By Steve Latin-Kasper, NTEA director of market data & research

This article was published in the June 2019 edition of NTEA News.

Key highlights

- Of the nearly $39 billion of work truck industry products imported by the U.S. in 2018, the top four product lines accounted for $30.2 billion.

- Canada and Mexico continue to account for a majority of the industry’s international trade.

- The industry will likely export about $20 billion of products in 2019.

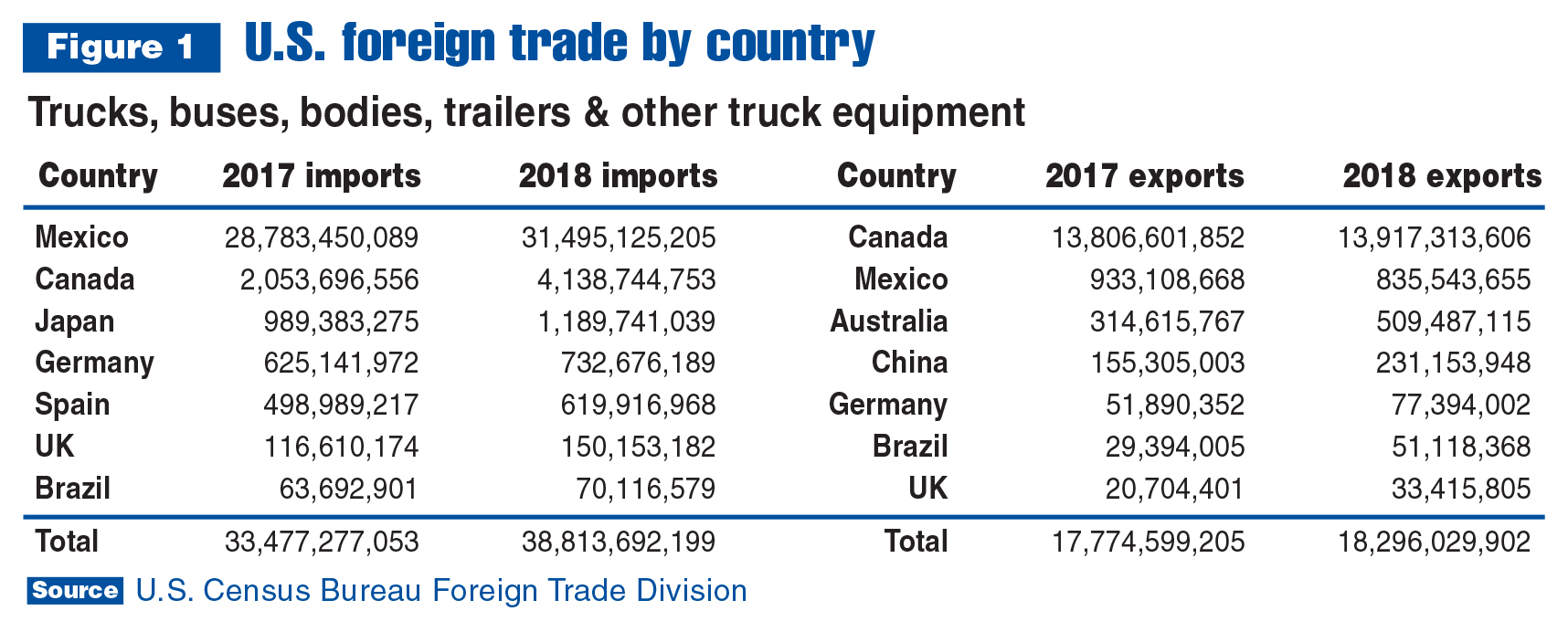

According to U.S. Census Bureau’s Foreign Trade Division, total exports of work truck industry products reached $18.3 billion in 2018 — a 2.9% increase from the $17.8 billion of exports registered in 2017. Imports increased 15.9% last year to $38.8 billion — up from $33.5 billion in 2017.

Figures 1 and 2 make it clear Canada and Mexico account for the majority of work truck industry international trade. This has remained consistent for at least the last 20 years and is unlikely to change over the next few. As shown in Figure 1, Mexico is by far the largest exporter of industry products to the U.S — accounting for 86% of total imports in 2017. The percentage fell to 81% in 2018 as imports from Canada more than doubled, and increased substantially from the rest of the top eight exporters to the U.S.

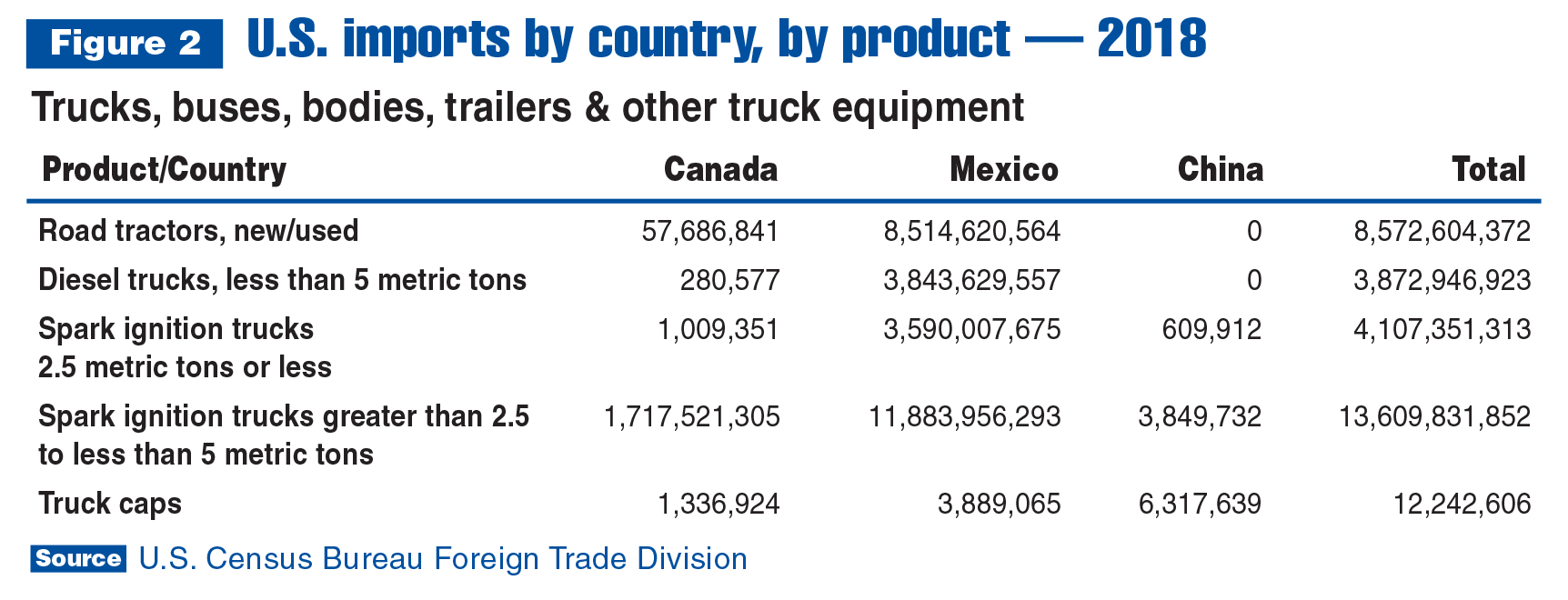

Figure 2 shows one country is responsible for the majority of U.S. exports of work truck industry products. Canada accounted for 78% of exports in 2017 and 76% in 2018. It was one of just three countries among the top eight export markets for U.S. work truck industry companies that imported more than it exported. The others were Australia and China.

Four product categories account for the bulk of U.S. work truck industry imports, plus truck

caps, as illustrated in Figure 2. Truck caps were included because they are the highest volume industry import from China. While China exports a lot of goods to the U.S., they are primarily nondurable and inexpensive. In the work truck industry, most trade between the U.S. and China flows in the other direction, and the U.S. has a trade surplus of about $213 million.

Of the almost $39 billion of work truck industry products imported by the U.S. in 2018, the top four product lines accounted for $30.2 billion. Mexico is the largest exporter to the U.S. in each product category. Spain isn’t shown in Figure 2, but it’s one of the top exporters to the U.S. because it’s the number two exporter of spark ignition trucks weighing less than 2.5 metric tons. Ford Transit Connects and Mercedes-Benz Vitos are made in Spain and shipped to the U.S. Spain’s share of that product category was $511 million.

Tariffs imposed on steel and aluminum imports led to truck and truck equipment price increases in 2018, but it ended up being a good year for trade. Both imports and exports increased, although imports rose more in percentage terms. This will likely happen again in 2019 due to the U.S. dollar appreciating versus most other major currencies. Still, the bottom line is the work truck industry will likely export about $20 billion of products in 2019.

More resources

Market data

NTEA's 2019 Executive Leadership Summit (member discounts apply)

Webinar: Work truck industry market activity — A mid-year update

Presented by: Steve Latin-Kasper

Wednesday, July 24, 2019 (11:15 a.m.-noon EDT)