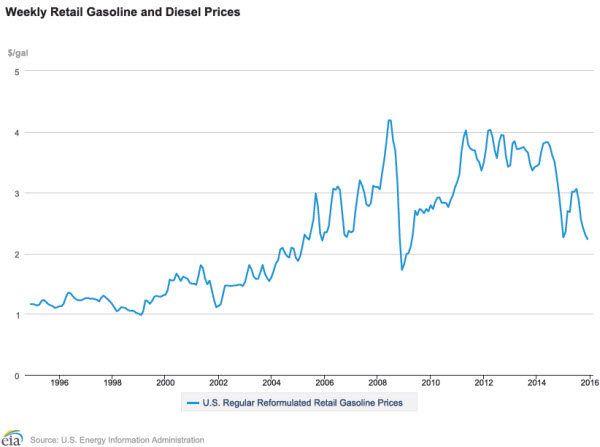

When conventional fuels were trending between $4.00 and $5.00 per gallon, investing in alternative fuels was the “thing to do.” This resulted in reduced fuel costs, cleaner air, and reduced dependence on foreign oil – a win-win for your business model. However, conventional fuel trending around $2.00 can present a challenge in making a business case for alternative fuel infrastructure and vehicle deployment. The current market appears to be in a wait-and-see mode with regard to future alternative fuel deployment. Although forecasters are not predicting oil prices to start trending upward anytime soon, it will happen eventually. Historical data over the past decade shows plenty of booms and busts in pricing.

Green concepts with low budget impact

Your organization may not be able to justify the investment to “traditional” alternative fuels such as compressed natural gas (CNG) or propane autogas; however, reducing your overall energy consumption will hit your bottom line. A few strategies can be implemented to accomplish this. First, go after the low hanging fruit: idle management and route optimization can be accomplished with little or no capital investment.

Idling gets you nowhere. Literally, no work is being performed. Idle management can be a simple as writing and implementing a policy. However, results will correlate with how well the policy is enforced and followed.

Active anti-idling technology can be a relative low investment option as well. Route optimization is another low-cost strategy. Reducing the amount of miles naturally results in less fuel burn, which translates to an automatic savings for your bottom line.

Driver behavior modification is another strategy. Aggressive acceleration, hard braking and cruising speed all contribute to the amount of energy required to move a vehicle. Communicating these concepts and providing feedback to your operators can trim your fuel budget.

The case for alternative fuels

Even with historic low conventional fuel costs, there may be a case for alternative fuels within your organization. Maintenance becomes a prominent cost to consider when comparing options.

When comparing life-cycle costs of diesel versus CNG or propane autogas, remember the three Fs: filters, fluids and fuel.

Filters: With tighter EPA standards on diesel engines, diesel particulate filters can become a significant cost to your maintenance budget.

Fluids: Compare oil capacity requirements – traditional diesel engines can use 50 percent more oil. Since propane autogas and CNG run cleaner, you may be able to extend your oil change intervals.

Fuel: Propane autogas and CNG have historically been less costly than gasoline or diesel.

Finally, company image and being green by choice based on your internal organizational values, can be of tangible value.

Looking to the future

Fuel prices will rebound at some point; we’ve seen this cycle in the past. Take an approach to your energy demands that fit within your organizational mission. In the end it’s about the bottom line. Having a plan for your organization can result in making a difference to your bottom line. This plan could be as simple as having an anti-idling policy, or as complex as investing into alternative fuels and technologies.

To discuss this or any other fleet issue with the NTEA, call 800-441-6832