By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the February 2019 edition of NTEA News.

Key highlights

- Industry segments are expected to experience less sales growth than anticipated six months ago.

- Higher U.S. interest rates will likely put downward pressure on demand for Class 8 trucks/tractors/buses, in particular, and could affect Class 4–7 demand.

- New commercial truck registrations in Canada and Mexico are predicted to remain positive through 2022.

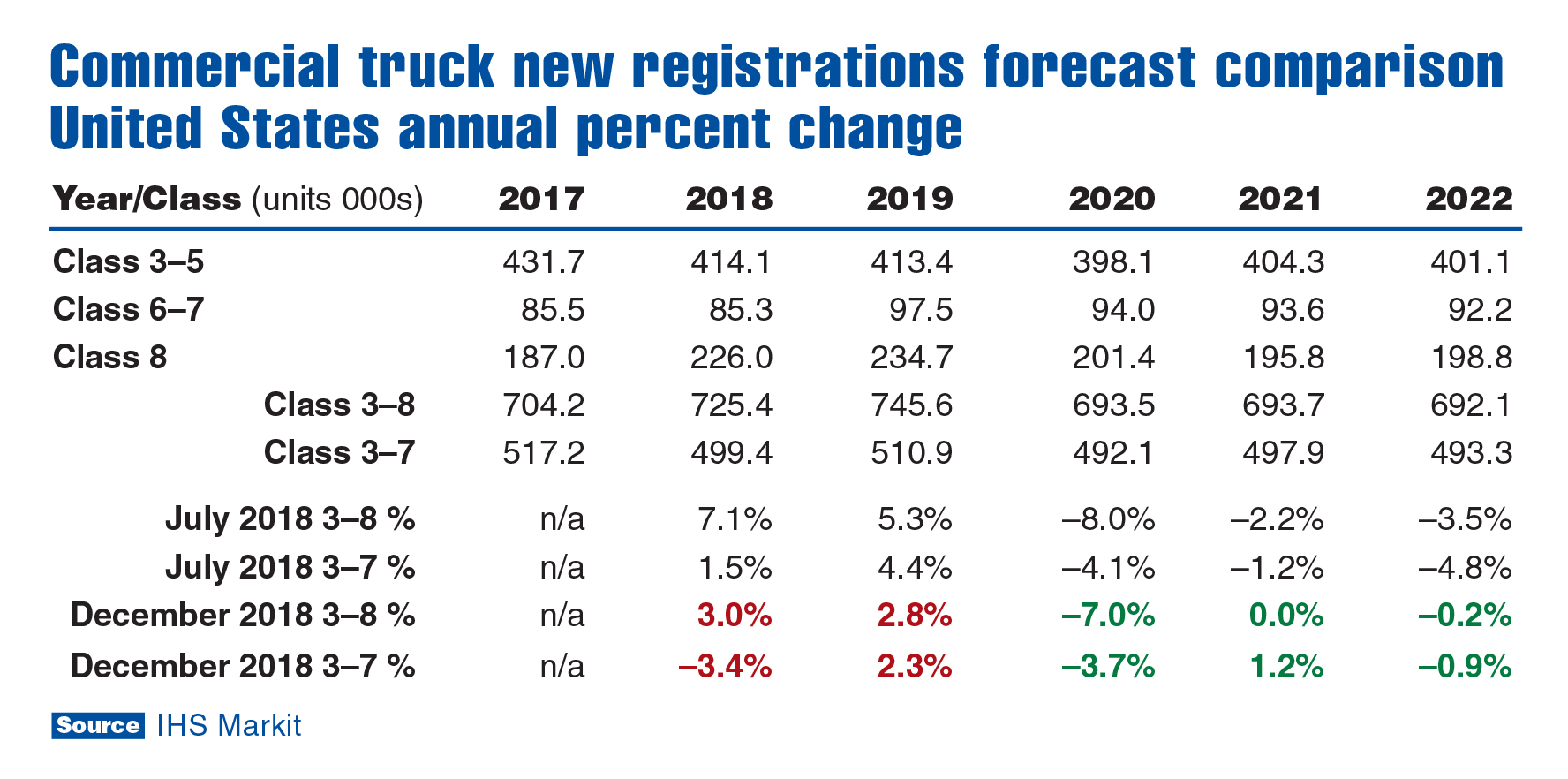

Last July, IHS Markit predicted 7.1 percent growth for 2018 new registrations of Class 3–8 commercial trucks. In the December 2018 forecast update, the rate of growth was revised downward to 3.0 percent. This thread carries through 2019 — the July forecast called for 5.3 percent growth this year, but the December revision lowered to 2.8 percent.

The 2018 Class 3–7 forecast total was revised downward even more; a 4.9 percentage point drop from 1.5 to 3.4 percent. Clearly, IHS believes all industry segments will experience less sales growth than anticipated just six months ago.

Canada and Mexico estimates (not included in the chart above) were also revised downward (minimally for Canada). The July Class 4–8 new registrations forecast predicted 10.1 percent growth, which was changed to 9.3 percent in December. The Class 4–7 estimate was revised downward from 5.3 to 5.2 percent. For 2019, Class 4–8 and 4–7 predictions went from 8.4 to 8.3 percent, and 3.3 to 2.9 percent, respectively.

The 2018–2020 Mexico forecast was revised downward (but remained positive) in Class 8, and shifted upward significantly for Classes 4–7. Predictions were revised from 8.1 to 21.8 percent, 17.1 to 32.9 percent and 0.3 to 13.0 percent in 2018, 2019 and 2020, respectively. The forecast for new registrations remains positive through 2022.

New Canadian registrations are also expected to be positive through 2022. This is not the case for the U.S. as indicated in the chart. IHS predicts new registrations will decline — for numerous reasons — from 2020 to 2022.

Why the decrease?

Tariffs on steel and aluminum caused more supply chain disruptions in the U.S. than in Canada and Mexico. This occurred due to other countries, including Canada and Mexico, retaliating against U.S. tariff impositions.

Interest rate increases will likely have a greater impact in the U.S. since corporate debt is at a concerning level. Higher interest rates will put downward pressure on demand for Class 8

trucks/tractors/buses, in particular, and will negatively affect demand in the Class 4–7 market segment.

Additionally, U.S. economic growth is decelerating, and some economists are now calling for recession by late 2019 or early 2020. Macroeconomic forecasts remain mostly positive for Canada and Mexico.

Visit ntea.com/marketdata to find key publications, reports and regular market updates.