By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the May 2017 edition of NTEA News.

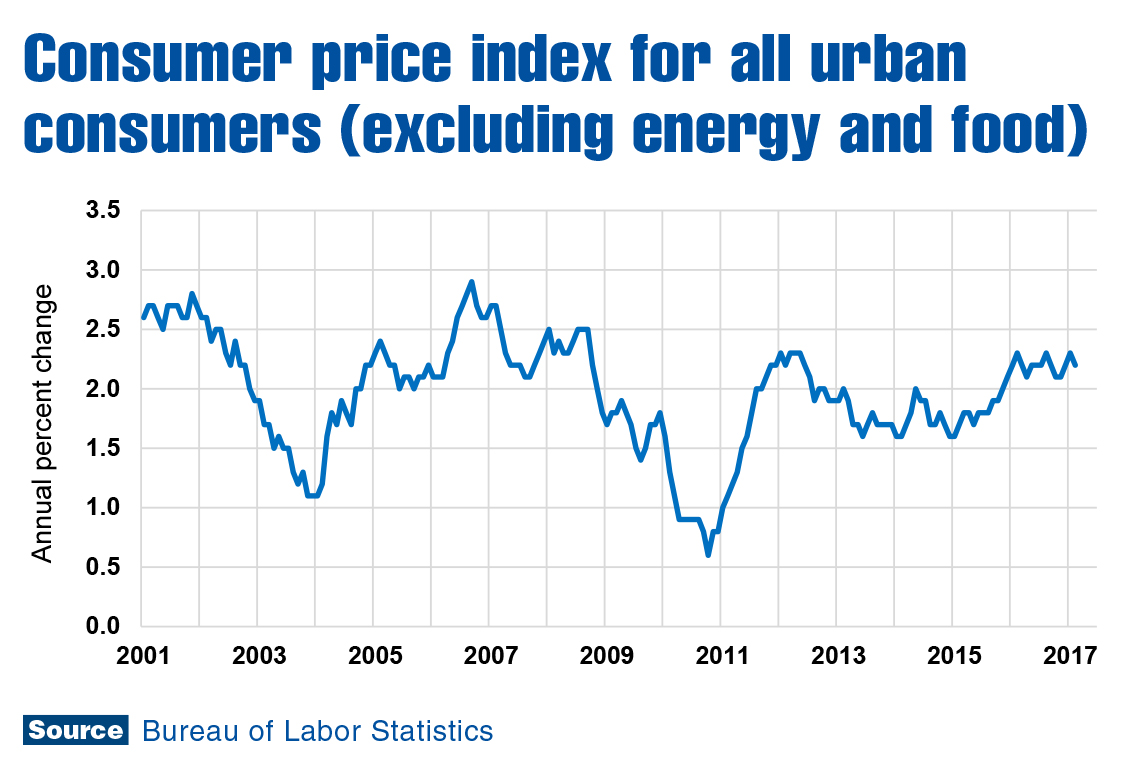

According to Bureau of Labor Statistics (BLS), the consumer

price index (CPI) for all urban consumers (excluding energy and food) increased

2.2 percent in February 2017 as compared to the same month the previous year.

This aligns with the 2.3-percent forecast for 2017 in the latest Outlook

published by National Association for Business Economics (NABE).

However, there is reason to believe the inflation forecast

may be too low. BLS data for total private sector average hourly earnings indicates

wages increased 2.8 percent in February. The growth rate of average hourly

earnings began accelerating steadily in the first quarter of 2015, and it’s not

a coincidence the inflation rate started gaining momentum in the same

timeframe. The latest NABE forecast indicates average hourly earnings will

likely rise 3.2 percent this year. If wage and income levels keep growing

faster, inflation will probably follow suit.

As of the first quarter, producer prices (price of goods

when one firm buys from another) are increasing even faster than consumer goods.

Producer prices were up 4 percent in February 2017 as compared to the same

month the previous year. The average price increase for steel mill products was

15.1 percent.

In any business cycle, there are periods when prices change

more than others. As companies react to the changes, communications up and down

the supply chain can become difficult. One way to avoid those challenges is to

take advantage of price indexes published monthly by BLS.

Organizations do so by including price escalators in contracts — especially

long-term ones.

Escalators have been part of business-to-business contracts

for a long time. In fact, a primary reason BLS publishes price indexes is for

escalator use. Utilizing price indexes as contract escalators is not just

relevant to certain business types. All companies buy things and, therefore,

can benefit from contract escalators.

The price index type you select is important. A producer

price index (PPI) exposes both parties in a contract to more volatility than

going with a CPI. However, for contracts involving a bill of materials with a

total cost substantially accounted for by one product (such as aluminum sheet

or steel plate), availability of those commodity price indexes offers a risk

elimination opportunity which should be carefully considered. Keep in mind that

escalators work in both directions.

For contracts with bills of materials including many items

(none of which account for a large percentage of total cost), using a CPI or

employment cost index may be a better option. Companies can use a PPI for their

own products — if existing.

While BLS is a good source for price information, other

options are available. For example, some businesses depend on their steel suppliers

to provide steel price details. Others pay for database subscriptions from

market research companies. However, if BLS publishes a price index useful to

your organization, you can download the file free of charge. BLS explains the

entire process of using price indexes as contract escalators at bls.gov/ppi/ppiescalation.htm.