This article was published in the September 2016 edition of NTEA News.

Growth in the work truck industry has been slow but steady. Vitality in the construction sector of the U.S. economy is a primary driver of current commercial vehicle demand. To maximize available economic opportunities, many companies are starting to build strategic plans for the year ahead. NTEA provides relevant market data resources to help members stay informed on timely issues like hiring expectations, sales levels and business growth trends.

Twice a year, NTEA seeks the perspective of Distributor and Manufacturer members to assess the business climate and future expectations. Results offer insights into:

- Sales levels and quoting activity

- Backlogs

- Production capacity

- Employment levels

- Key factors influencing member business

- Upcoming challenges and opportunities

This article presents the most recent survey results, incorporating data from previous research initiatives to supply trends and enable benchmarking. The next survey will be emailed to Distributor and Manufacturer members in January 2017.

Recent survey results

Of the respondents, 58 percent are distributors and 42 percent manufacturers. Contributing companies report annual sales from less than $2 million to beyond $70 million, with the largest groups representing $2–5 million and $10–20 million (both 23 percent). Participants ranked construction, government/municipal and utility/telecom sectors the most influential application markets for their businesses, respectively. Result highlights include strong sales and quoting activity.

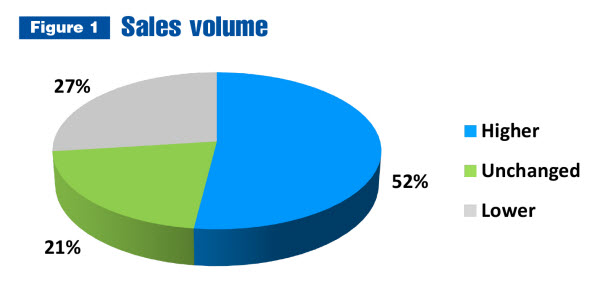

Figure 1 shows 52 percent of survey respondents registered higher sales as compared to the last half of 2015, with 27 percent reporting a decline.

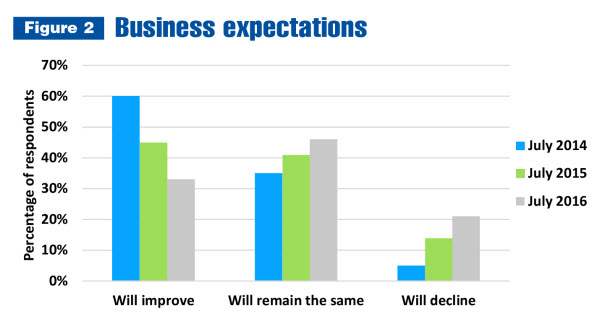

A third anticipate an uptick in business in 2016 — a 12-percent decline from the July outlook last year. Growth expectations have dampened in recent years, with 21 percent foreseeing a slump in activity as compared to 14 percent in July 2015 and 5 percent in July 2014.

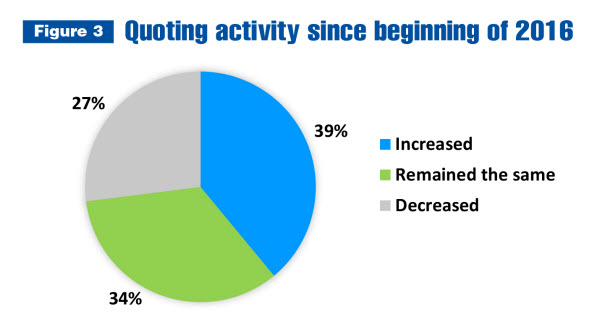

Since January 2016, nearly 40 percent of participants experienced an increase in quoting activity. More than a third reported balanced levels, while 27 percent recognized a falloff (see Figure 3).

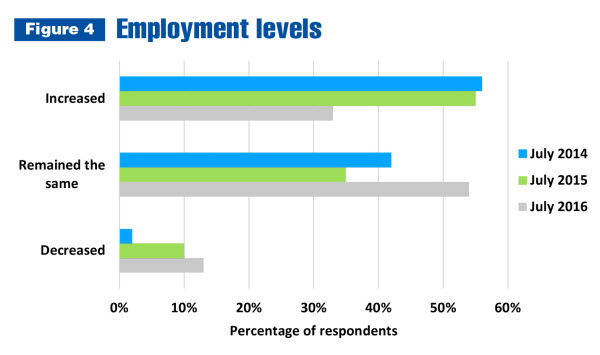

One-third of respondents cited rising employment — a 22-percent plunge from the July 2015 report. At this time, more than half are maintaining employment levels — a 19-percent surge as compared to the previous year.

Members continue to face backlog issues. In fact, 80 percent of responding companies have backlogs to some degree. For 28 percent of those respondents, levels have intensified since January 2016. Nearly 30 percent say their backlog status is in recovery.

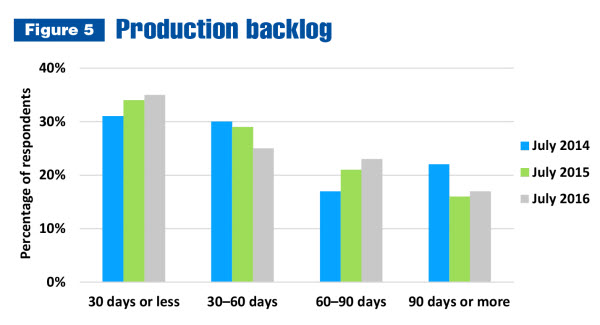

Production backlogs have not shifted drastically in recent years, suggesting members have been able to manage a high-intensity workload. Forty percent have backlogs extending beyond 60 days — and 17 percent reported levels exceeding 90 days.

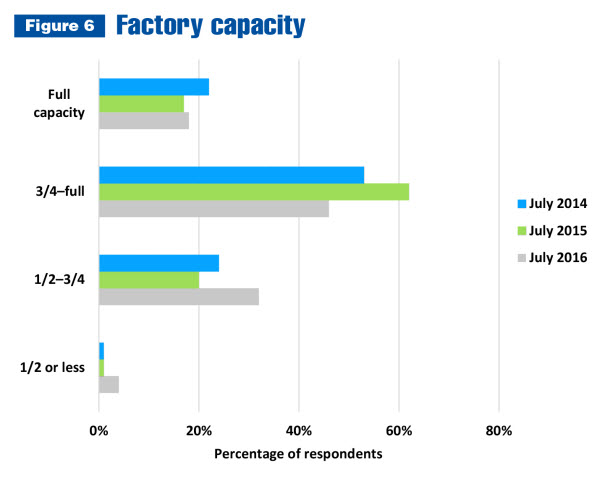

Reporting companies cite a notable drop in factory capacity, with 64 percent operating with little to no ability to increase workload above current levels (without a significant business expansion or merger) — down from 79 percent in July 2015. Nearly a third are operating at 50–75-percent capacity, as compared to 20 percent in this position last year.

Factors affecting business

Factors affecting business

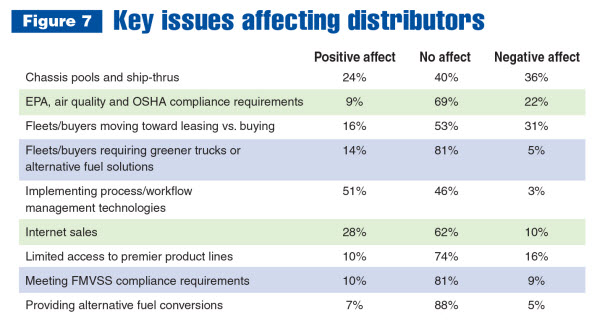

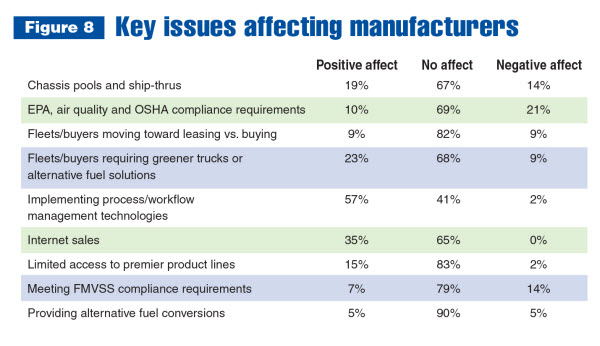

Companies in the work truck industry encounter a wide range of influential market factors. Figures 7 and 8 present distributor and manufacturer perspectives on current issues.

More than half of distributors said the factor with the most significant positive affect on their business is the implementation of process and workflow management technologies and systems. In terms of negative impact, chassis pools and ship-thrus proved most detrimental, followed by fleets or other commercial truck buyers moving toward leasing versus buying. Providing alternative fuel conversions, meeting Federal Motor Vehicle Safety Standard (FMVSS) compliance requirements, and fleets and buyers requiring greener trucks or alternative fuel solutions, had minimal impact on responding distributors.

Similar to distributors, manufacturers found implementing process and workflow management technologies to be the best influence on business, with internet sales ranking a distant second. For manufacturers, Environmental Protection Agency (EPA), air quality and Occupational Safety and Health Administration (OSHA) compliance was cited as most harmful, while supplying alternative fuel conversions, having limited access to premier product lines, and fleets or other commercial truck buyers moving toward leasing versus buying, had the least consequence.

Industry challenges

Industry challenges

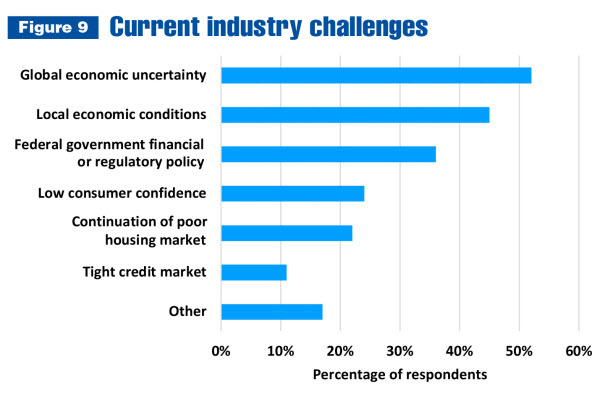

Though business expectations point toward stability through the remainder of 2016, economic concerns are top of mind among survey respondents, with more than half expressing concerns about the state of the global economy and 45 percent registering uncertainty about local economic conditions. In addition, federal government financial and regulatory policies present a major hurdle.

Note: Totals are not equal to 100 percent because of respondents’ ability to select multiple answers.

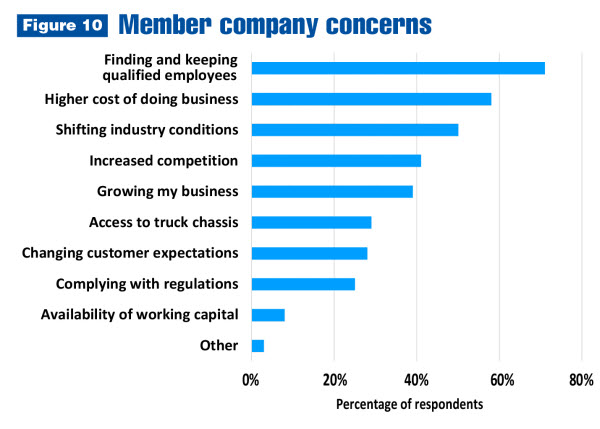

More than 70 percent of reporting members listed finding and retaining qualified employees as the largest problem (see Figure 10). In addition, at least half identified the higher cost of doing business and changing industry conditions as pressing issues.

Note: Totals are not equal to 100 percent because of respondents’ ability to select multiple answers.

Success strategies

Success strategies

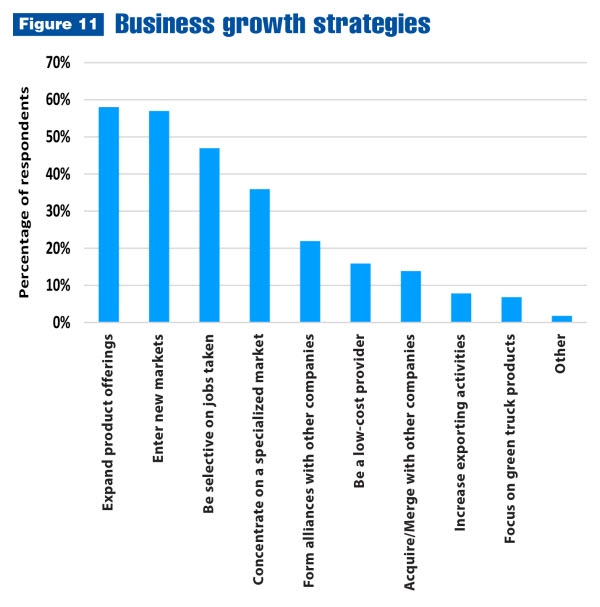

When it comes to business development, most popular approaches include expanding product offerings (58 percent), entering new markets (57 percent) and being selective on jobs taken (47 percent). Concentrating on a specialized market and forming alliances with other companies are additional noteworthy options.

Looking ahead

Looking ahead

The overall industry forecast remains positive through 2017. Despite challenges, the commercial vehicle landscape continues to grow and diversify.

Distributor and manufacturer survey respondents identified some specific business opportunities, including:

- Acquiring another company

- Adding product lines

- Increasing plant capacity

- Boosting productivity

- Developing a loyal customer base

- Tapping into underrepresented geographic regions in North America

- Offering more customization capabilities

- Exploring the export market

- Securing long-term contracts

For members, rising healthcare and wage costs in combination with downward pressure on sales prices are concerns, along with the oil and gas market slowdown. Survey participants referenced other problematic factors, such as:

- Building the cash flow needed to expand

- Dealing with consolidation of competitors

- Limited chassis options and availability

- Difficulty finding effective business partners

- Modernizing processes

- Planning for consistent capacity

- Managing inventory levels

For questions or more information on this survey, contact Joy Knesnik, NTEA communications manager, at

joy@ntea.com.