Guest editorial

Dr. Albert D. Bates, Principal, Distribution Performance Project

This article was published in the April 2018 edition of NTEA News.

Distributors operate in a sales-focused environment, which can be both positive and negative. For instance, the economy continues to provide a strong tailwind, allowing companies to enjoy steady — albeit, moderate — growth. However, there are concerns over whether or not online retailers like Amazon will cause the sales party to end.

Such a sales focus inevitably leads to challenges with expense control. In a strong growth environment, expense control is largely neglected. Further, if online retailers are a competitive concern, then there is a feeling that customer service — and the associated expenses — needs to be increased.

Goal-setting for expense control

Expense control has a bad reputation because it is generally confused with expense cutting. It is the polar opposite, though — except in a few instances where expense levels may be outrageous. Expense control involves matching up expenses with sales in a more meaningful way. It starts with the assumption that in most businesses, expenses are likely to rise from year-to-year. The key is to control the rate of growth relative to the anticipated increase in sales.

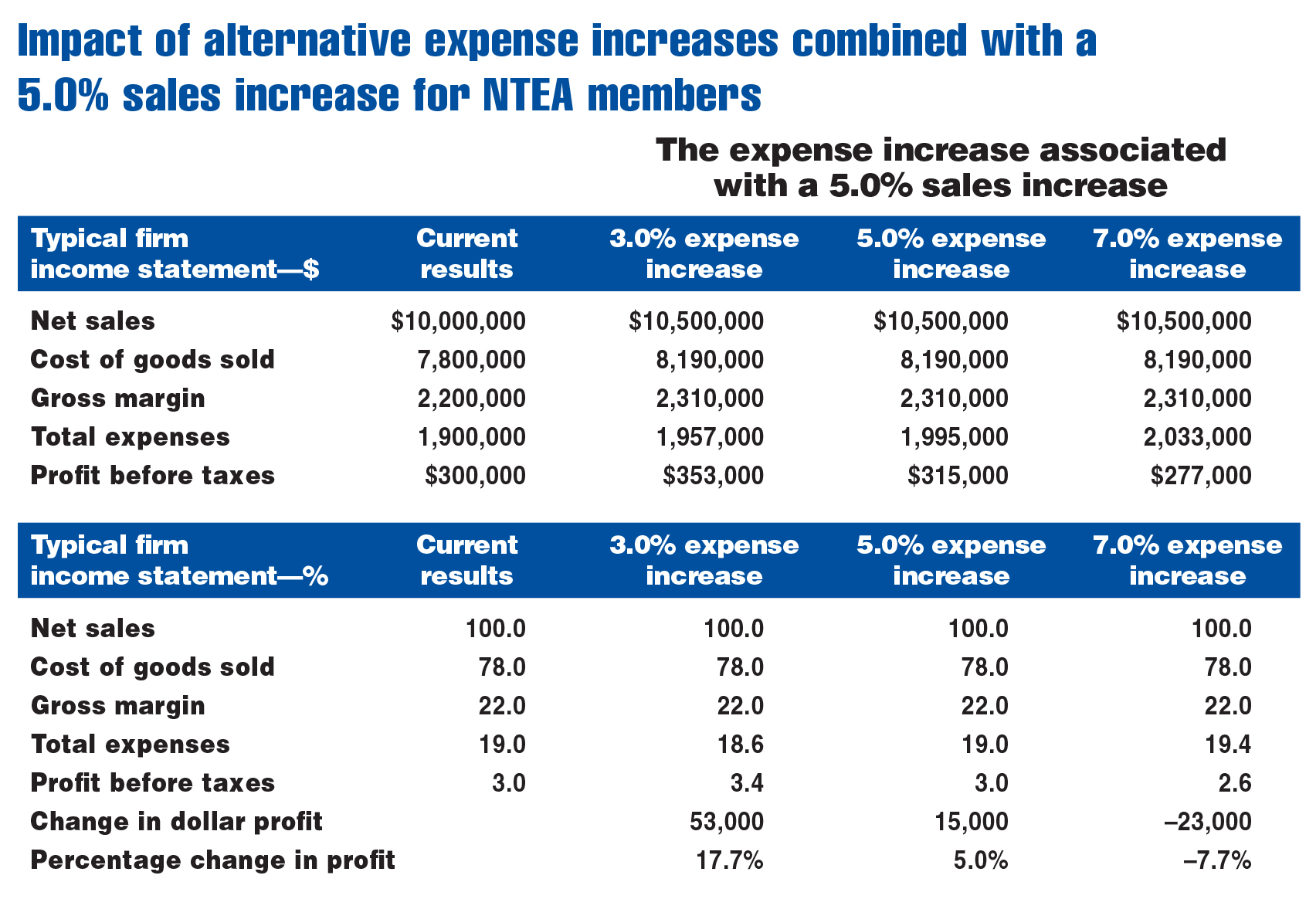

This is demonstrated in the chart above, which presents current results for the typical NTEA member. The first column provides information at the present time, with dollar figures at the top and percent of sales figures at the bottom.

The typical firm currently generates $10,000,000 in sales, operates on 22.0 percent gross margin percentage and generates $300,000 in pre-tax profits. This represents a bottom-line profit of 3.0 percent of sales.

The final three columns track performance as the company generates 5.0 percent sales growth (a fairly typical figure in mature industries). The columns combine the same 5.0 percent sales growth rate with three different levels of expense growth.

The first of three scenarios demonstrates the impact of 5.0 percent sales growth with an expense increase of only 3.0 percent. This produces what is typically called a 2.0 percent sales-to-expense wedge — widely discussed in distribution as a reasonable goal for expense control.

As illustrated, profits explode from the current $300,000 to $353,000 — an increase of 17.7 percent as shown at the bottom of the first “what if” column. It represents a modest improvement in expense control and significant gain in bottom line.

The second scenario reflects sales and expenses increasing by the same 5.0 percent rate. It is a sales-to-expense wedge of zero — resulting in a modest 5.0 percent profit increase. This represents what has tended to happen in distribution over the last two decades — glacial change.

The final situation highlights what happens if the sales-to-expense wedge is negative. In this case, expenses increased 2.0 percent faster than sales. Sales still reach the same $10,500,000 level as in the first two examples, but profit is decimated. The resulting profit margin is just 2.6 percent, and profit falls by $23,000.

In all three projected columns, sales increased at the same 5.0 percent rate. However, the level of expense growth causes profit to rise by different amounts. Over time, the change is massive.

Ideally, companies should look for ways to achieve a positive sales-to-expense wedge of 2.0 percent. This can’t be generated without some precise planning, though.

Expense control procedures

Some businesses assume that greater use of technology results in expense control. The previously mentioned historical pattern indicates sales and expenses have grown at about the same rate over time — but that doesn’t mean technology is not important. Instead, it suggests something must be added to the technology mix. Four additional ingredients are required to help achieve true expense control.

Analytics

Without points of comparison, it’s difficult to determine if expenses are under or out of control. It’s essential to benchmark against other firms in the same industry on an expense-line-by-expense-line basis.

Transaction economics

The two most important metrics that influence costs are the number of lines on each order and the average line value. Transactions with few line items or a low value per line extension are inherently unprofitable.

Customers buy the quantity they want, of course. However, opportunities to change line extension and number of lines per order are huge. The simple idea of one more item on every order can dramatically change the entire sales-to-expense equation.

Customer analysis

Results continually show some customers are highly profitable and others are quite unprofitable for the business. While eliminating customers is almost never justified, it’s reasonable to work with them to equate the support and services they receive to the profit levels they generate.

Proper planning

The role of planning in generating higher profit levels cannot be overstated. Unfortunately, too many companies continue to plan sales and expenses separately. This must be done simultaneously to ensure the desired sales-to-expense wedge is achieved.

Moving forward

Businesses should consider planning for a sales-to-expense wedge on the magnitude of 2.0 percent. If the planning process is backed up with specific actions to make the wedge a reality, expenses can be controlled and profits can be sharply increased.