Guest editorial

Dr. Albert D. Bates

Principal

Distribution Performance Project

This article was published in the July 2019 edition of NTEA News.

There have always been — and always will be — good and bad economic periods. Another inevitability is some companies will make the same mistakes in responding to the next downturn as during past recessions.

Profit impact of a sales decline

The relationship between a sales decrease and the resulting drop in profit can be measured by the sales sensitivity index (SSI), which gauges how much of a sales decline is required to cause profit to fall to zero.

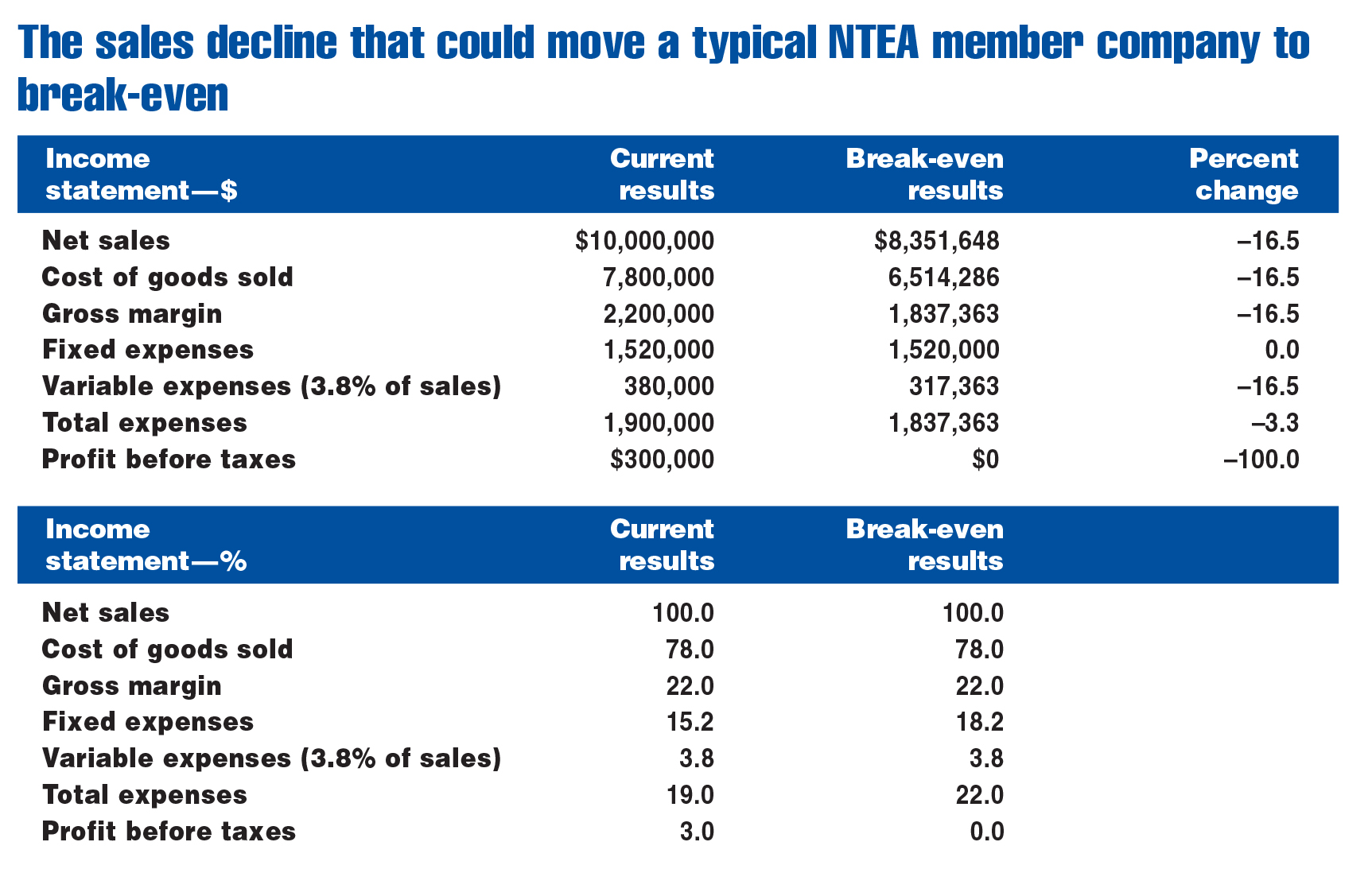

SSI size mainly depends on a company’s expense structure (see chart). As shown in the first column, the firm generates $10,000,000 in sales and operates on a gross margin of 22.0% of sales. This results in $300,000 pre-tax profit (equal to 3.0% of sales).

To understand how sales declines impact profit, expenses must be broken down into fixed and variable.

Fixed expenses are overhead costs. Once an annual budget is set, these will only change if management takes specific actions to do so, such as negotiating lower rent. For most companies, fixed expenses represent somewhere around 80% of total expenses.

Variable expenses — which rise and fall automatically with sales — include interest on accounts receivable, sales commissions, and the like. For the typical company, they amount to around 3.8% of sales.

The second column in the chart examines the impact of a sales drop that causes the firm to reach its break-even point. That is, it generates no profit. For the typical NTEA member company, a sales decrease of just 16.5% is all that’s required to wipe out the entire profit. This figure is the firm’s SSI.

The 16.5% is based on a common structure where approximately 80% of expenses are fixed and the remaining 20% are variable. Deviations from this ratio will cause the business to be more or less impacted by a sales decline.

For example, let’s say a company changed its expense structure from 80% fixed/20% variable to 90% fixed/10% variable. This could be accomplished by lowering the commission rate and compensating the sales force with a larger base salary. The result would be to cut variable expenses in half — and they would be only 1.9% of sales, not 3.8%.

This would mean as sales fell, the business would shed variable expenses at a slower rate. The 1.9% firm would be affected more by a given sales decline than would the 3.8% company. For every $100,000 drop in sales, variable expenses would only fall by $1,900 rather than $3,800.

This does not mean one scenario of fixed to variable expenses is better than another. It does, however, mean the level of fixed and variable expenses depends on certain decisions, such as how to compensate the sales force. Profit implications of such actions need to be understood.

Actions for continued profit success

Mitigating the impact of a sales downturn involves taking specific steps and avoiding others.

Target SSI

Before the next downturn, businesses should not simply calculate SSI — they should develop a target for it and plan to make it a reality. As an example, if a firm enhanced its financial position to an SSI of at least 20%, it would mean almost no sales decline would be cause for panic. For the typical NTEA member company, increasing SSI requires only a small growth in current profit.

Avoid price cutting

An almost automatic response to a sales decline is reducing prices to “get that volume back.” However, any drop in pricing only increases the physical sales volume required to maintain profits.

Maintain working capital investment levels

Another reaction to sales decreases is to hoard cash, which can lead to converting inventory and accounts receivable into cash. Lowering inventory almost always involves a “stop buying” decree that could cause deterioration in service levels. Accounts receivable reductions have a similar impact on sales. Lowering either may drive down sales at a faster rate.

Don’t sell out the future

The idea of rightsizing expenses is tailor-made for a period of declining sales. However, expense cuts must be limited to areas that will do no harm to sales. For example, reducing marketing expenditures could result in lost contact with key customers when the market rebounds.

Benchmark continually

It’s important to understand how a business performs on key profit drivers. This can be accomplished by benchmarking against other industry companies. Some may feel it’s fruitless to do so during a downturn, but ongoing benchmarking can provide insights into the pathway for profit improvement, even in tough times.

Moving forward

While the next recession hasn’t even started, now is the time to plan for it. Focus not only on what to do during a recession, but also how to build momentum for when the recovery starts.