By Steve Latin-Kasper, NTEA Director of Market Data & Research

Meet our experts

This article was published in the February 2020 edition of NTEA News.

Key highlights

- U.S. new commercial truck registrations will likely soften in 2020.

- IHS Markit’s 2020–2022 forecast for new Class 8 registrations in Canada was revised to become more positive.

- New registrations are expected to grow faster in Mexico than in the rest of North America from 2020–2023.

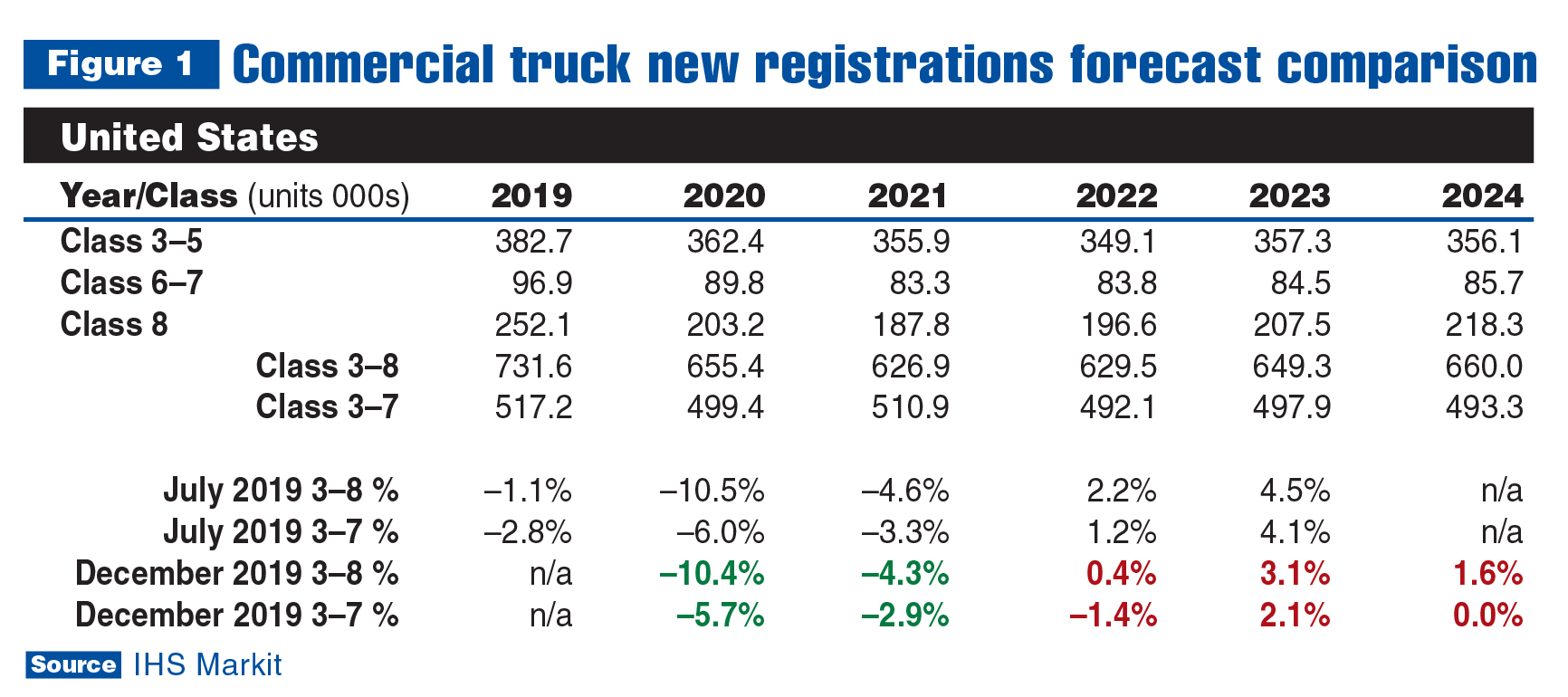

NTEA receives updates to IHS Markit’s commercial truck new registrations forecast — including data for U.S., Canada and Mexico — twice a year, in July and December. The July 2019 forecast indicated new U.S. registrations would likely fall in 2020. As shown in Figure 1, changes as of December were minimal.

Pickups and commercial vans are included in the Class 3–5 weight range, and they dominate that industry segment in terms of volume. In all cases, IHS Markit defines “commercial” as a truck owned by a commercial operation or government (federal/state/local). The annual percent change calculations for 2020–2024 are shown as published in July and December 2019. If the percentage is green, it was a slight improvement from mid- to end-year, and if it’s red, it means the forecast worsened.

U.S.

U.S. expectations improved slightly for 2020 and 2021, as indicated in Figure 1. For 2022 and 2023, IHS Markit became less optimistic about how well the industry will recover from the predicted 2020–2021 downturn. A low order level is the primary reason for the negative forecast for 2020–2021, as well as slowdowns in U.S. manufacturing and construction sectors that began in 2019.

Canada

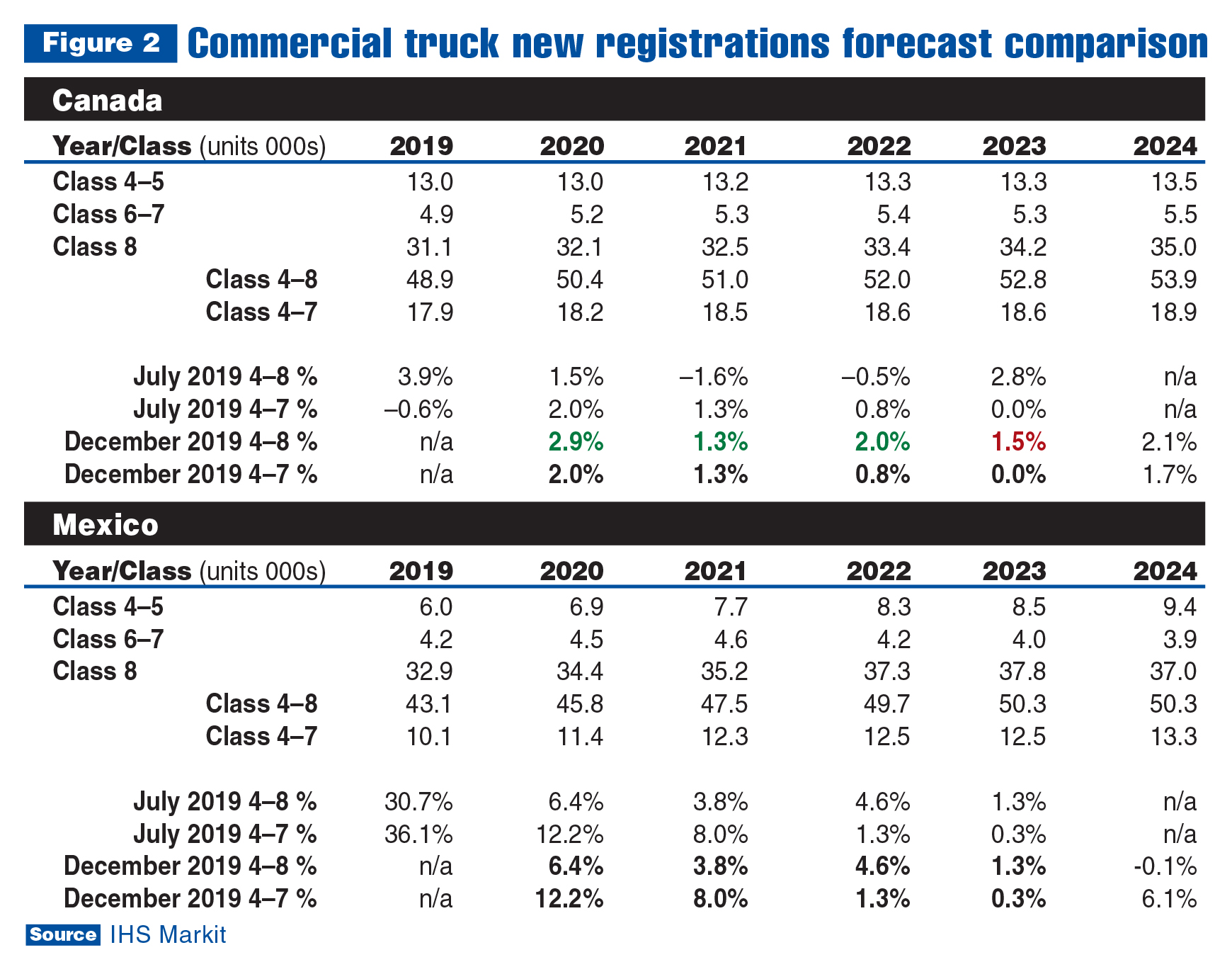

As shown in Figure 2, changes to Canada’s forecast were more substantial. Between July and December, IHS Markit estimates became more positive for Class 8 — which affected the Class 4–8 total for 2020–2022 — and less positive for 2023. There were no changes for Classes 4–7.

Mexico

IHS Markit’s 2020–2023 predictions for Mexico were not altered. New registrations of commercial trucks are still expected to grow faster in Mexico than in the rest of North America from 2020–2023, which is in line with predictions for the country’s gross domestic product.

For more industry market data, visit ntea.com/marketdata.