Guest editorial by Dr. Albert D. Bates, Principal, Distribution Performance Project

This article was published in the March 2019 edition of NTEA News.

Over time, payroll has remained an almost constant percent of sales for NTEA members. Adjusting for economic conditions, payroll costs are virtually unchanged from 20 years ago. That is, in a moderate-growth period 20 years earlier, payroll was about the same percent of revenue as in a moderate-growth period today. Both sales and payroll have grown at about the same rate.

Going forward, the issue is whether this equivalence of sales and payroll growth will continue or payroll will move ahead faster than sales. On a more positive note, sales could potentially grow faster than the payroll expenses required to generate those sales.

The relationship between sales and payroll growth is commonly called the sales to payroll wedge. It can be either positive, with sales growing faster than payroll, or negative if payroll growth outpaces sales. The size of the sales to payroll wedge is critical.

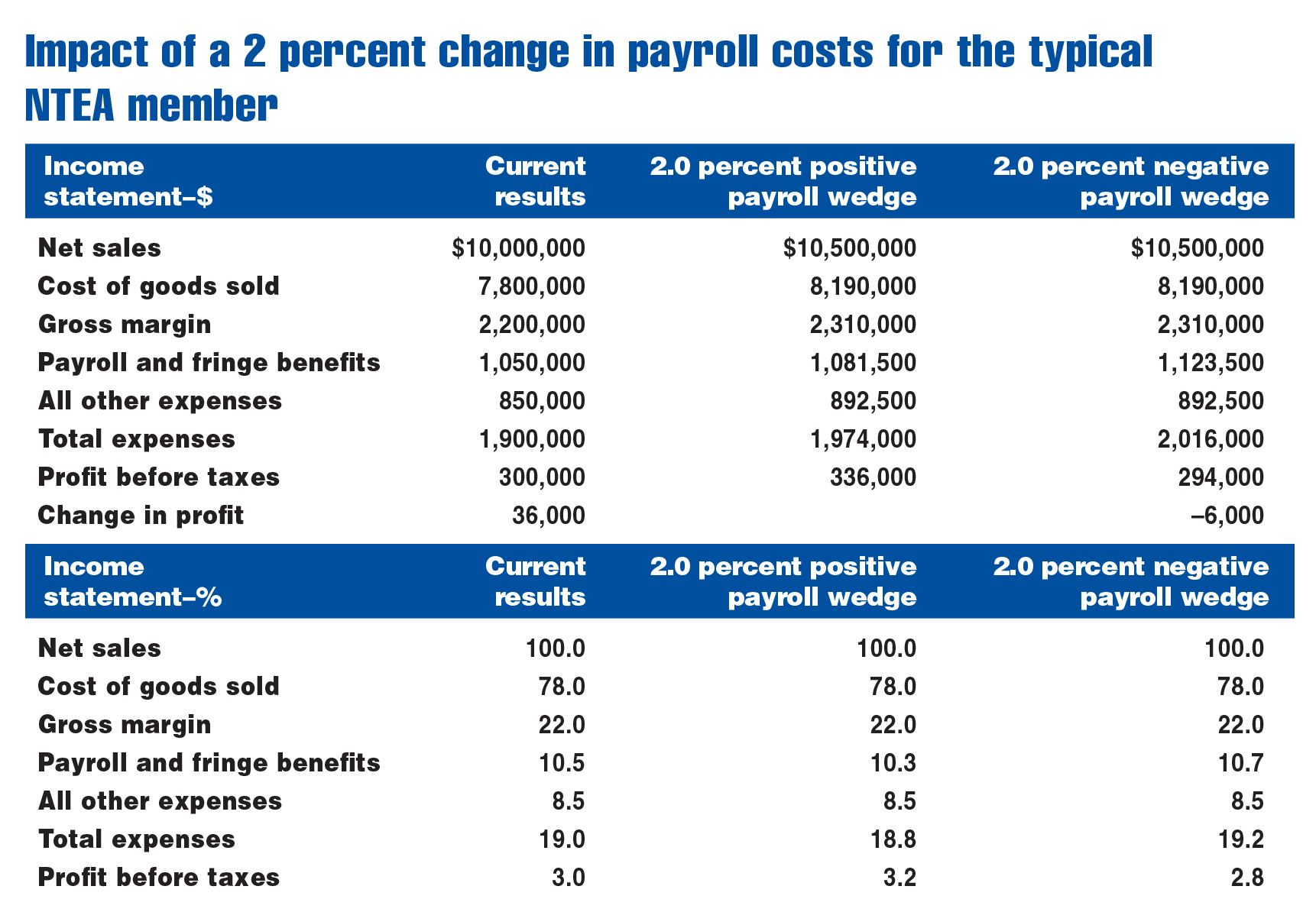

The chart above demonstrates the impact of the sales to payroll wedge for a typical NTEA member company. As shown in the first column, the firm generates $10,000,000 in sales, operates on a gross margin of 22.0 percent of sales and has a bottom-line profit of $300,000 or 3.0 percent of sales.

Payroll is 10.5 percent of sales and, in this instance, accounts for 55.3 percent of total operating expenses. Note, payroll expense is a fully-loaded number — it includes all salaries, wages, commission and bonuses, as well as associated social costs, such as FICA, Medicare, worker’s compensation, health insurance and all retirement programs. Payroll is, quite simply, the name of the game.

The last two columns examine the impact of a positive and negative sales to payroll wedge. This means sales are either growing faster than payroll (positive) or slower (negative). To demonstrate the effect of the wedge, a modest 5.0 percent sales growth figure was used. Any sales growth rate would produce the same sort of results.

In the middle column, payroll grows by 3.0 percent (2.0 percent slower than sales) for a positive sales to payroll wedge. In the final column, payroll increases by 7.0 percent (2.0 percent faster than sales), producing a negative sales to payroll wedge.

A 2.0 percent positive wedge generates a $36,000 profit increase, or a 12.0 percent change. With a negative wedge, profit declines, despite the same 5.0 percent rate of sales growth. Even modest differences in payroll control have a significant effect on the bottom line.

Managing payroll cost growth

In trying to generate a positive sales to payroll wedge, most companies turn to two specific approaches. The first is simply cutting payroll, ideally in areas deemed to be unimportant in servicing customers. The second is to rely increasingly on new technology to drive higher productivity, especially in key operations areas such as the distribution center and accounting.

The challenge with payroll reduction programs is that payroll isn’t just an expense item, such as utilities. Payroll costs represent employees who provide services that allow adequate sales generation. It may be possible to identify a few areas in the business that do not contribute to sales generation, but those opportunities are seldom large enough to change the relationship of payroll costs relative to sales without diminishing some aspect of customer service.

It’s difficult to argue against the ongoing process of improving the rate of order picking, processing, etc. Even though they’re important, their payoff tends to be generated slowly over time. Given the perceived challenge of increasing compensation rates, something with a quicker payoff is required.

The challenge is to drive sales growth faster than payroll growth, which requires actions that focus on both the sales and payroll expense side of the issue simultaneously. An important approach is to monitor the firm’s transaction economics.

Assessing transaction economics involves reviewing the amount of work associated with each individual transaction. It addresses the reality that the same level of sales volume can produce different profit levels, depending on workload required. The challenge is to be able to control the workload.

Two factors have always been key in transaction analysis — number of line items sold per transaction and average line value. A system that measures these factors and then uses them in planning can go a long way toward producing a positive sales to payroll wedge.

The number of line items rests heavily on how much add-on selling is continually reinforced throughout the company.

Average line item extension is by far the more important of the two factors in terms of creating a positive sales to payroll wedge. Increasing this number has almost no impact on payroll other than commissions. Like other areas in life, if it’s the most important, it may also be the most difficult.

The line extension improvement involves two different issues. The first is to work with customers to modify, at least slightly, buying patterns. Ideally, they would purchase the same amount of merchandise, but do so with fewer larger orders. The second approach is to raise prices judicially where possible.

Both approaches could alienate customers, so care must be taken. They are, however, key to generating a positive sales to payroll wedge.

Moving forward

Sales growth must be maintained at a level that allows the business to produce a positive sales to payroll wedge in the 2.0 percent range. However, sales growth can be rapid or modest as long as the relationship between sales and payroll growth is controlled. With such a delta, the long-term challenge with payroll control can finally be overcome.