By Steve Latin-Kasper, NTEA Director of Market Data & Research

Meet our experts

This article was published in the December 2019 edition of NTEA News.

Key highlights

- The U.S. labor market is expected to tighten throughout the next decade.

- At some point in the mid-2020s, there may not be enough new entrants to replace retirees in the workforce.

At NTEA’s 2019 Executive Leadership Summit, held in Charlotte, North Carolina, in October, four of the five presenters related demographics to economics — each referencing generation names. The issue with referring to Baby Boomers, Gen X, Gen Y (millennials) and Gen Z is there are no official definitions other than U.S. Census Bureau identifying a date range for Boomers (people born from 1946–1964). From a statistical perspective, there are better ways to make comparisons, especially regarding generational impact on the labor force.

Per Pew Research Center, there seems to be consensus that Gen X includes people born from 1965–1980, Gen Y includes those born between 1981 and 1996, and Gen Z’s birth date range is from 1997 to present. Comparing generation sizes is difficult as a result of the uneven date ranges. The term Boomers includes 19 years of births, while both Gen X and Y encompass only 16 years. The open-ended range for Gen Z, as of 2019, already includes 23 years of births. As a result, neither generation names nor the above date ranges should be used in discussions of how generations impact the labor market and economic growth. Certainly, the generation view adds value to behavior and culture discussions, but it lends confusion to labor market analysis.

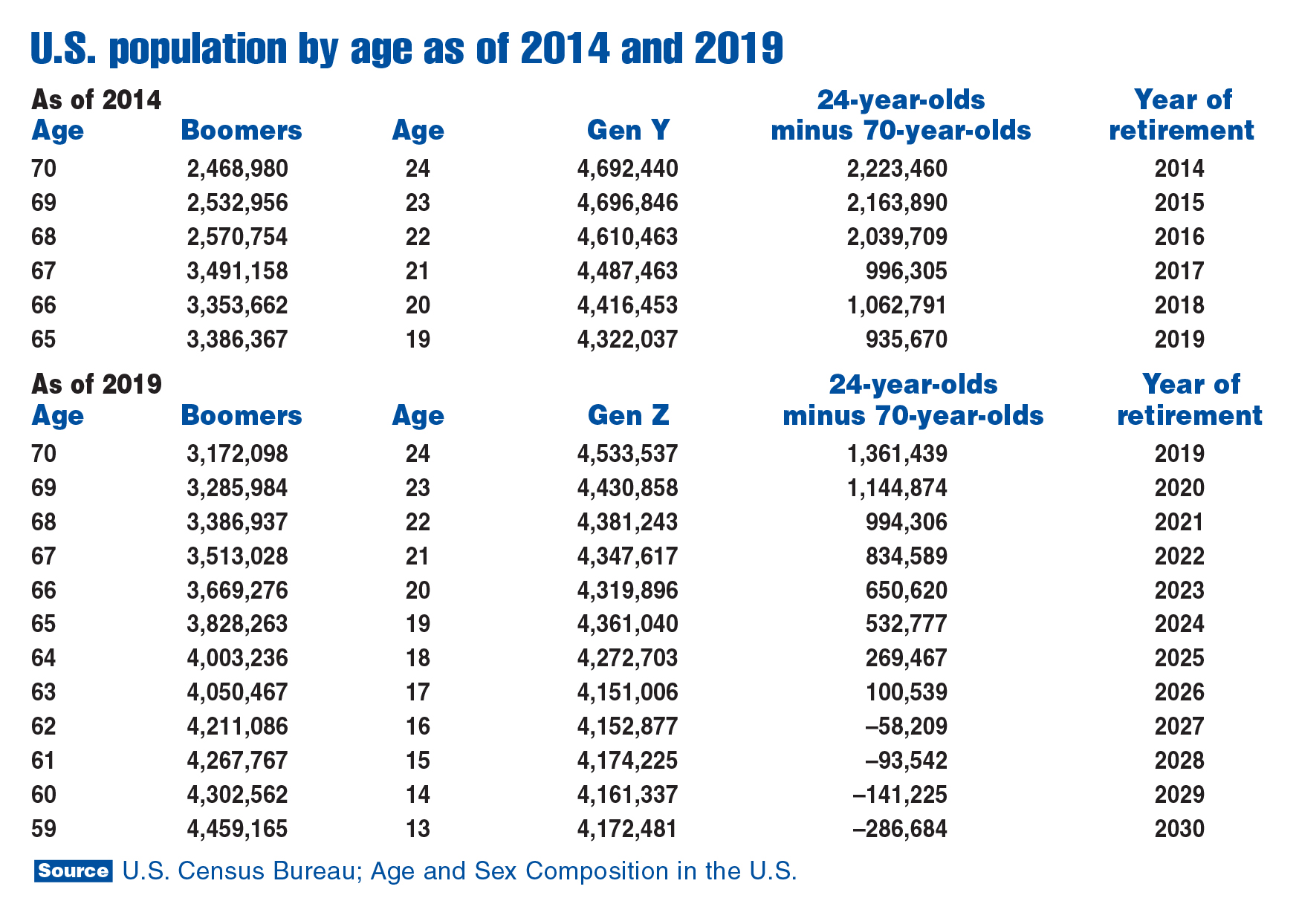

Data in the chart above helps clarify what’s happening in the U.S. labor market. The top section includes the actual number of people in the U.S. population by age as of 2014, and the bottom shows counts for each age as of 2019. The year 2019 is in both year of retirement sections to make it clear counts change from year-to-year, which occurs for numerous reasons.

One such reason is people can pass away at any age. The 3,386,367 individuals who were 65 years old in 2014 didn’t all survive to turn 66 in 2015. However, the number of 66-year-olds in 2015 could have been larger than the number of 65-year-olds in 2014 if the number of 66-year-old immigrants was greater than the number of 65-year-olds who died before reaching 66. This scenario is far more likely for younger ages.

As shown in the chart, not all 65-year-olds in 2014 survived to become 70-year-olds in 2019. This is a key reason the difference between 24- and 70-year-olds was larger in 2019 data than in 2014 data. When 2024 data becomes available, it’s likely the 24- to 70-year-old difference will improve, but it won’t change the trend in the 2019 data.

To be clear, 24-year-old new entrants to the labor force are not likely to replace a 70-year-old retiree. In the usual scheme of things, Gen X will replace Boomers, Gen Y will replace Gen X, and so on. In total, though, what matters is if there are enough new entrants to replace retirees. The assumptions applied to the data referenced here are that the average age of new U.S. labor market entrants is 24, and the average age at retirement is 70.

Obviously, the assumptions are debatable. Some Boomers are retiring prior to, and beyond, age 70. New entrants will be younger, and older, than 24. However, if we go with 67 and 21, for example, the trend looks the same. At some point in the mid-2020s, there won’t be enough new entrants to replace retirees. As of 2019, when there are still enough, the labor market is already tight. Since the number of new entrants joining the labor pool started trending down in 2016, and the number of retirees has been trending up since the first Boomer retired in 2011, the labor market will probably get tighter throughout the 2020s.

As there are a large number of economic and political factors that influence the labor market, the trend could change, but likely won’t. Such factors include business expansion requiring labor, immigration policy, labor force participation rate and alignment of available skillsets with demand. Of the factors listed, only a substantial change in immigration policy could be influential enough to reverse the current labor market trend in a timeframe that would make a difference. However, given the current political climate, there is diminished possibility. Since labor is an important input to the work truck production process, companies should consider planning for the trend toward further tightening.

In closing, the work truck industry will likely experience a bit of a slowdown from 2020–2021, but will likely grow again afterward, which could make a tight labor market look more like a labor shortage. As important as labor retention and training programs already are, the need may be magnified throughout the next decade.

For more industry market data, visit ntea.com/marketdata.