By: Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the January 2017 edition of NTEA News.

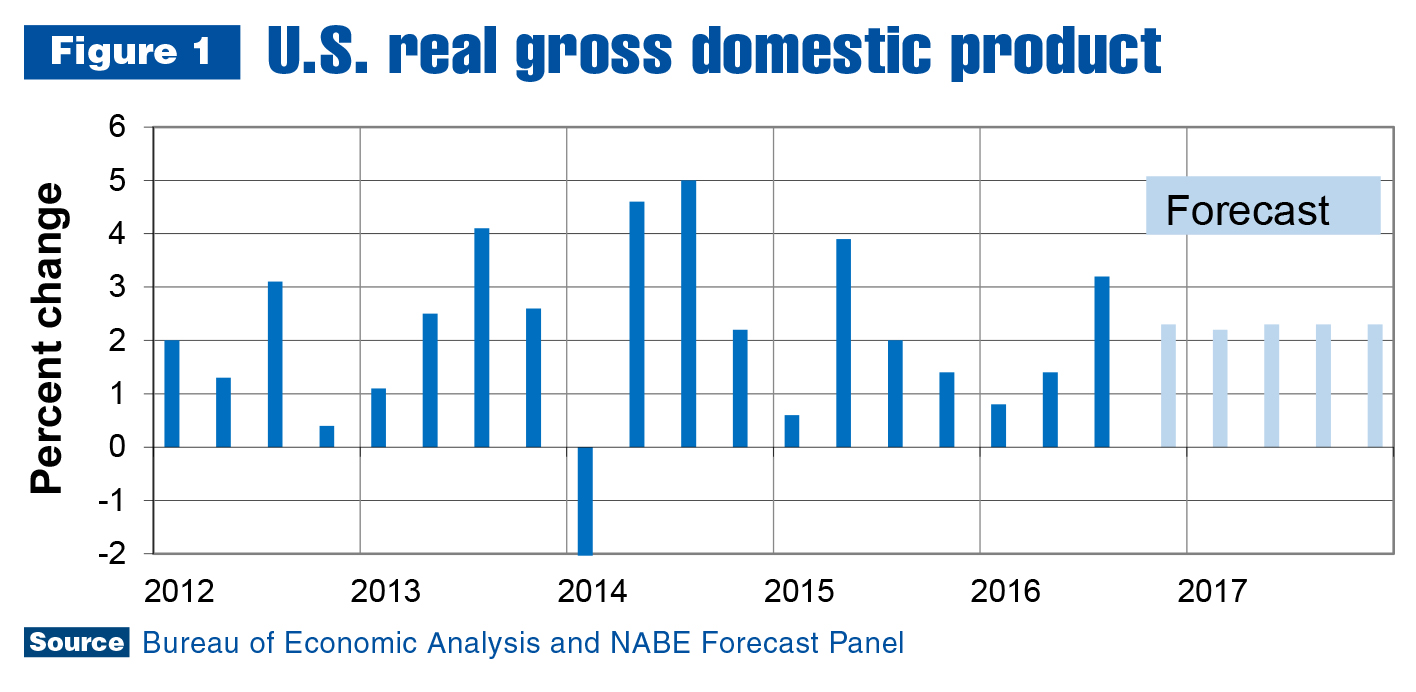

In November 2016, Bureau of Economic Analysis (BEA) released the second estimate of third-quarter gross domestic product (GDP) growth. Using more complete data than available in October, BEA estimated the U.S. economy grew 3.2 percent in the third quarter. This was slightly higher than the initial 2.9 percent approximation, and marked the first time GDP grew 3 percent or more since the third quarter of 2014 (see Figure 1).

The third-quarter real GDP increase was primarily due to positive contributions from personal consumption expenditures, exports, private inventory investment and federal government spending. Residential fixed investment and state and local government spending fell. However, state and local government expenditures on structures and equipment moved in the opposite direction. The downturn in total state and local spending resulted from a large decline in expenditures on structures outweighing a small increase in equipment spending.

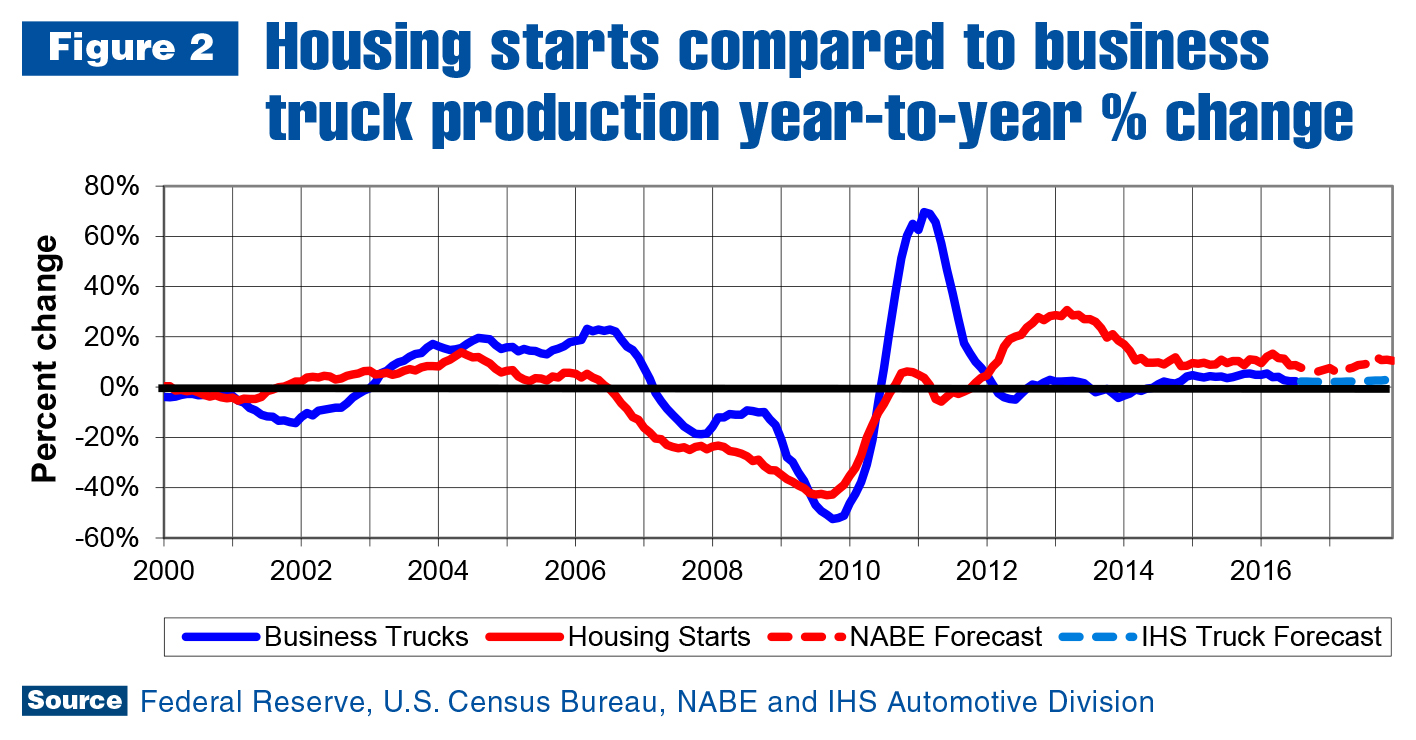

The decrease in residential fixed investment (housing starts) resulted from a decline in single-family housing starts outweighing an increase in multi-family. Residential expenditures (goods and services) also dropped (at a 1.1 percent rate) in the third quarter. This was an improvement from the second quarter when residential expenditures fell at a 2.0 percent rate. As shown in Figure 2, housing starts remain on track to increase in 2016 as compared to the previous year, despite slight weakening in the second and third quarters. In October 2016, housing starts increased 26.4 percent, supporting expectations for residential fixed investment improvement in the fourth quarter.

GDP data shows U.S. economic growth accelerated in the third quarter and confirms the end of the inventory correction that began in the second quarter of 2015. Further, as incomes continue rising, personal consumption expenditures should do so as well (this typically leads to increases in nonresidential expenditures).

In the labor market, the unemployment rate fell to 4.6 percent in October 2016, and wage gains motivated renewed job searches, which pushed up the labor participation rate. And since the rate of inflation is near 2 percent, the Federal Reserve Board of Governors will likely raise interest rates at its end-of-year meeting for the first time since December 2015.

Mortgage rates have been rising since September, and as of November, the average 30-year fixed rate was more than 4 percent. While this is low in historic terms, rates are clearly climbing, as are home prices. This could lead to an increase in demand for homes in 2017 as prospective buyers try to enter the market before being priced out.

It seems as if the stage is set for the U.S. economy to take off in in the new year, but growth limits remain. The same construction crew can’t build a house in Kansas City and a road in St. Louis simultaneously. As such, the 2017 GDP forecast calls for 2.3 percent growth — slightly higher than through the first three quarters of 2016, but below the historic norm. Housing starts are also expected to grow a bit faster in 2017 than the previous year.

Work truck industry

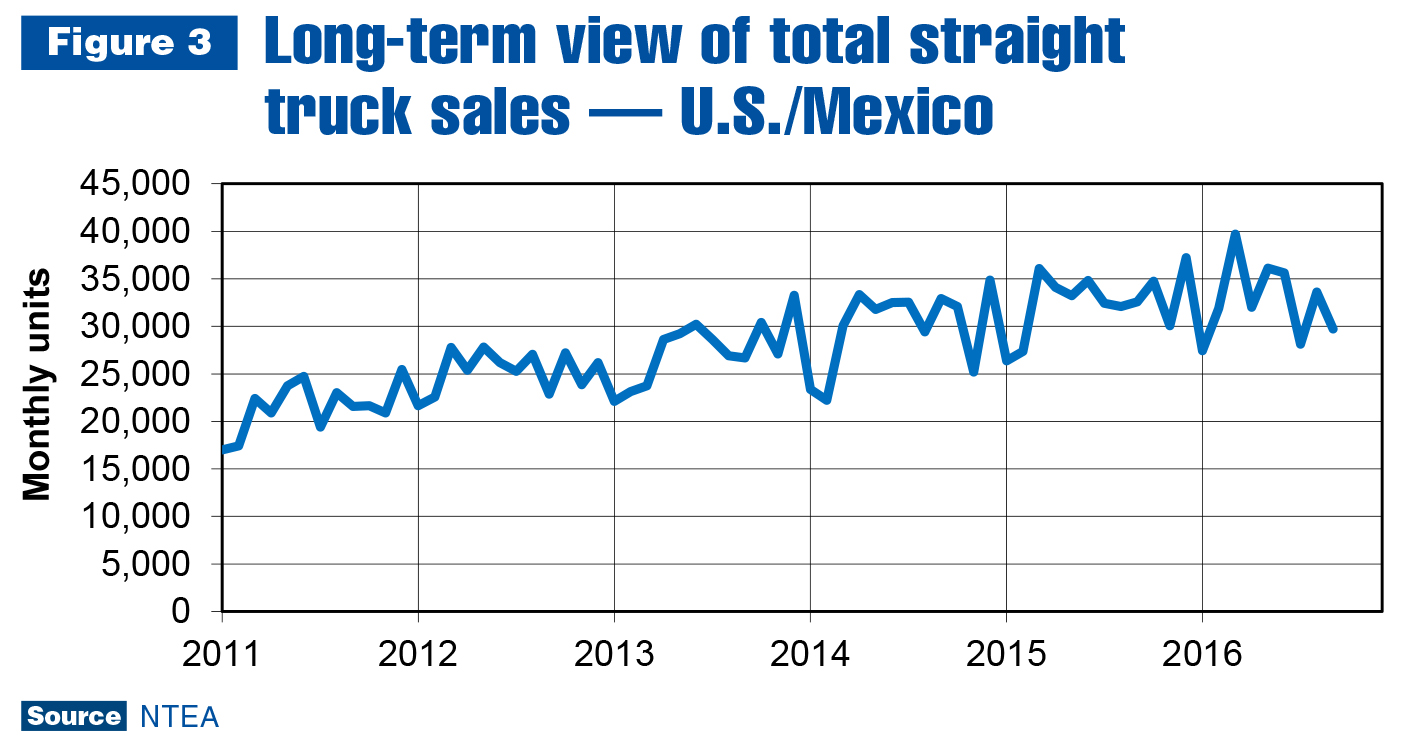

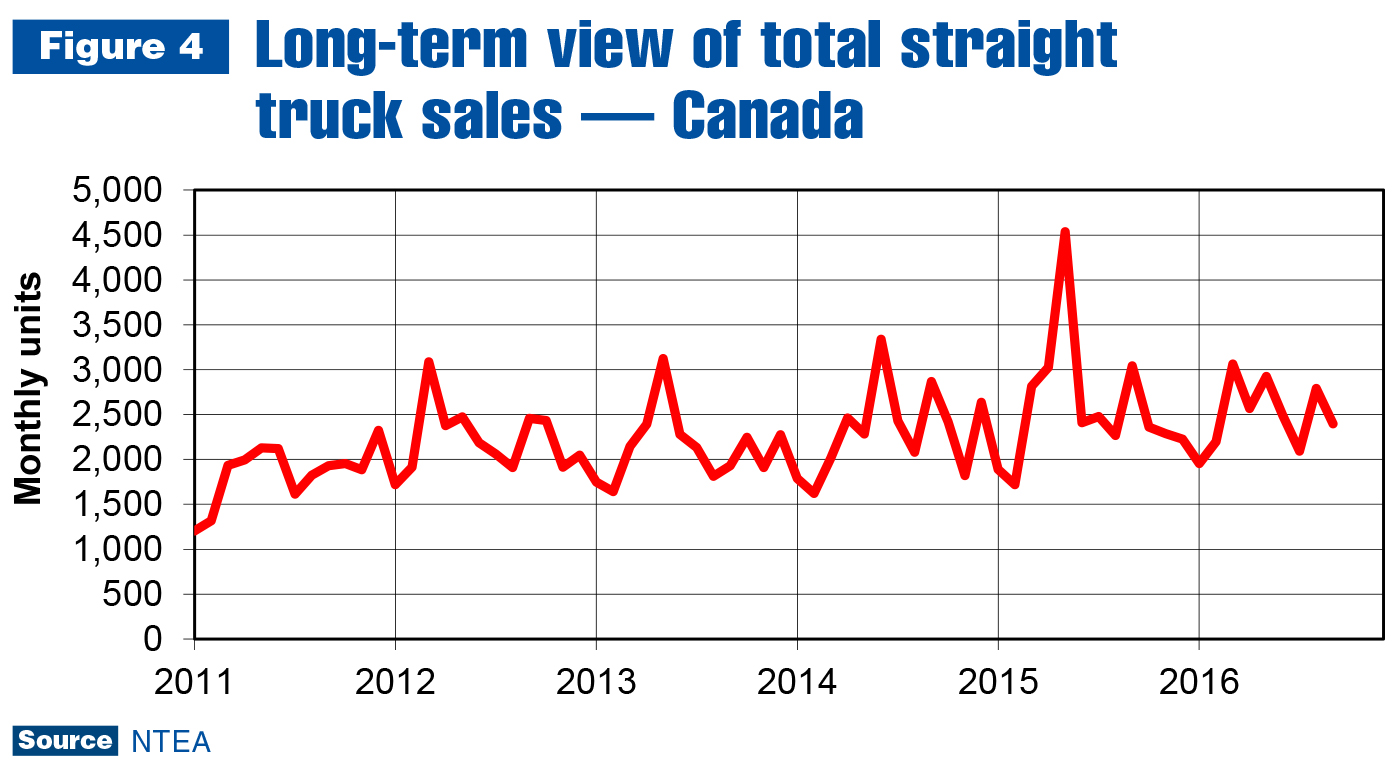

Commercial truck chassis sales had a fast start in 2016 with 10.3 percent growth in the first quarter. This rate began decelerating in the second quarter, however, falling to 1.3 percent. In the third quarter, the rate of change became negative, dropping to –5.8 percent. Cumulatively through September, chassis sales remained up 1.8 percent for U.S./Mexico.

Fourth-quarter performance will determine whether or not the industry stays up for the year. Anecdotal evidence indicates sales were slow in October and November, so it may come down to how well buyers respond to end-of-year sales incentives.

The good news is some companies saw a high level of quote activity and orders in November. This bodes well for 2017, and per the forecasts made at NTEA’s 2016 Executive Leadership Summit, increases in demand will likely be broad-based this year. The energy sector is expected to rebound, along with the global price of oil. Transportation service industries and the truck/trailer rental market are anticipated to do well. In addition, the construction sector and state and local government should continue increasing their demand for work trucks and equipment.

The current forecast calls for a 4 percent increase in commercial truck chassis sales in 2017. The medium-duty segment (Classes 4–7) is expected to grow, but at a slower pace than in 2016. The light-duty sector (Classes 1–3) may rise a bit faster than the previous year. The heavy-duty segment (Class 8 straight trucks and tractors) is predicted to be flat as compared to 2016. Current expectations are that shipments will not balance with sales until the end of the second quarter, and that sales will start increasing in the second half of the year.

Metals and energy prices

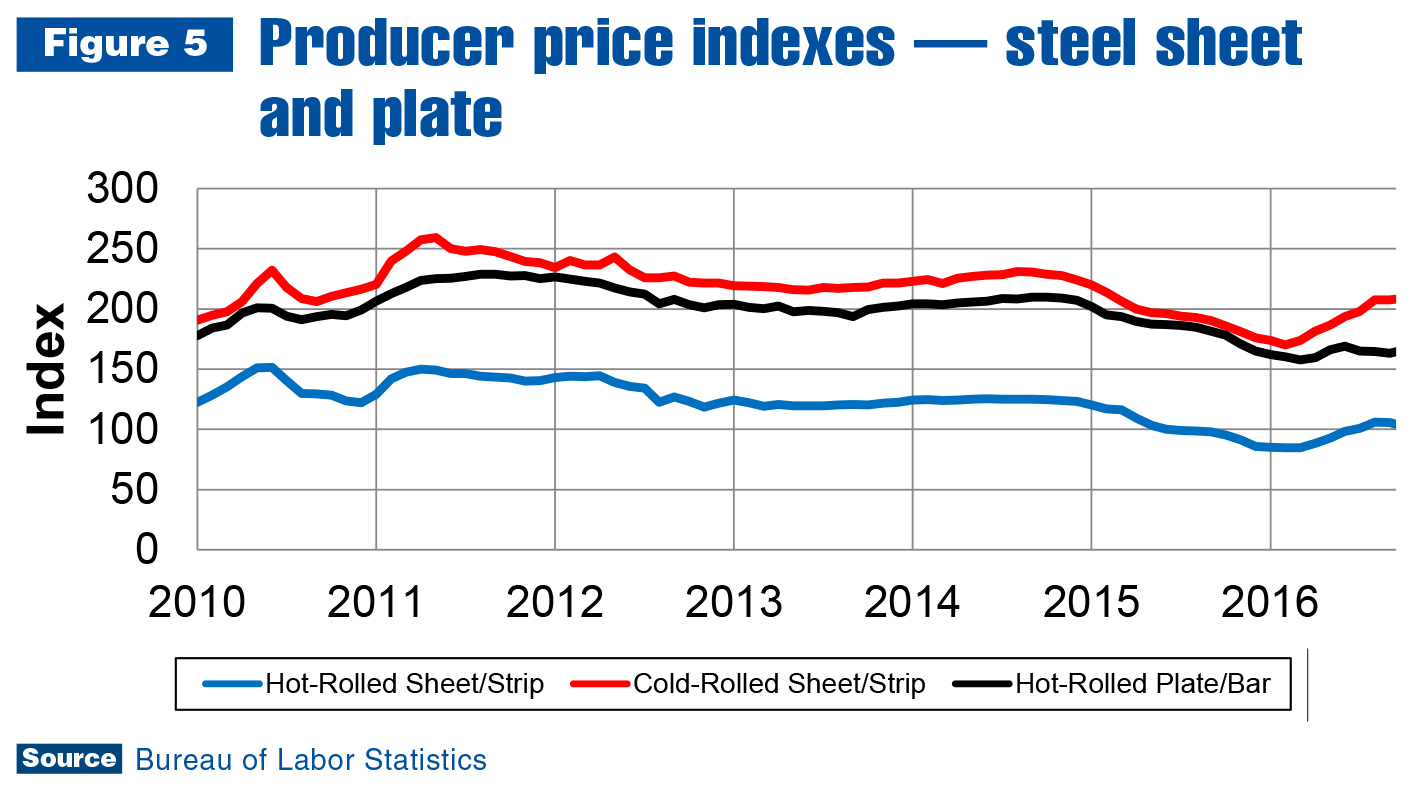

Hot-rolled steel sheet/strip prices continued rising in the third quarter of 2016, but at a declining rate. They were up 1.7 percent for the quarter August to October, which was substantially less than the 7.2 percent gain for the year through October. The same pattern existed for cold-rolled steel sheet/strip. For the quarter through October, prices were up 5.4 percent, which was much less than the 12.4 percent gain for the year. Steel prices seem to be flattening entering 2017, but the trend may change soon.

This year, the Chinese economy will likely be the primary driver behind steel price increases, as infrastructure investment that began in 2016 is expected to carry over into the new year. The Australian mine that supplies many Chinese steel manufacturers with high-grade iron ore asked them to pay a premium as of November.

In addition, in the U.S., both major party candidates for president indicated they would promote investment in public infrastructure. Now that the election is over, metals futures prices are rising. At one point, copper prices jumped 20 percent in one week. Steel manufacturer stock prices have also increased on expectations of higher steel prices. Futures markets are not always the best predictors, but rising steel prices in 2017 is likely.

In the aluminum market, prices may climb as well, simply because of continued global economic growth, but they probably won’t increase at the same pace as steel prices. Aluminum sheet rose just 1.1 percent from August to October — slightly higher than the 0.8 percent increase for the year. As 2017 begins, there is still a supply surplus in the aluminum market, which could prevent significant price growth in 2017.

In the oil market, OPEC made things interesting at its November 2016 meeting, with members agreeing to cut supply. This led to spot price increases around the world (about 14 percent in three days). In real terms, it means the price per barrel rose from about $45.5 to $51.5. They may keep escalating into the first quarter of 2017, but it depends on how U.S. and Canadian producers react to the price increase. U.S. production alone could grow enough to push the price back down. NABE’s current forecast estimates the price of oil will jump to about $55 in 2017.

Leading indicators

Housing starts grew at a rate of about 26 percent in October 2016 — a significant turnaround from the second- and third-quarter deceleration. They’re expected to continue growing in 2017 to about 1.36 million units, which is roughly 150,000 more than the number of starts last year.

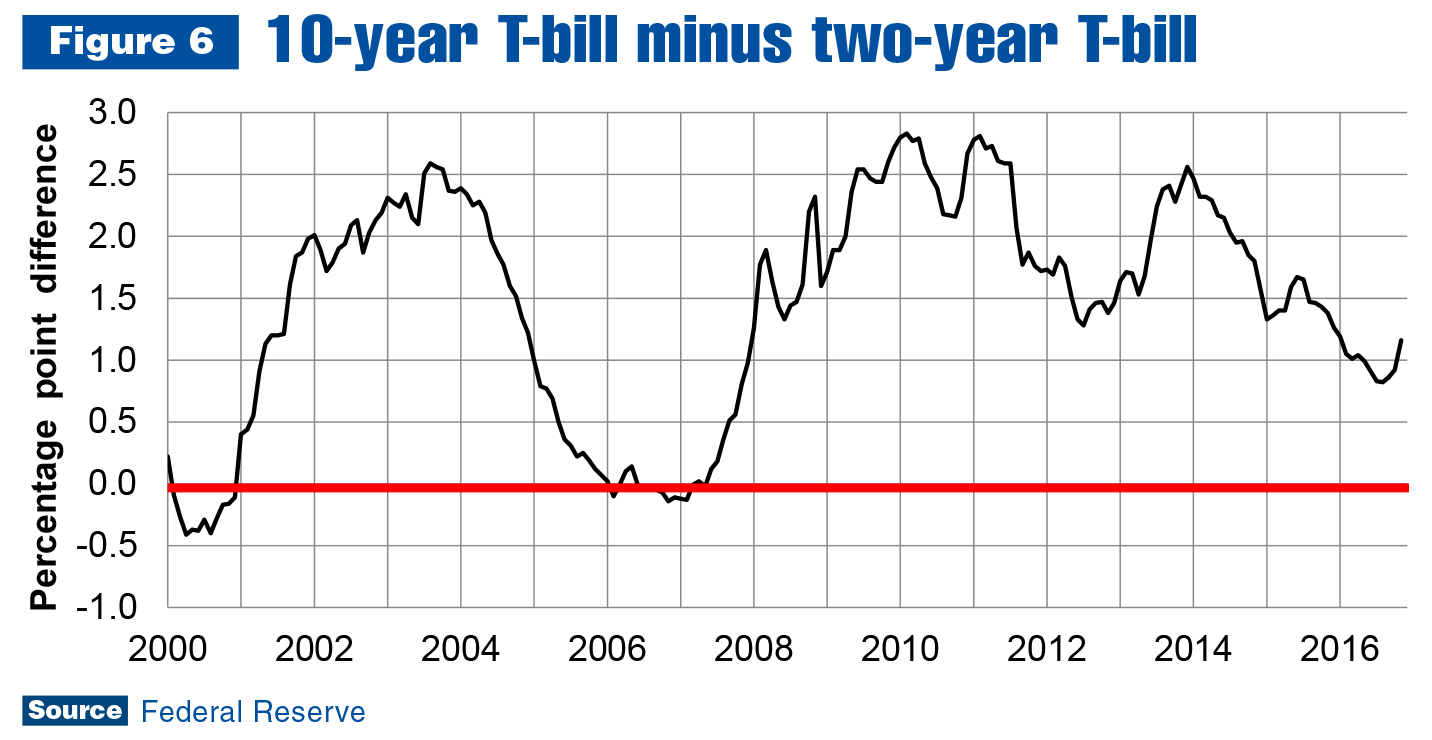

Interest rates paid on U.S. treasury notes started rising in September. Long-term rates climbed faster than short-term. As shown in Figure 6, the yield curve turned up again as a result. This indicates financial market uncertainty that led to a steep decline in the yield curve over the course of 2016 abated as of September.

The yield curve has been a consistent leading indicator of U.S. economic recession since the 1960s. Historically, recessions begin about one year after a yield curve inversion (the 10-year rate falling below the two-year rate). At its pre-September rate of decline, it would have inverted toward the end of 2017 and predicted the next recession toward the end of 2018. Since it’s climbing again, the next recession will likely occur at a later date than otherwise (more than two years away).

The current forecast for work truck sales calls for about 4 percent growth in 2017. Depending on how the U.S. energy sector reacts to the price of oil rising above $50, this prediction may need to be revised higher.

However, growth limits that have made planning difficult in 2016 will not disappear this year. The labor market may get even tighter, and finding qualified employees will become more difficult. In addition, capacity utilization will get even higher. Rising labor and steel prices could put pressure on profit margins. In sum, the industry will likely continue growing, but managing that growth could present challenges.

For questions on this article, contact Steve Latin-Kasper.