By Doyle Sumrall, NTEA Managing Director

This article was published in the September 2019 edition of NTEA News.

With educational planning well underway for The Work Truck Show® 2020 and Green Truck Summit, I’ve had the chance to meet with many NTEA members and industry organizations in determining program topics of key importance. One that stands out is the evolution of diesel.

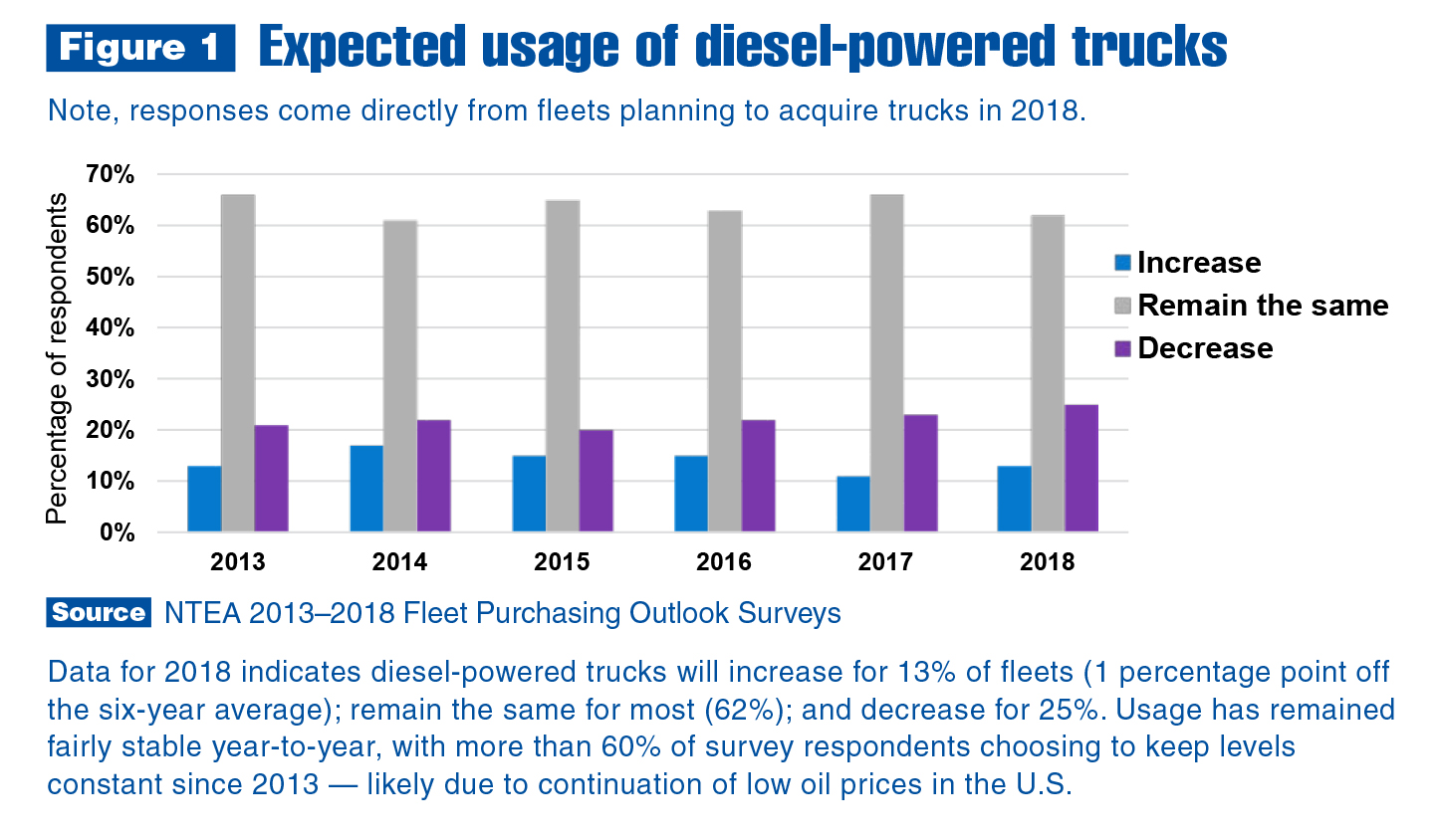

NTEA’s Fleet Purchasing Outlook (ntea.com/fpo) makes it clear fleets and buyers are open to a variety of options — diesel and alternative fuels — for powering their vehicles (see Figure 1).

Report data indicates two important trends. Fleets view diesel differently based on segment, and there appears to be a shift toward decreasing the number of diesel-powered trucks. A notable insight (not included in Fleet Purchasing Outlook but anecdotally shared in the user community) is diesel emission systems are creating maintenance demands many fleets/buyers find challenging.

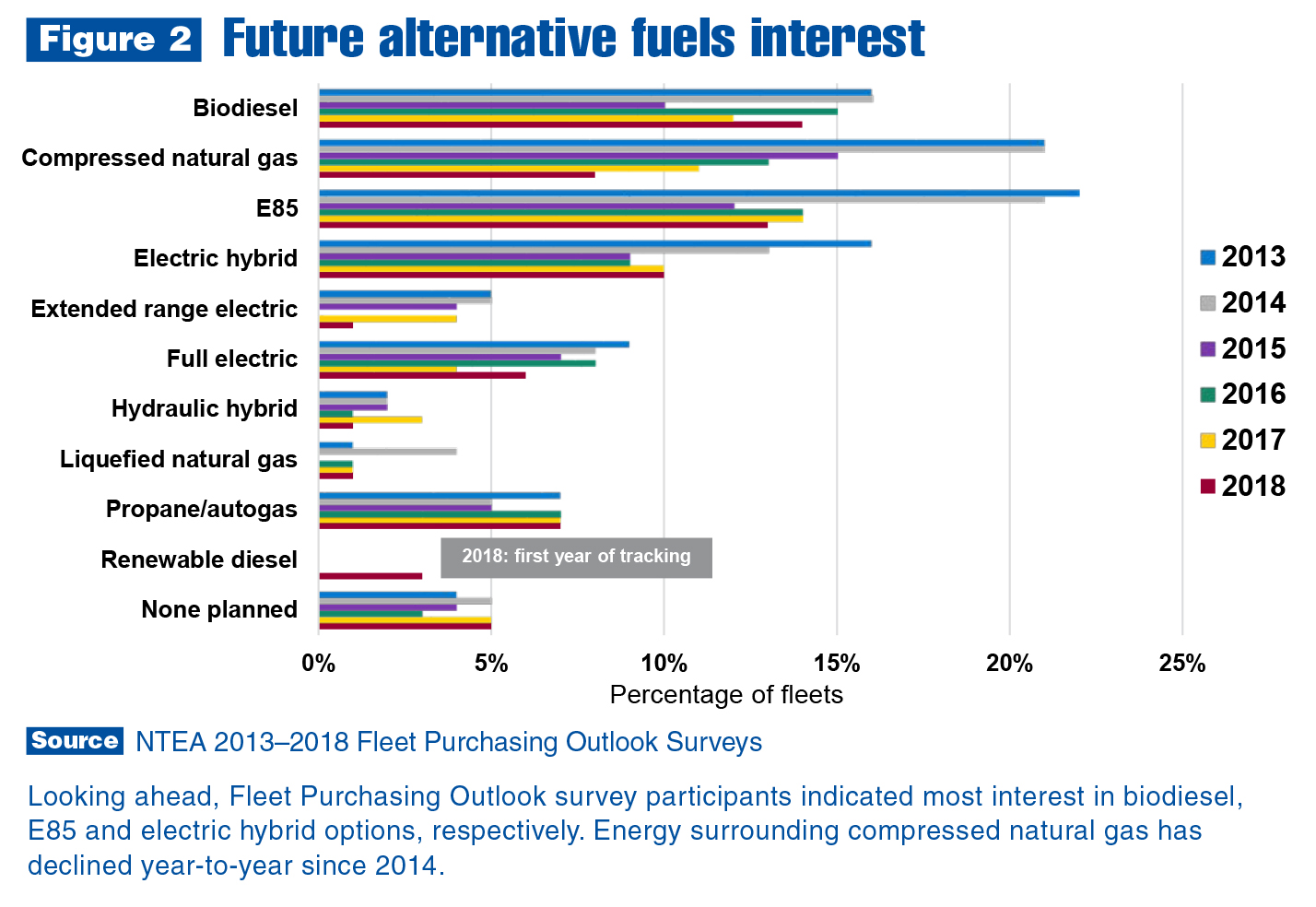

Fleets currently using and buying diesel trucks are looking for a sustainability aspect — likely primarily due to mandates as well as governmental and consumer pressures. Some, though, are simply committed to making a difference, and moving to biodiesel and renewable diesel is a way to accomplish sustainability.

Note, diesel fuel — unlike natural gas or propane — has both bio and renewable approaches to production. According to Department of Energy (DOE), biodiesel is a domestically produced, renewable fuel that can be manufactured from vegetable oils, animal fats or recycled restaurant grease for use in diesel vehicles or any equipment that operates on diesel fuel. Its physical properties are similar to those of petroleum diesel. DOE also points out renewable diesel is different from biodiesel. Renewable is chemically similar to petroleum diesel, while biodiesel is a mono-alkyl ester, which has distinct physical properties and, therefore, different fuel specifications (ASTM D6751 and EN 14214).

In most cases, biodiesel is blended into diesel to derive a fuel more in line with sustainability objectives. B20, or 20% biodiesel, is the most common blend in the U.S., although there are blends starting at 5%. Some fleets are successfully using 100% biodiesel.

There are concerns with biodiesel, per DOE, including with B100 used in some engines built since 1994. It has a solvent effect and can clean a vehicle’s fuel system and release deposits accumulated from petroleum diesel use. Releasing these deposits may initially clog filters and require frequent filter replacement in the first few tanks of high-level blends.

When using high-level blends, several factors need to be considered. Pure biodiesel contains less energy on a volumetric basis than petroleum diesel. Therefore, the higher the percentage of biodiesel (above 20%), the lower the energy content per gallon. High-level biodiesel blends can impact engine warranties and gel in cold temperatures as well as present unique storage issues. B100 use could also increase nitrogen oxides emissions, although it greatly reduces other toxic emissions.

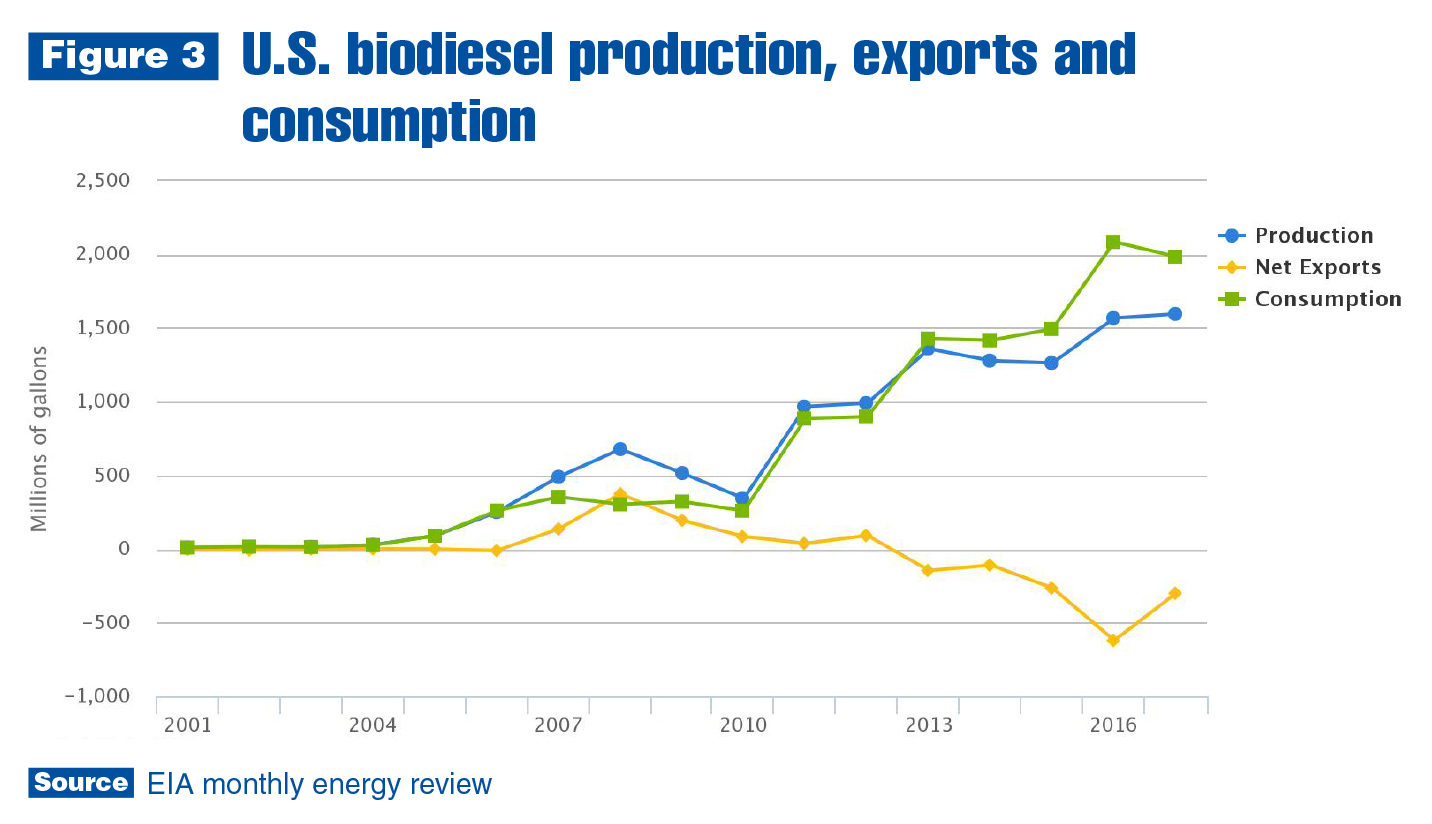

Figure 3 shows trends in U.S. biodiesel production, exports and consumption from 2001–2017. Biodiesel exports peaked in 2008 largely due to unintended effect of a European Union biodiesel tax credit. Exports dropped after the effect was eliminated. Increased production and consumption from 2011 onward are largely driven by the Renewable Fuel Standard. The net export of biodiesel changed from positive to negative in 2013, meaning the quantity of biodiesel imported by the U.S. exceeded quantity exported. Positive growth of net exports since 2013 can likely be attributed to the continued effort of reducing greenhouse gas emissions and expanding regulations.

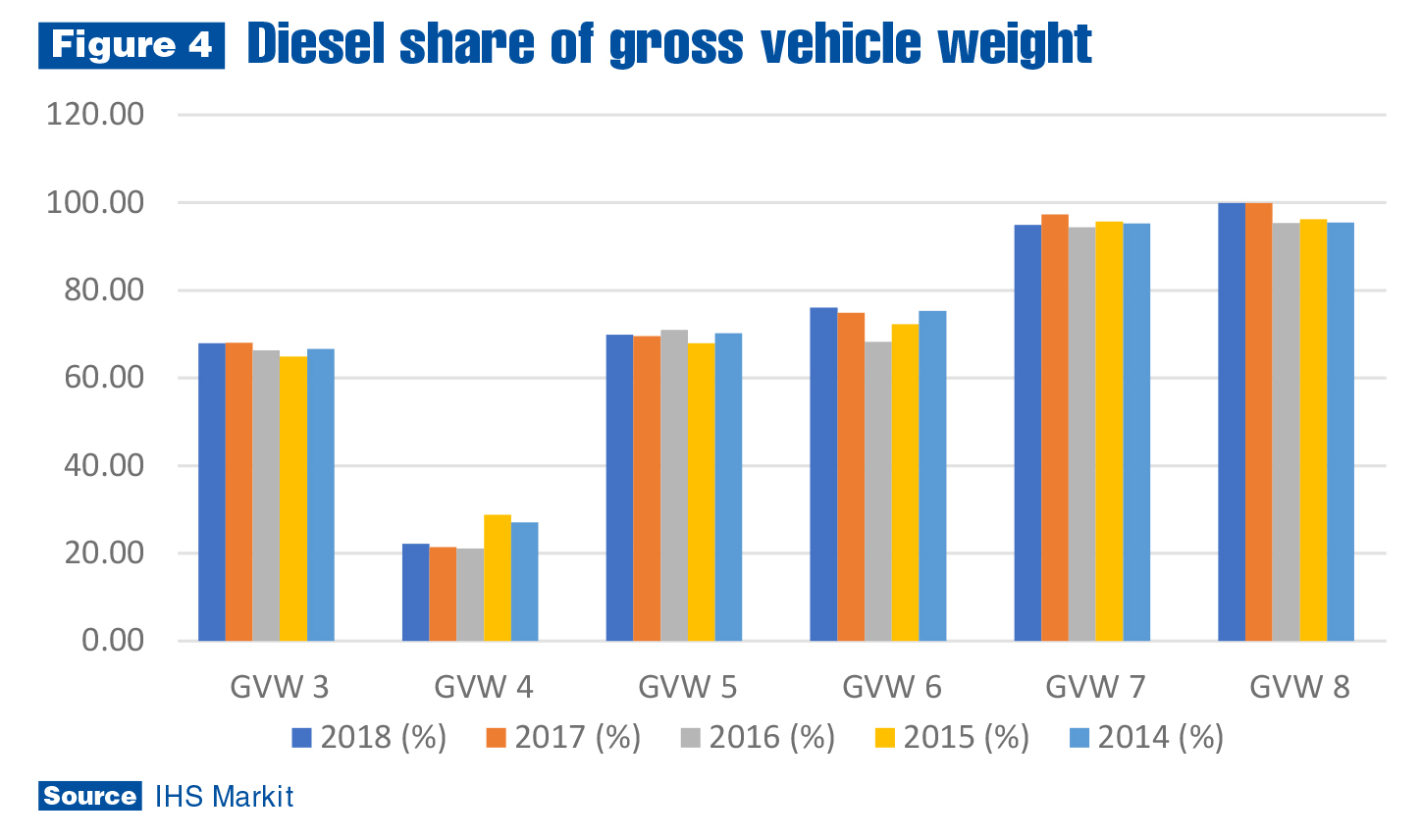

Looking at IHS Markit’s registration data in Figure 4, it appears diesel is holding its own, with usage increasing in some gross vehicle weight classes in recent years. While many factors influence these numbers, OEM offerings are at the top of the list.

These insights on diesel are not meant to detract from advances in electric, propane, natural gas and other alternatives. Alternative power and fuel options will continue taking market share, but this evolution is expected to be slow and steady, with diesel remaining a key player for years to come.

Learn more about alternative fuels and advanced technologies for commercial vehicles at Green Truck Summit, held March 3, 2020, in conjunction with The Work Truck Show 2020. Sign up to be notified when registration opens in October at worktruckshow.com.