By Doyle Sumrall, NTEA Managing Director

This article was published in the April 2018 edition of NTEA News.

When I come across a report like NTEA’s 2018 Fleet Purchasing Outlook, I tend to wonder about the details and take a close look at the areas of specific interest to me (many of you may share my natural curiosity). This newly-released publication is based on current survey results and incorporates data from previous research initiatives, with year-to-year comparisons serving as a benchmark. I have reviewed the most recent dataset in depth and wanted to highlight some of my findings.

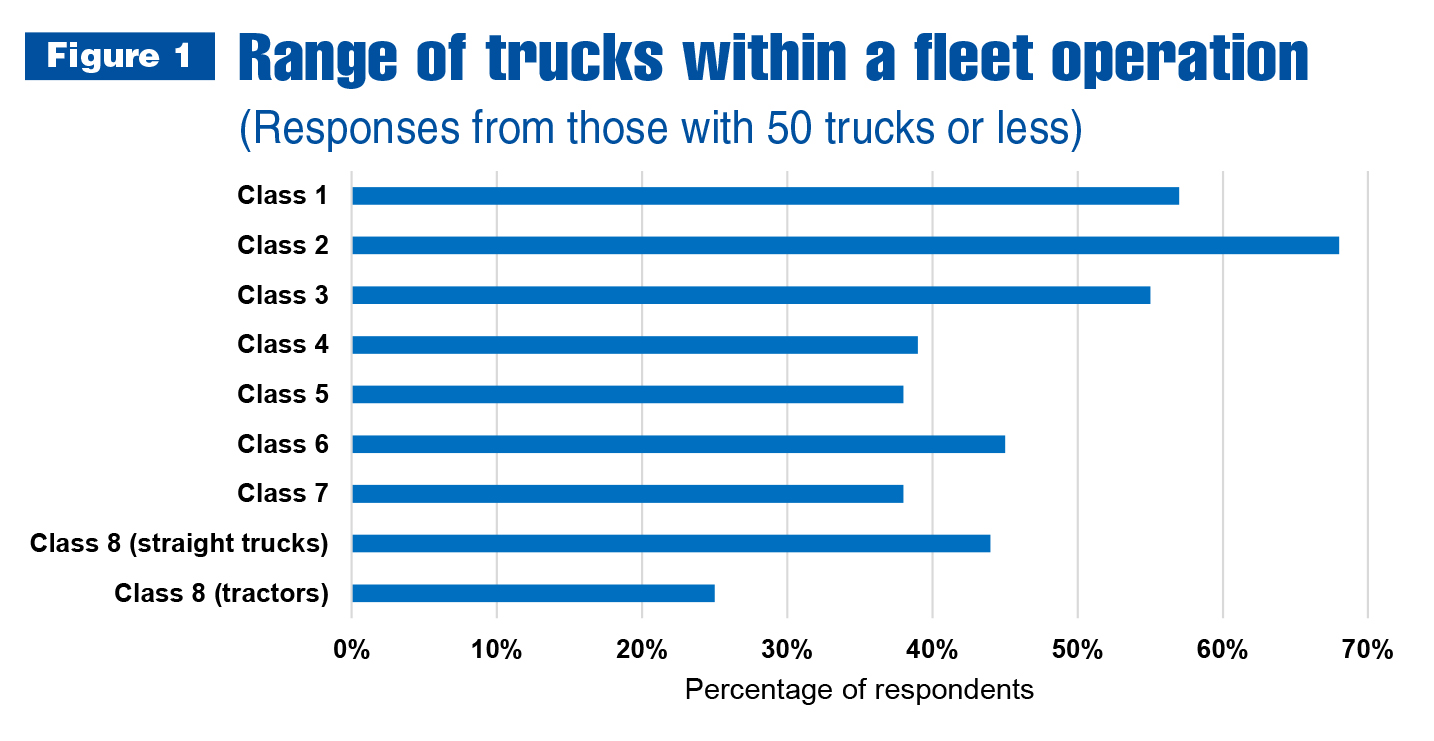

First, I found it interesting that, no matter the fleet size category, all respondent segments have trucks in each gross vehicle weight range (GVWR) — from Classes 1–8. This dispersion is fairly well balanced across weight classes. Fleet respondents with less than 10 and 101–500 trucks were the exceptions, reporting a much higher percentage of Class 1–2 trucks and lighter concentration of other weight classes.

It seems respondents with 50 trucks or less are a bit below average when it comes to having the full range of GVWR represented (see Figure 1).

(Totals in Figure 1 are not equal to 100 percent due to respondents’ ability to select multiple answers.)

When analyzing fleet truck count, the dispersion covers the full GVW range, with fleets having less than 10 trucks heavier in Classes 1–2 and those with more than 10,000 trucks very strongly represented by Class 2 (Class 2 accounts for more than 50 percent of the trucks among fleets in this category).

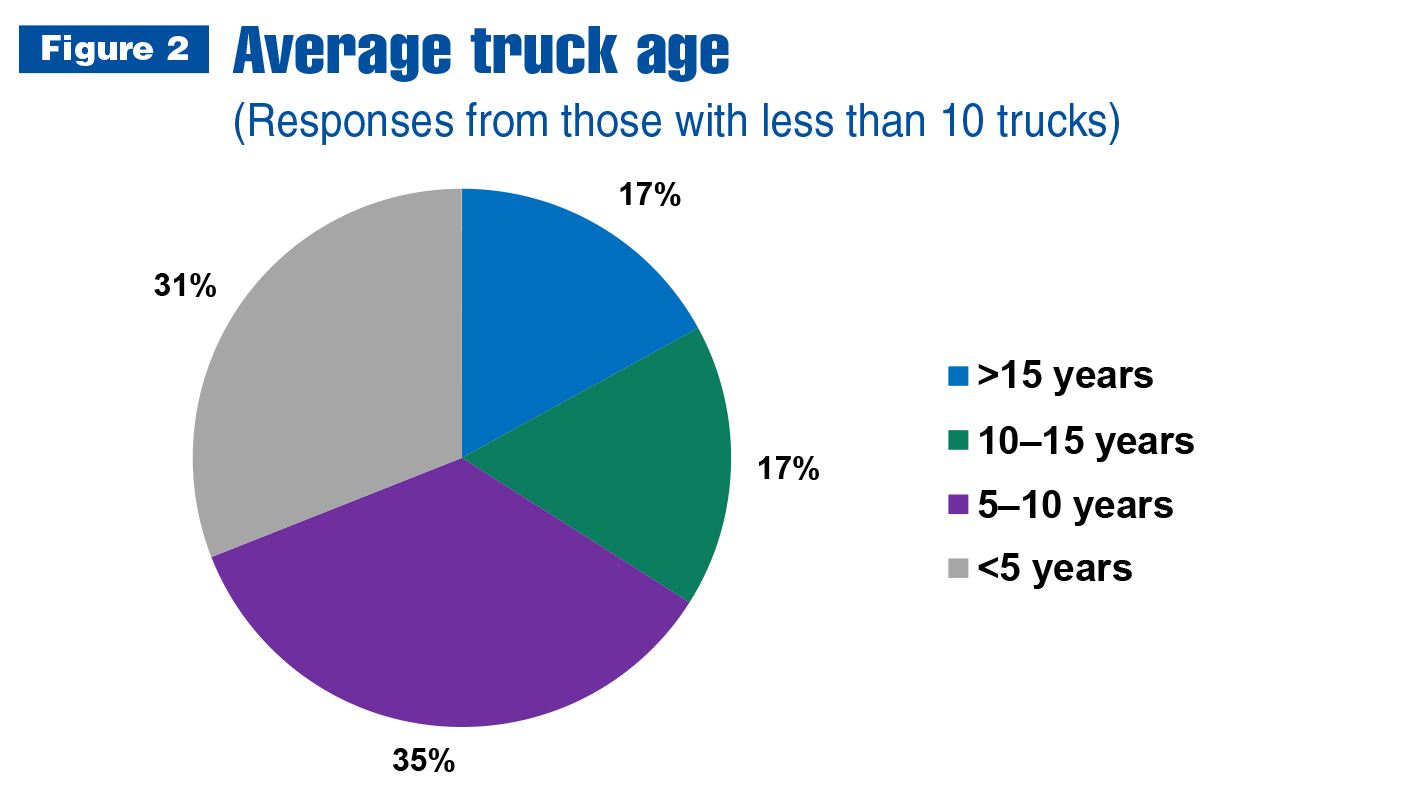

Vehicle age is always a topic of interest. It’s amazing how long a truck can be in service providing value. An older truck might seem to be a good candidate for replacement. However, based on survey results, it appears most work trucks get replaced somewhere in the 5–10-year age range. This relates to the rough rule of thumb that a fleet tries to replace about 10 percent of its vehicles each year. Survey results indicate fleets with less than 10 trucks own the oldest vehicles. In fact, this is the only group reporting trucks in the 20-year range (see Figure 2). Another interesting finding is that fleet respondents with 500 or more trucks do not have any vehicles more than 15 years old.

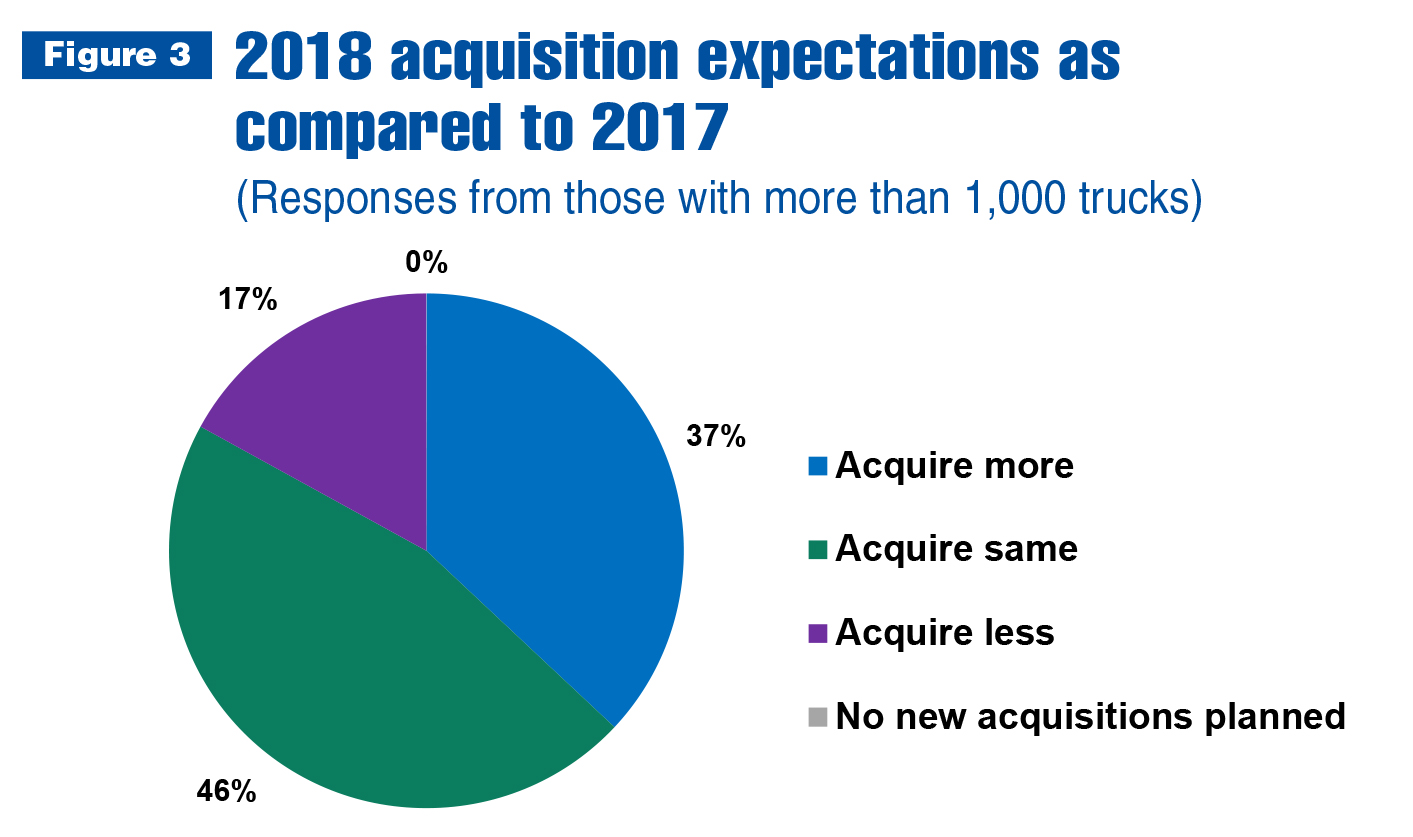

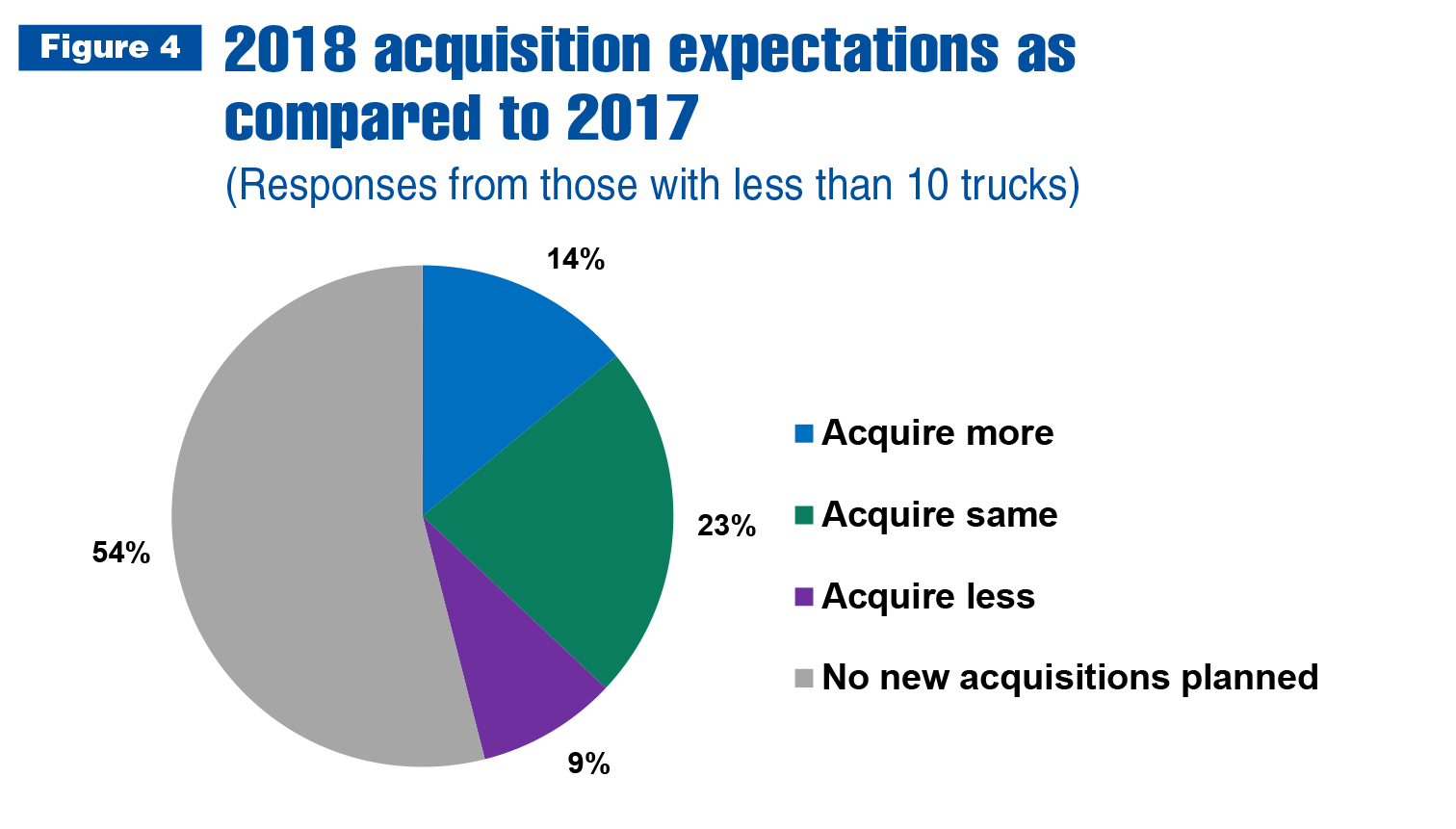

Of respondents with 51–100 and 1,001–5,000 trucks, more than 30 percent say they will increase truck acquisitions in 2018 as compared to 2017. Fleets with 50 trucks or less are on the more conservative side, with more than 30 percent saying they will not acquire any trucks in 2018. Additionally, more than 50 percent of fleet respondents with less than 10 trucks are not planning to acquire in 2018.

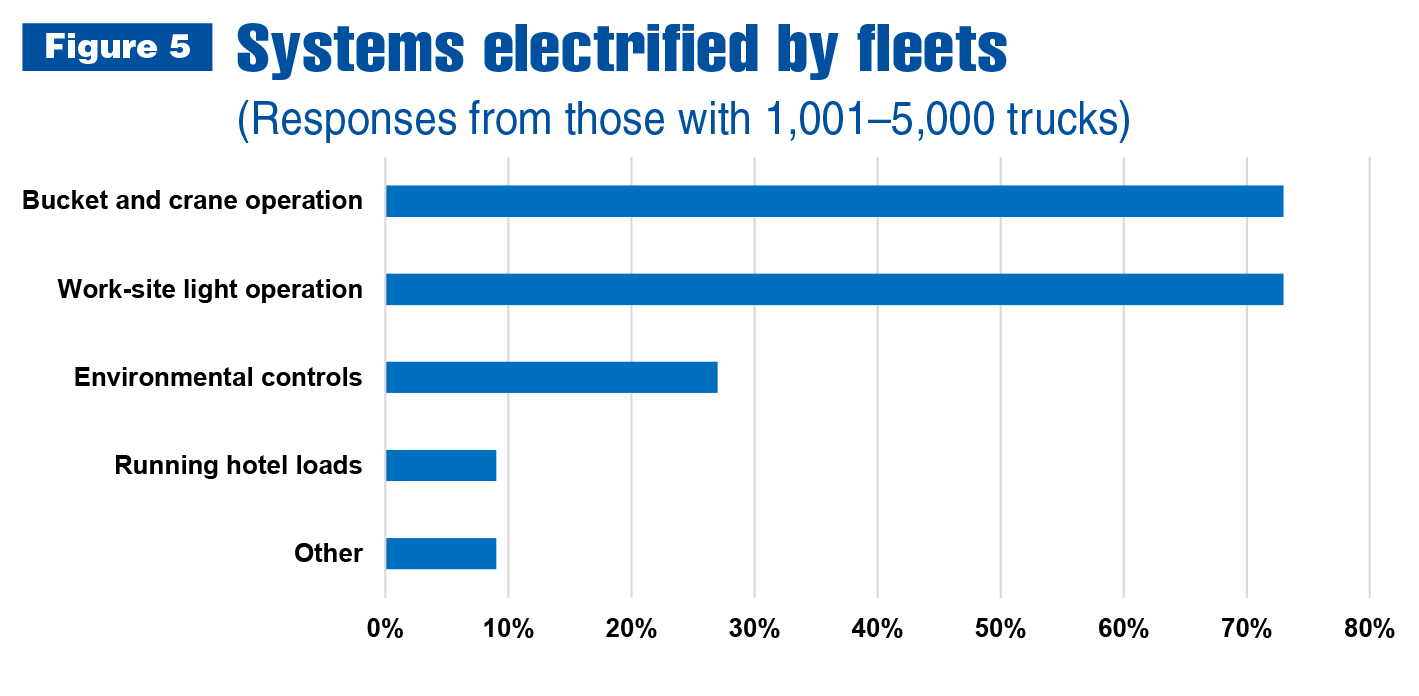

Electrification is another significant topic addressed in NTEA’s Fleet Purchasing Outlook. Comparing responses between large and small fleets, it’s evident 25 percent of fleet respondents with more than 1,000 trucks are electrifying their truck systems, while only 6 percent of fleets with 50 trucks or less are adding this technology.

The majority are using battery packs (more than 70 percent) but rank electrification the seventh priority in their efforts to improve fuel use. Fleets with more than 1,000 trucks reported the following priorities: telematics, start/stop systems, weight reduction, driver training, alternative fuels and auxiliary power units.

Totals in Figure 5 are not equal to 100 percent due to respondents’ ability to select multiple answers.

If you have not yet reviewed NTEA’s 2018 Fleet Purchasing Outlook, I encourage you to take a look and let us know what you think.

Learn more

Each year, NTEA’s Fleet Purchasing Outlook explores the commercial vehicle landscape and measures common acquisition incentives. NTEA captures responses from a variety of fleet professionals in mid- to high-level management, with authority to make truck acquisition and vehicle specification decisions. Participants represent a wide range of fleet sizes, vehicle weight classes and vocational truck applications across the U.S. and Canada. Key sectors studied in this analysis include government, construction, delivery and utility.

The 2018 Fleet Purchasing Outlook is free to NTEA members in print and digital formats. Nonmembers can purchase the report for $199. Learn more at ntea.com/fpo.