Guest editorial

By Al Bates, Director of Research, Profit Planning Group

This article was published in the April 2017 edition of NTEA News.

Many distribution managers see two profitability challenges over the next few years — an anticipated squeeze on gross margin percentages and escalation of payroll costs. While these are troublesome individually, they are threatening in combination.

NTEA’s Distributor Financial Benchmarking Report provides a basis for understanding and overcoming these challenges. The most useful of those insights is provided by the personnel productivity ratio (PPR), a little-understood metric that can be key to enhancing profitability.

Understanding PPR

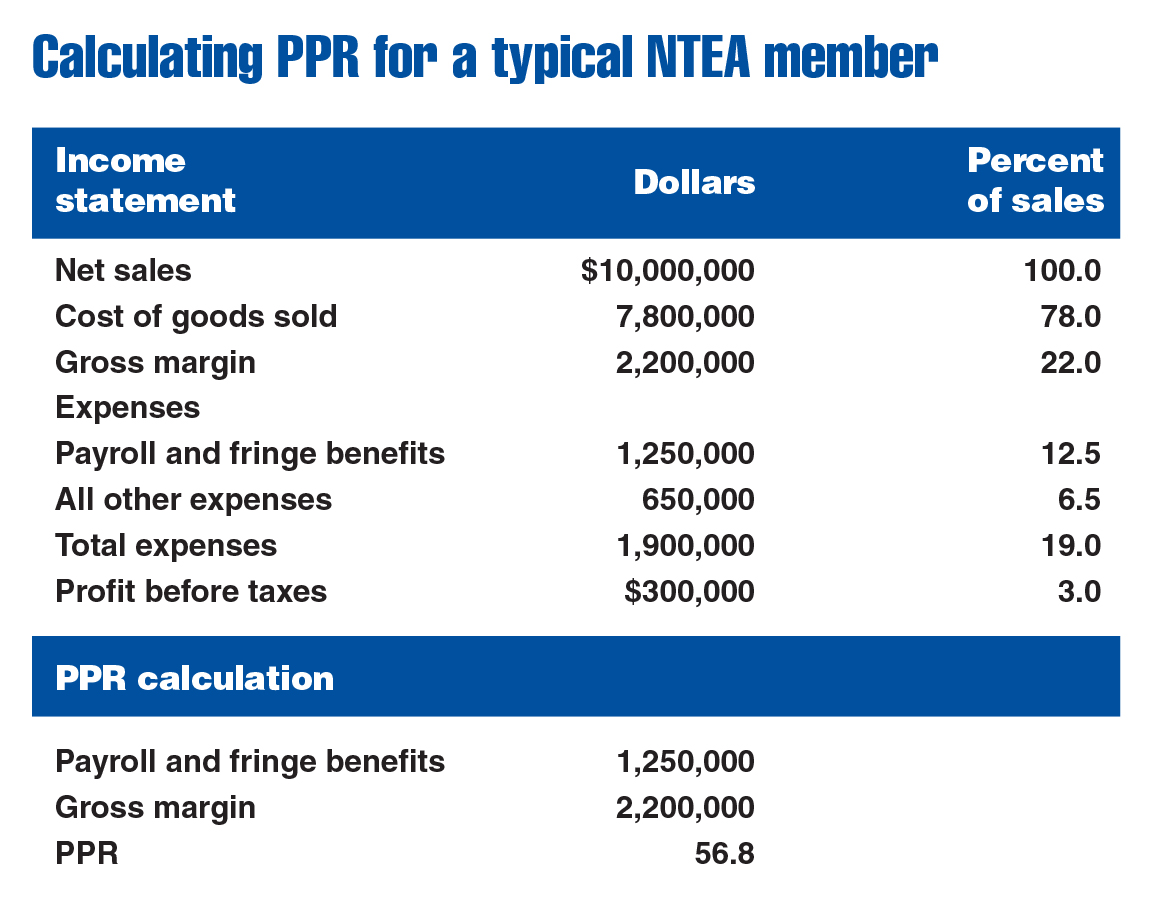

PPR expresses total payroll costs (all direct compensation to employees and fringe benefits such as FICA, Medicare, 401(k) contributions and health insurance) as a percentage of the company’s gross margin.

The chart above examines the income statement performance of a typical NTEA member. At the bottom is a PPR calculation showing the ratio is 56.8 percent. This means for every dollar of gross margin generated, 56.8 cents must be spent on payroll. It is one of the few financial ratios where lower is better. The objective is to minimize payroll expenditure required to generate gross margin dollars.

When using PPR as a management tool, it is challenging to set a realistic goal. Distribution consultants offer numerous generic guidelines — many of which are ineffective or, in some cases, harmful.

The most commonly prescribed goal is a PPR under 50.0 percent. PPR varies by line of trade, though, making a one-size-fits-all number meaningless. It might be a useful guideline for a market in which PPR is 55.0 percent, but not for one with a 45.0 percent PPR. This target must always be industry-specific.

Setting a useful objective starts with the industry-average PPR (56.8 percent for NTEA members). Research suggests the most successful businesses tend to operate, in aggregate, on a PPR about 10.0 percent lower than the industry norm. Using this guideline, 51.0 percent would be a realistic goal for an NTEA member company.

Improving PPR

From a timing perspective, it is helpful to break down the 10.0 percent improvement into one-year components of around 2.0 percent each. In terms of strategy, a company can increase gross margin or lower payroll expenses. These seemingly simple ideas run headlong into reality.

Research conducted by Distribution Performance Project indicates within every distribution segment, there are wide operating differences between firms. Some have relatively high gross margins versus their peers in the same line of trade, while others are lower. Similarly, some have relatively little payroll expenses (which leads to higher total costs) while others have elevated expenses.

An obstacle to improvement is that payroll and gross margin percentages are highly correlated (businesses with high gross margin percentages also tend to have high operating expense percentages, especially payroll). At the same time, companies with low operating expense percentages tend to have low gross margin percentages. The two factors are linked.

Success in PPR improvement comes from finding ways to increase gross margin as close to expense-free as possible while simultaneously lowering payroll expenses without negatively affecting gross margin.

Gross margin

Increasing gross margin percentage is almost entirely a pricing issue. Improving margins via service enhancements and the like inevitably lead to higher payroll expenses. It is why gross margin and expenses generally rise and fall in tandem.

Margin enhancement through pricing changes must involve stretching the price matrix. Many distributors are, rightfully so, price-aggressive on fast-selling items. However, they tend to under-price slower-selling items. It is a substantial opportunity to raise gross margin and, even more important, is payroll-expense free. PPR improves immediately.

Expenses

The key to expense control (without margin degradation) is to concentrate on transaction economics. Simply put, companies do too much work for the revenue being generated.

Transaction economics focuses on number of lines per order and average line extension. In short, this means increasing the number of SKUs on each transaction and selling more of each SKU. The former is easier, but only slightly improves transaction economics. The latter is harder but brings significantly greater results.

Number of lines per order and average line value are largely a sales issue. Every sales force (outside and inside) says it is maximizing suggestion selling and trying to sell more of each item. Regular measurement and monitoring, though, are necessary.

Moving forward

Downward pressure on gross margin and upward pressure on payroll will not likely go away. Proper use of PPR as a measurement tool can help alleviate those stresses. However, improvement can only be made by paying close attention to factors that help enhance PPR — stretching the price matrix, and increasing number of lines per order and line extension.