Guest editorial

By Dr. Albert D. Bates, Director of Research, Profit Planning Group

This article was published in the January 2017 edition of NTEA News.

Over the last few years, some companies have moved away from improving operations — focusing instead on rethinking the nature of their business. New ideas include reducing the number of customers served, utilizing big data to gain a marketing advantage, structuring separate web-based entities and using mobile technology to preempt competitors.

Somewhat absent is the idea of managing the existing business for greater profit. It’s not that companies have no desire to increase profitability — it’s just the idea of improved performance from better blocking and tackling seems so 20th century.

Economic impact of small improvements

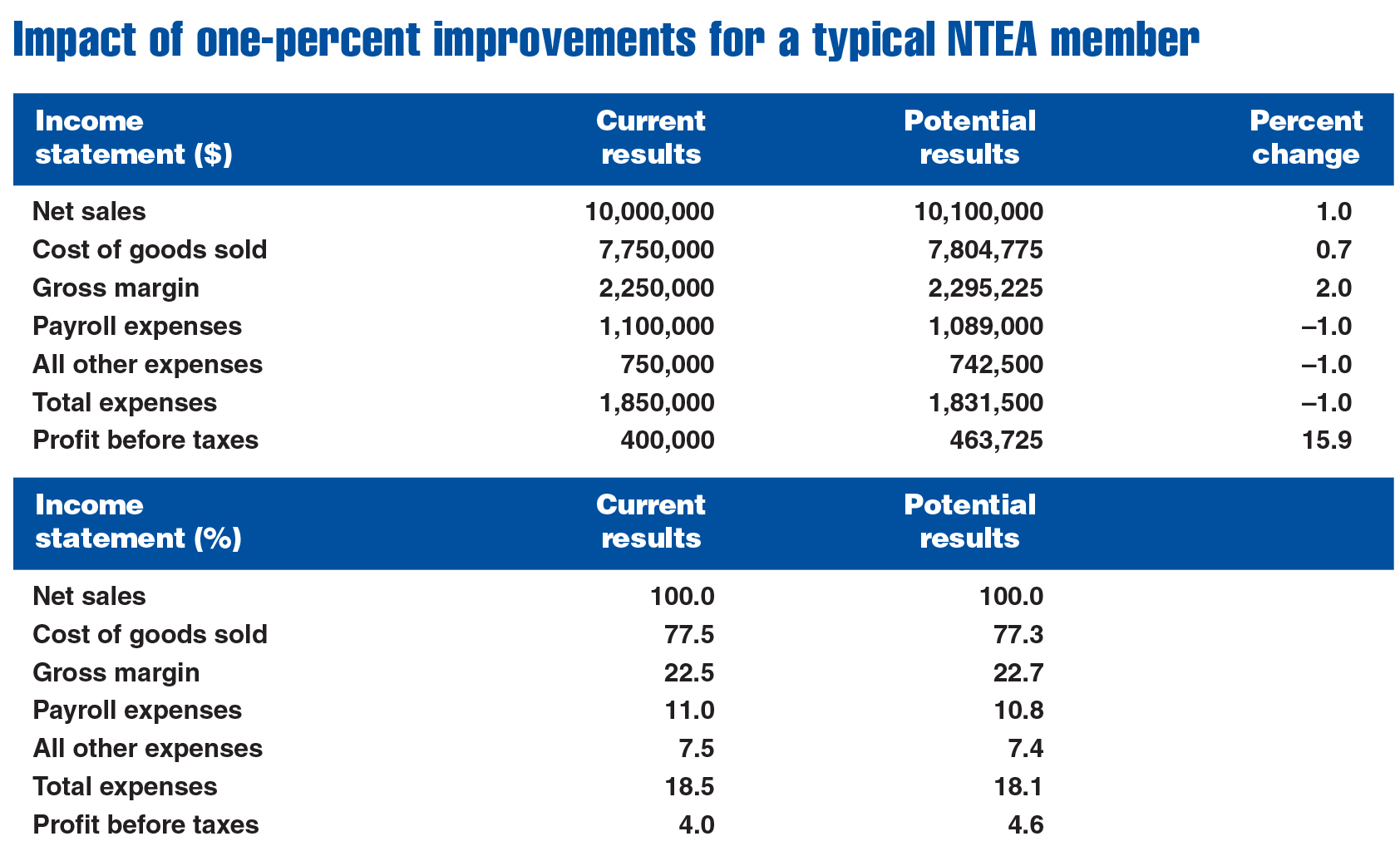

The chart below examines income statement performance of a typical NTEA member. As indicated in the current results column, the business generates $10.0 million in revenue and operates on a gross margin of 22.5 percent of sales with expenses of 18.5 percent of sales. This generates a pre-tax profit of $400,000, or 4.0 percent.

The potential results column reflects the impact of three seemingly inconsequential improvements: (1) 1.0 percent increase in sales, (2) 1.0 percent boost in gross margin percentage from 22.5 to 22.7 percent (22.5 percent times 1.01), and (3) 1.0 percent reduction in total expenses. It is better blocking and tackling personified.

While each improvement is a modest 1.0 percent, the impact on profitability is greater. The company’s pre-tax profit increases from 4.0 percent of revenue to 4.6 percent. More importantly, the dollar profit increases by $63,725 — a 15.9 percent boost. For some businesses, systematic improvements have lost favor, but it’s important to remember little things can mean a lot.

Guidelines for operational improvements

It’s one thing to talk about operating the business more effectively — but it’s something else to actually do it. In essence, how does the firm block and tackle better? In making the improvements, consider two key issues: (1) focusing on what matters and (2) developing a consensus in the business as to what those items are.

Operational focus

Three areas of change drove the financial improvements shown in the chart — net sales, gross margin and expenses. Each should be addressed, and in doing so, firms need to avoid over-complicating improvement actions.

Net sales — Research indicates distributors are missing anywhere from 3.0 to 5.0 percent of sales potential due to inventory investment cutbacks. This trend began almost a decade ago as firms took a more financial view of their businesses. The move to reduce inventory continues even as research projects show the two main customer complaints are inadequate service levels and an overly narrow assortment.

Gross margin — Many companies have a significant and largely untapped opportunity to improve gross margin percentage. It involves identifying products where prices can be increased without impacting competitive position. Such items, almost all of which are slow-selling SKUs, represent a small proportion of sales volume. At the same time, they have the potential to contribute to a substantial improvement in overall gross margin percentage.

Expenses — The majority of distribution managers are tired of hearing about expense control, as many feel there is nothing left to cut. The real key to expense control is not to reduce expenses or increase productivity. What is needed is an emphasis on internal order economics. In essence, the battle is to get the maximum number of items on every order. If that can be done, expenses will systematically fall as a percent of sales, even as they continue to increase in dollars.

Operational consensus

Research from Distribution Performance Project on various lines of trade found a lack of consensus among key managers as to what is important in performance improvement. For instance, half may think prices should be reduced to gain sales volume, while the rest believe they should be increased.

The key to achieving goal congruence is management education. There is often a feeling that “they all know that” regarding issues such as the impact of inventory reductions. The reality, in fact, is that some do not.

Education needs to be geared toward providing a basic understanding of what really drives profit. There should be no intent to make everybody an accountant. However, it should be relatively easy to ensure all managers understand the economics of price cutting, for example.

Moving forward

There is no denying the industry is in an era of change. Every company must look for chances to take advantage of new strategic initiatives, technology and ways of serving customers. However, if businesses ignore existing profit opportunities, they are severely limiting their ability to take part in the future. It is time to once again emphasize better blocking and tackling.