By Steve Latin-Kasper, NTEA Director of Market Data & Research

This article was published in the June 2018 edition of NTEA News

Earlier this year, NTEA published U.S. Construction Sector Report, which evaluates overall

market conditions and the future outlook. This study contains data-based insights on the construction sector, providing readers with tools to aid in long-term planning, including insights into how activity in this segment relates to work truck and equipment sales.

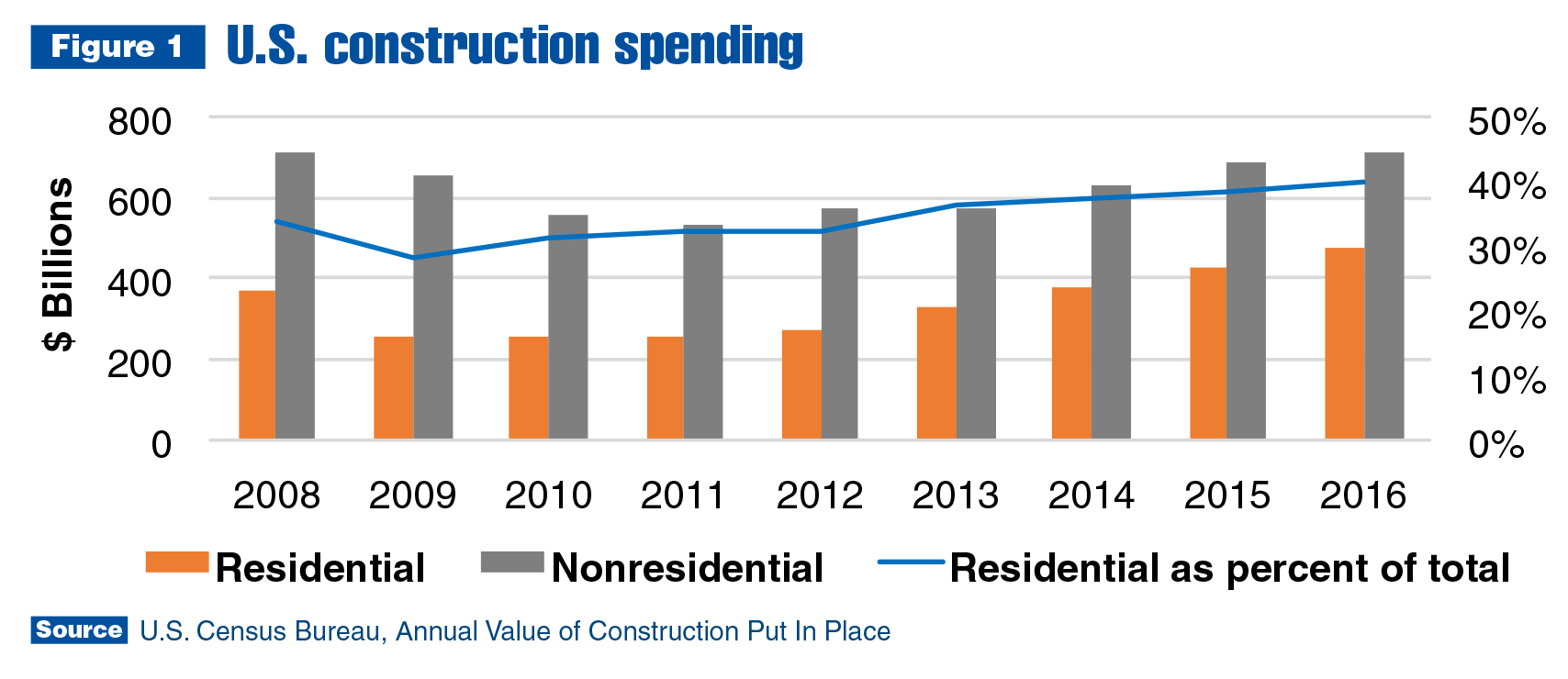

The value of construction put in place fell from 2009–2011 in the U.S., as reflected in Figure 1. The sector did not emerge from recession until 2012. Since then, total dollars spent on construction increased steadily but did not rise above the prerecession level until 2015. As of 2017, the total reached just higher than $1.2 trillion. A sizable fraction of the industry’s revenues are used to buy and maintain the sector’s truck fleet.

The U.S. construction sector accounts for roughly 25 percent of all commercial trucks and truck equipment sold. The report segments the sector into industry groups and specific industries, and details how the structure of the sector has changed since the 2007–2009 recession. It also explains how growth trends have changed since 2012, and what that means for work truck sales in 2018–2019 and beyond.

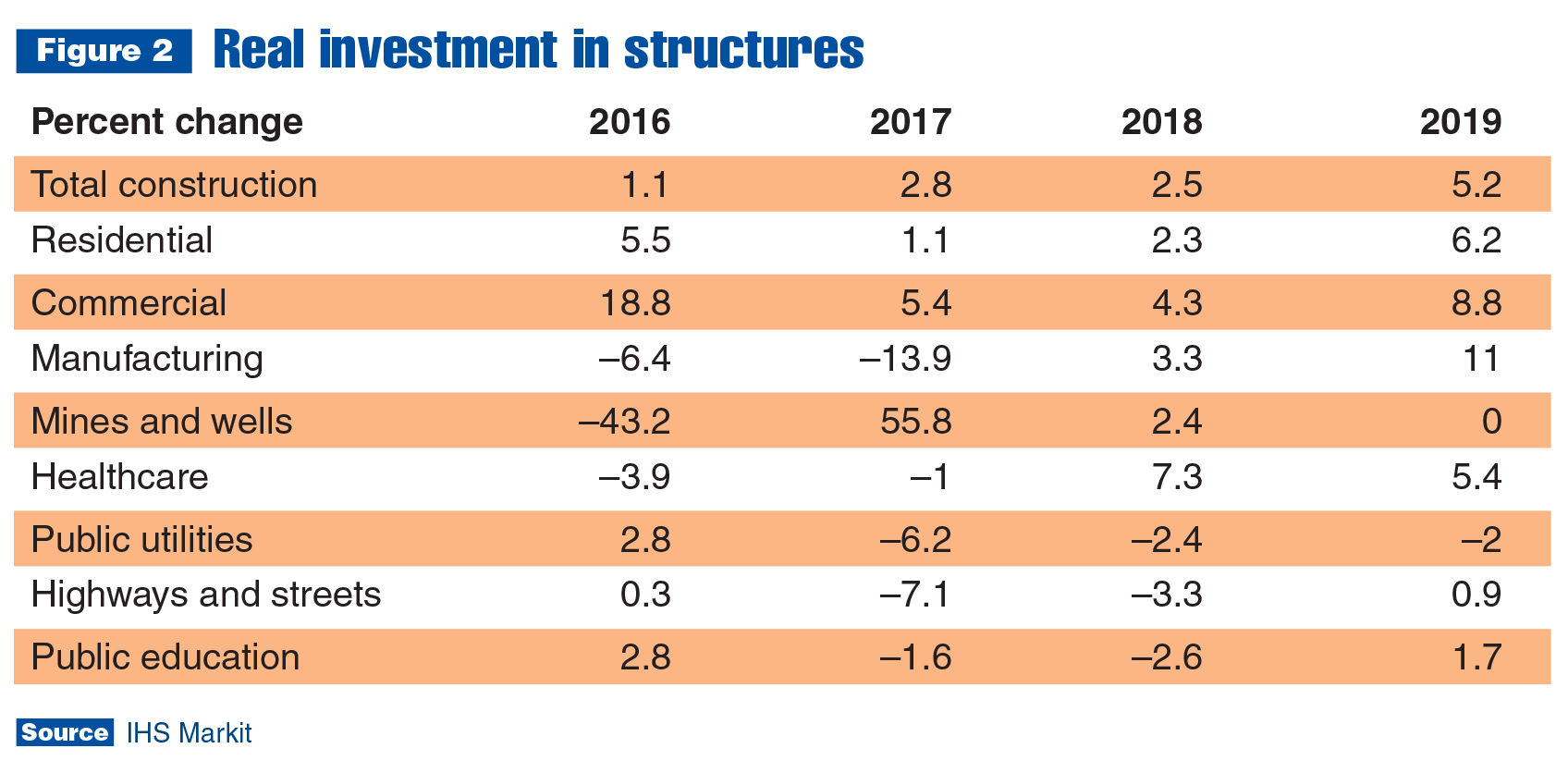

As shown in Figure 2, the report features a forecast for expenditures on structures by economic sector. Some are expected to generate more growth for construction than others in the next couple of years. There are forecasts for the sector as a whole as well as key segments.

The report draws on numerous data sources to provide an in-depth look at why various segments of the construction sector are expected to provide better opportunities than others for work truck and equipment sales through 2019. For example, state and local government spending on education will likely continue growing, while expenditures on road-building and repair will probably keep falling through next year.

Additionally, the report utilizes IHS Markit data to segment the market by geographic region, truck types used and model year of those trucks by weight class. It also references NTEA’s U.S. Potential Sales of Work Trucks and Truck Equipment by Geographic Market (Item #2234 at ntea.com/shopntea) to segment truck equipment sales to specific construction sector industries by state.

NTEA members can learn more and download the U.S. Construction Sector Report from ntea.com/constructionreport. Nonmembers can purchase for $99 at ntea.com/shopntea (Item #2312).

For more industry data, visit ntea.com/marketdata.