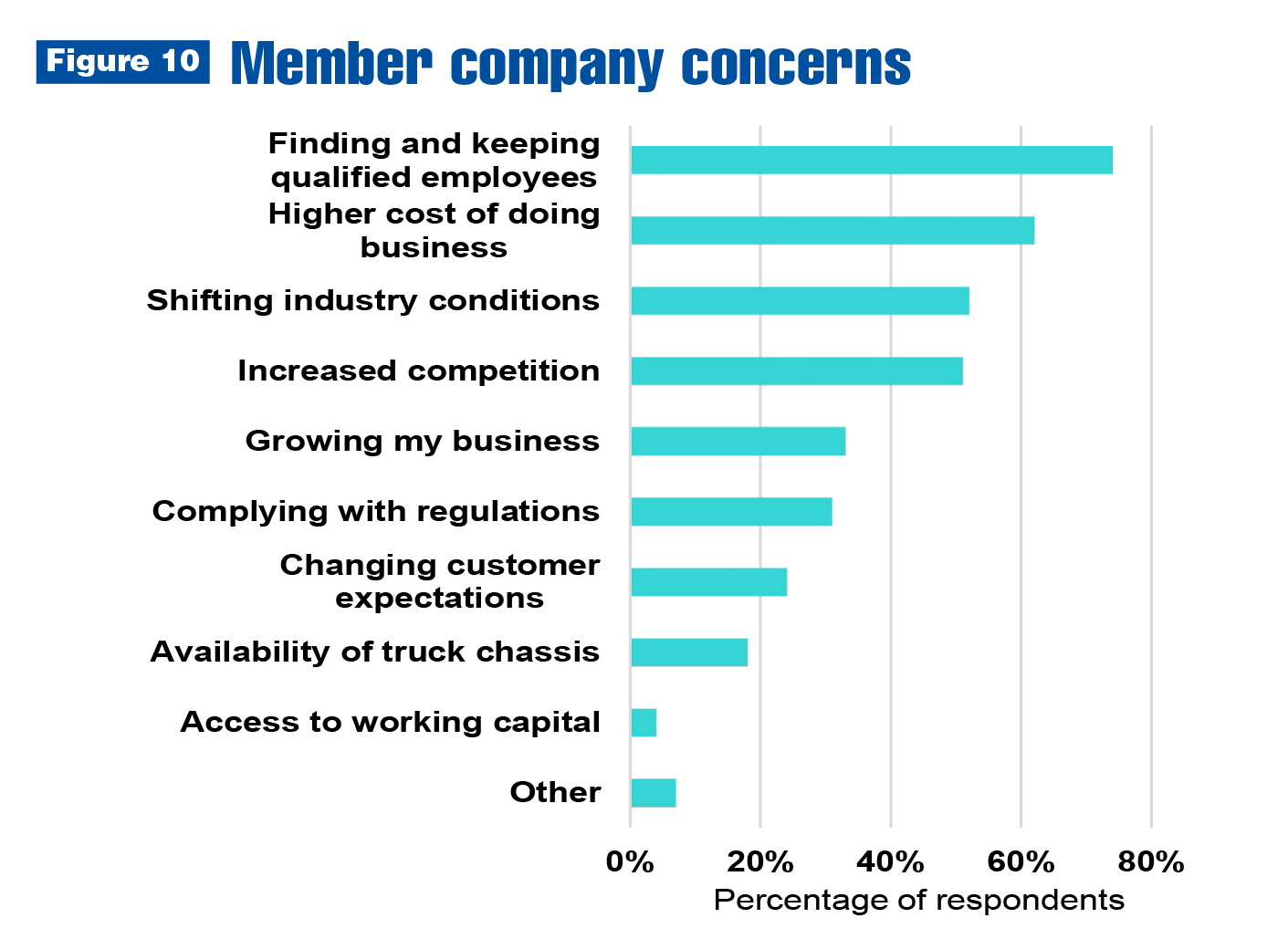

Nearly three quarters of reporting members designated finding and retaining qualified employees as the biggest issue facing their companies today. At least half of survey participants identified the higher cost of doing business (62 percent), changing industry conditions (52 percent) and increased competition (51 percent) as major concerns.

Note: Totals in Figure 10 do not equal 100 percent as respondents could choose multiple answers.

Success strategies

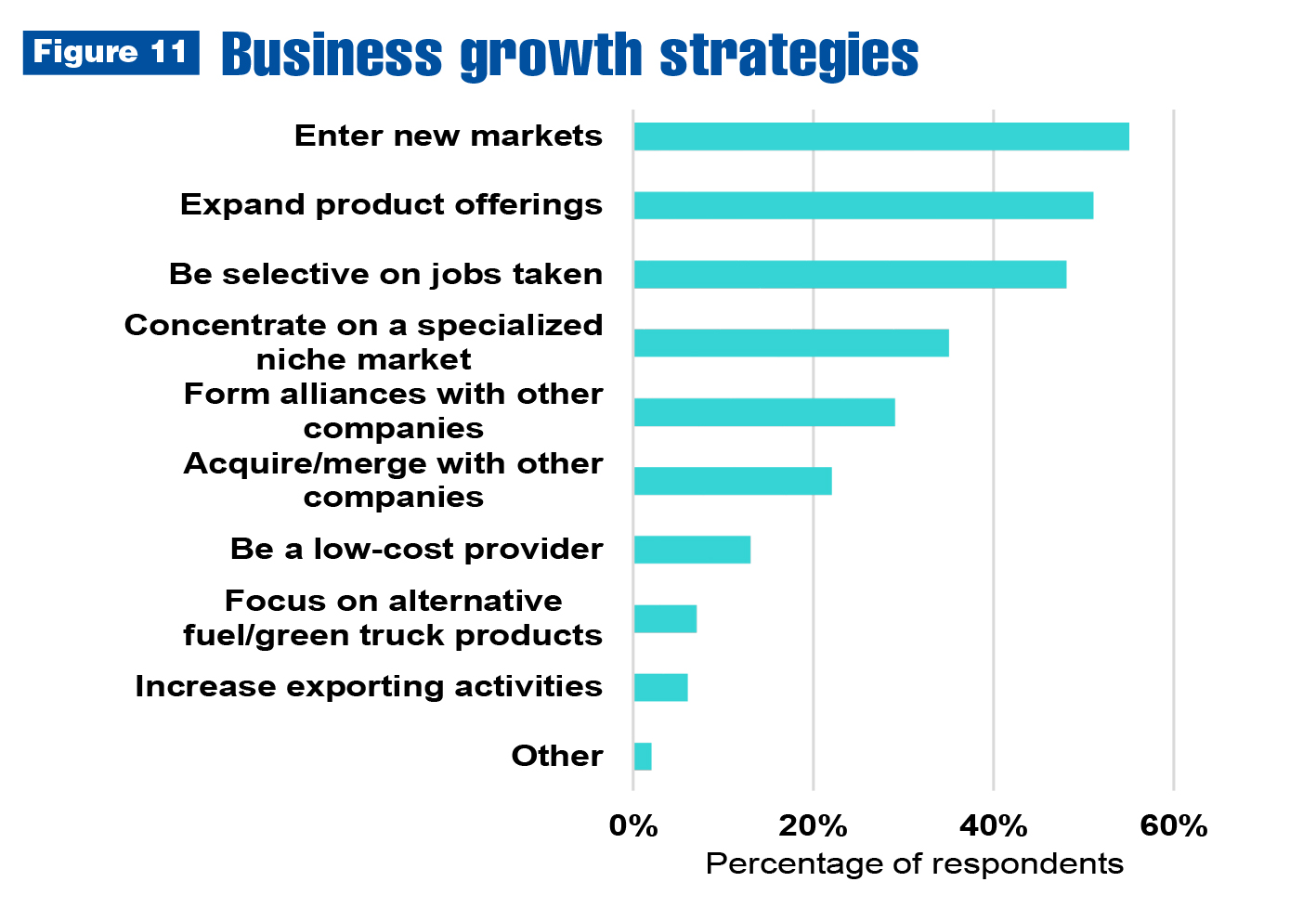

When asked about strategies that would best help their companies grow and prosper moving forward, respondents ranked entering new markets as the most popular approach (55 percent), followed by expanding product offerings (51 percent) and being selective on jobs taken (48 percent).

Note: Totals in Figure 11 do not equal 100 percent as respondents could choose multiple answers.

Looking ahead

The overall work truck industry outlook remains positive through year-end, and industry growth is expected into 2019. Despite the steady stream of challenges, opportunities abound for the commercial vehicle community.

If you have any questions or comments regarding this survey, email Joy Knesnik, NTEA communications manager, at joy@ntea.com.